Compared to the Gas futures market, ETHGas is more interested in being a real-time execution layer

Original Article Title: "ETHGas Aims to Be More About Real-Time Execution Layer Than Gas Futures Market"

Original Article Author: Eric, Foresight News

On December 17, the Ethereum block space futures market ETHGas announced the completion of a $12 million financing round, led by Polychain Capital and with participation from Stake Capital, BlueYard Capital, Lafayette Macro Advisors, SIG DT, and Amber Group. Founder Kevin Lepsoe stated that ETHGas had previously raised an undisclosed Pre-Seed round of around $5 million in mid-2024.

Additionally, Lepsoe mentioned that Ethereum validators, block producers, and relayers have committed to providing around $800 million to support market and product development, not in cash investment but in the form of Ethereum block space liquidity to the ETHGas market.

While the project is defined as a block space futures market, its true vision is to achieve "Real-Time Ethereum."

Block Order

Ethereum co-founder Vitalik Buterin proposed the concept of a Gas futures market earlier this month, aimed at addressing Ethereum Gas volatility. Similar to the logic of traditional commodity futures markets, the key role of futures locking in future Gas costs is to make Gas costs predictable and controllable.

As a result, DApps can lock in Gas costs, for example, before events like user token airdrops, and design incentives for user activities. L2 can also buy futures when Gas fees are lower to reduce the cost of submitting data packets to L1, making transaction costs on L2 stable and predictable, serving businesses that require upfront cost calculations, such as tokenizing stocks.

According to the documentation, ETHGas will also launch a zero-code tool called Open Gas specifically for DApps to provide Gas subsidy plans, allowing users to claim back Gas fees spent while using a DApp on the ETHGas platform.

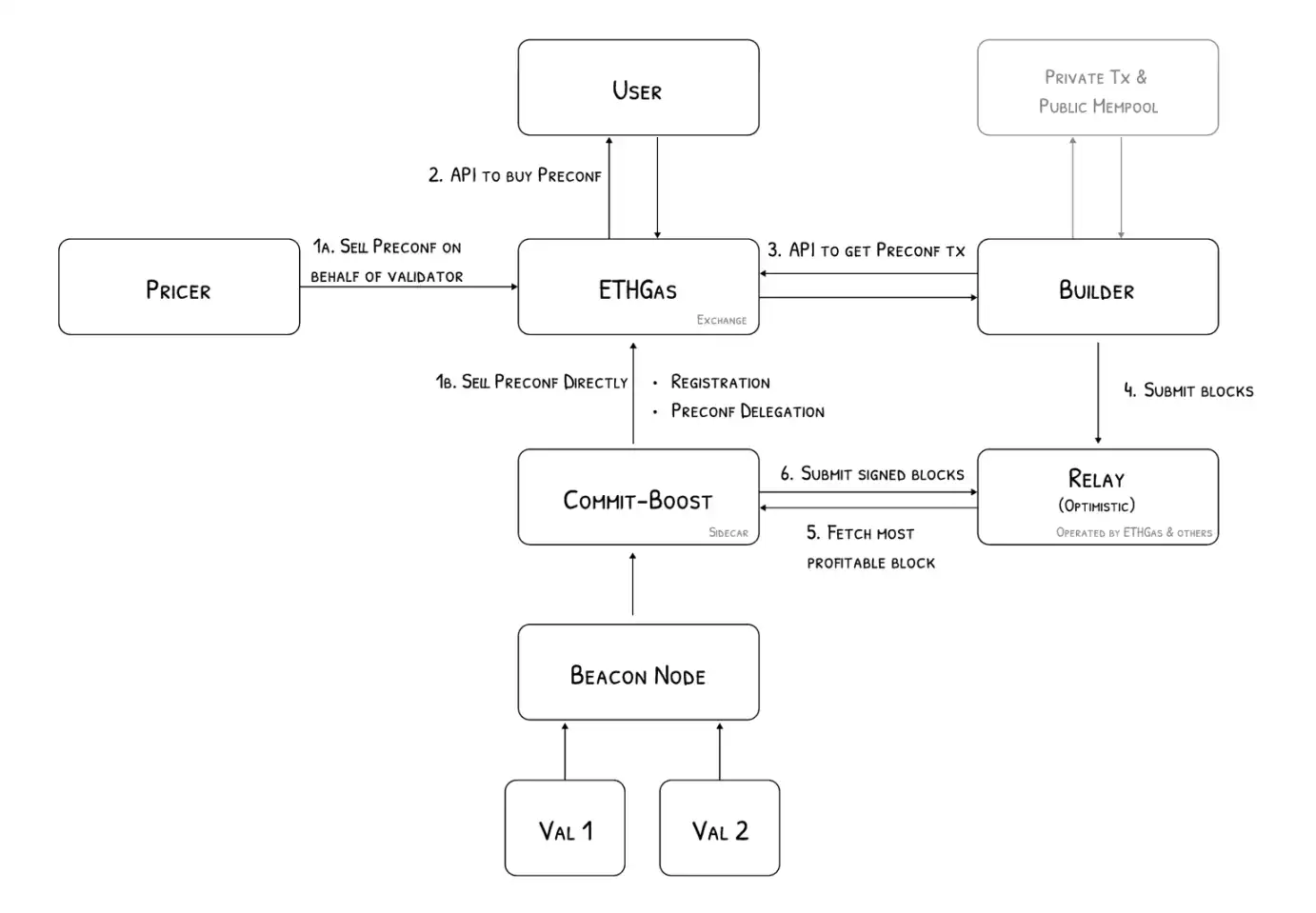

There is not much difficulty in the design and development of the Gas futures market; essentially, it requires establishing an on-chain futures trading market with sufficient liquidity. However, ETHGas's "killer move" is the block space auction market.

The auction market is called Blockspace, where Ethereum validators, block creators, and relay nodes can auction off space in upcoming blocks to ensure that the bidder's transaction will be included in the next block and to guarantee the transaction's execution efficiency. Furthermore, bidders can even bid for the entire next block to have it contain only their own transactions or transactions provided by others.

If we liken transactions to packages, ensuring a block's inclusion of transactions is like ensuring a package will definitely be loaded onto a transport plane, and ensuring transaction execution is like ensuring the package will be delivered to a specific recipient on time. Bidding for a complete block is akin to chartering a plane to transport your packages, but at the same time, you can sublease any excess space to other packages.

ETHGas' ultimate goal is to achieve Ethereum's "real-time transactions" through Blockspace. This real-time transaction can only be in quotes because the completion of transactions on the Ethereum mainnet must wait for the block to be finalized, but if a transaction can be guaranteed to be included in the next block, it can, to some extent, be considered "completed". We can think of ETHGas as an execution layer on top of Ethereum, but how real-time transactions will be reflected in the frontend still awaits ETHGas' answer.

The core of ETHGas is to establish an orderly block space, rather than the current chaotic bidding to compete for block space, which leads to numerous uncontrollable MEV transactions. By attracting infrastructure operators to join Blockspace through predictable earnings to create sufficient liquidity for achieving real-time transactions, the efficiency improvement attracts various DApps. DApps attract users through Open Gas, bringing more transaction volume into the ETHGas network, thereby increasing the earnings of infrastructure operators, creating a virtuous cycle.

Challenges Under the Good Vision

For a DApp about to conduct a token airdrop, it can estimate the number of transactions for claiming the airdrop, prebook a certain number of blocks after a specific time, and provide a Gas subsidy plan to achieve budget controllability without causing network congestion during the token claim activity.

Although such visions are ideal, allowing block space to be auctioned off may lead to many foreseeable issues.

First, if institutional users can freely auction block space, they may bid heavily for entire blocks and resell them to retail users. In this scenario, while validators' earnings are secure and stable, it actually raises transaction costs for retail users. In this case, retail users, due to their lack of technical ability, are unable to compete with institutional users, and even if retail users can participate in auctions or use futures markets to hedge against the increased Gas costs, it fundamentally raises transaction costs.

Furthermore, the futures market may also serve as a tool for market manipulation, where large holders intentionally generate a large number of on-chain transactions to increase Gas fees and profit in the futures market. However, this action may cause other users to experience a rise in transaction costs on the Ethereum mainnet. Additionally, as a DApp operator, being aware of specific times when certain actions may cause a surge in transaction volume, one can proactively benefit from operations in the futures market, turning the futures market into an arbitrage market for information advantage players, leading to unforeseen losses for regular users who solely rely on market hedging.

The emergence of a new trading market inevitably means that there will be arbitrage opportunities due to information asymmetry, affecting the market's ability to address the problems it aims to solve. For ETHGas, balancing this issue to prevent the "positive feedback loop" from turning into a "death spiral" may require some necessary regulatory measures.

You may also like

ThunderChain Resumes Legal Battle as Former CEO Chen Lei Accused of Embezzlement for Cryptocurrency Speculation - What Happened Back Then?

Key Market Intelligence for January 15th, how much did you miss out on?

XRP Price Action: Crypto Bill Could Grant XRP the Same Legal Designation as Bitcoin

Key Takeaways A new legislative draft in the United States might classify XRP alongside Bitcoin (BTC) and Ethereum…

Coinbase CEO Raises Red Flags Regarding US Crypto Bill

Key Takeaways Coinbase CEO Brian Armstrong voices opposition to the proposed Senate crypto bill, citing significant concerns. The…

Ethereum Price Prediction: SharpLink Activates Multi-Billion ETH Strategy – How Soon Might ETH Achieve a New All-Time High?

Key Takeaways SharpLink has strategically deployed $170 million in Ethereum on the Linea network, showcasing a productive use…

Transforming the Cryptocurrency Landscape: A 2026 Outlook

Key Takeaways Cryptocurrency systems have seen expansive growth and technological innovation. The introduction of new regulations has reshaped…

Pi Coin Price Prediction: Mainnet Tokens Just Unlocked – What Does This Mean for Holders?

Key Takeaways Daily token unlocks are increasing the supply of Pi Coin, affecting its short-term price stability. Pi…

New ChatGPT Forecasts for XRP, Ethereum, and Solana by 2026

Key Takeaways ChatGPT predicts a potential bull market for XRP, Ethereum, and Solana by 2026, supported by the…

Why Is Crypto Up Today? – January 14, 2026

Key Takeaways Cryptocurrency market capitalization has risen by 3.6% to $3.33 trillion, with 95 of the top 100…

Ethereum Value Falls Below 3,100 USDT Amidst Market Fluctuations

Key Takeaways Ethereum’s price has dropped below 3,100 USDT, reflecting a 24-hour decrease of up to 0.51%. Current…

YO Protocol’s Automated Conversion Error Resolves $3.7 Million Shortfall

Key Takeaways YO Protocol, a decentralized finance platform, recently experienced an automated conversion operation error, resulting in a…

Sonic Labs Recovers and Redistributes Millions in Stolen Assets

Key Takeaways Sonic Labs has successfully recovered 5,829,196 stolen S tokens after a November 2025 exploit. These recovered…

Flash Trader Executes High-Leverage Bitcoin Trades

Key Takeaways The investor known as “Flash Trader” is actively using high leverage to trade Bitcoin. Recently, Flash…

Whale Places Big Bets on BTC, ETH, and ZEC

Key Takeaways A large investor, identified as a whale, has initiated significant long positions on Bitcoin (BTC), Ethereum…

Whale’s 3x LIT Position Sees $2.84 Million in Unrealized Losses

Key Takeaways A whale holding a 3x leveraged long position on LIT faces over $2.84 million in unrealized…

Amber and Ethena Transfer 3,956 ETH to Major Exchanges

Key Takeaways Amber Group and Ethena deposited a total of 3,956 ETH, equivalent to approximately $13.24 million, to…

HTX Market Experiences Notable Price Changes and Volatility

Key Takeaways The last known price of HTX is $0.0000017 USD, reflecting a 24-hour decrease of -0.12%. HTX…

Ethereum Drops Below $3,300 as Market Volatility Continues

Key Takeaways Ethereum’s price has fallen below $3,300, currently sitting at $3,297 with a 0.87% decline over the…

ThunderChain Resumes Legal Battle as Former CEO Chen Lei Accused of Embezzlement for Cryptocurrency Speculation - What Happened Back Then?

Key Market Intelligence for January 15th, how much did you miss out on?

XRP Price Action: Crypto Bill Could Grant XRP the Same Legal Designation as Bitcoin

Key Takeaways A new legislative draft in the United States might classify XRP alongside Bitcoin (BTC) and Ethereum…

Coinbase CEO Raises Red Flags Regarding US Crypto Bill

Key Takeaways Coinbase CEO Brian Armstrong voices opposition to the proposed Senate crypto bill, citing significant concerns. The…

Ethereum Price Prediction: SharpLink Activates Multi-Billion ETH Strategy – How Soon Might ETH Achieve a New All-Time High?

Key Takeaways SharpLink has strategically deployed $170 million in Ethereum on the Linea network, showcasing a productive use…

Transforming the Cryptocurrency Landscape: A 2026 Outlook

Key Takeaways Cryptocurrency systems have seen expansive growth and technological innovation. The introduction of new regulations has reshaped…