Live XRP AI price chart

XRP AI key metrics

How to buy XRP AI?

XRP AI price history

1What is the all-time high (ATH) of XRP AI?

2What is the all-time low (ATL) of XRP AI?

XRP AI technical analysis

Additionally, the RSI is currently at 0, which is generally considered oversold, suggesting that the price has fallen too rapidly and might be poised for a bounce or upward correction.

XRP AI (XRP) 2026 price prediction: Market outlook and investment analysis

XRP AI holder statistics

Top 10 XRP AI holders

Whale holding concentration (Monthly)

XRP AI Holders

About XRP AI

1. What is XRP?

XRP is a digital asset built for enterprise use, offering banks and financial institutions a highly efficient way to bridge different currencies. Launched in 2012, it is the native asset of the XRP Ledger (XRPL)—an open-source, permissionless, and decentralized blockchain. In 2026, XRP is recognized as the premier "Bridge Currency" for global value transfer, designed to move money as fast as information moves today.

2. Speed and Efficiency

While Bitcoin can take minutes and Ethereum several seconds, XRP transactions settle in just 3 to 5 seconds. The network is capable of handling 1,500 transactions per second (TPS) 24/7, making it thousands of times faster and cheaper than traditional systems like SWIFT. By early 2026, its role in real-time gross settlement (RTGS) has made it indispensable for the modern internet of value.

3. The XRP Ledger (XRPL)

The XRP Ledger is a sustainable, decentralized blockchain that does not rely on mining. Instead, it uses a unique Consensus Protocol where designated nodes agree on transactions. This design makes it one of the most eco-friendly blockchains in existence. In 2026, the XRPL has evolved into a multi-functional platform supporting native decentralized exchanges (DEX), sidechains, and sophisticated smart contract capabilities.

4. Legal Clarity in the US

XRP holds a unique position in 2026 as one of the few digital assets with comprehensive legal clarity in the United States. Following years of litigation and subsequent regulatory milestones in 2023 and 2024, XRP is officially classified as a non-security. This legal certainty has paved the way for unprecedented adoption by conservative financial institutions and traditional payment processors.

5. Spot XRP ETFs and Institutional Inflow

A major catalyst for XRP in late 2025 and early 2026 was the launch and maturation of Spot XRP ETFs. Following the success of Bitcoin and Ethereum ETFs, these regulated investment vehicles have allowed Wall Street giants to offer XRP exposure to retail and institutional clients. This has significantly increased XRP's liquidity and solidified its status as a "top-tier" institutional asset alongside BTC and ETH.

6. Cross-Border Liquidity and RLUSD

Ripple, the largest contributor to the XRP ecosystem, utilizes XRP to power its liquidity solutions. By 2026, the integration of Ripple’s USD-pegged stablecoin (RLUSD) alongside XRP has created a powerful dual-asset system. Financial institutions use XRP as the bridge for volatile currency pairs, while stablecoins provide a secure peg for daily settlements, drastically reducing the cost of dormant capital in Nostro/Vostro accounts.

7. The Escrow System: Supply Predictability

Unlike Bitcoin's mining, Ripple (the largest holder) placed 55 billion XRP into a series of Escrows in 2017. Each month, 1 billion XRP are released to provide liquidity to the market. Any unused portion is returned to a new escrow at the end of the month. As of early 2026, this system provides institutional-grade predictability, ensuring that there is no "supply dump" and that the market can forecast exactly how much XRP will be available years in advance.

8. The Burn Mechanism: Deflationary Utility

XRP is inherently deflationary. To prevent spam and DDoS attacks, the XRP Ledger requires a small fee for every transaction, which is not paid to any party but is permanently destroyed (burned). In 2026, as the volume of global cross-border payments on the XRPL hits new highs, the cumulative "burn rate" has effectively reduced the total supply of XRP. This means that as network utility increases, the asset becomes scarcer over time—a unique economic model known as "Utility-Driven Deflation."

XRP AI price performance

XRP to USD converter

XRP

XRP

XRP profit calculator

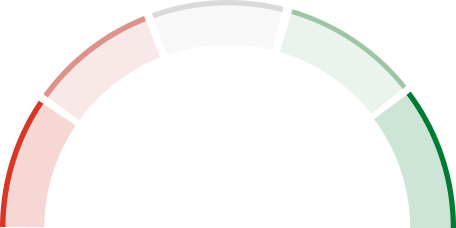

Rate your computational analysis of XRP today

0

0 0

0XRP AI price calculator

FAQ

1. What is the current price of XRP AI (XRP) in USD?

2. What is the market capitalization of XRP AI (XRP)?

3. What is the circulating supply of XRP AI (XRP)?

4. What factors influence the price of XRP AI (XRP)?

5. Is XRP AI (XRP) a good investment?

6. Where can I buy XRP AI (XRP)?

7. What are the typical fees when buying XRP AI (XRP)?

8. What are some technical indicators used for analyzing XRP AI (XRP)?

XRP AI news

XRP on WEEX

Discover easy-to-follow guides to buy XRP AI and explore a wide range of crypto markets on our user-friendly platform. Plus, gain access to up to 400× leverage to boost your earning potential.

Join WEEX and kick off your trading adventure with a winning edge. Don't miss out—sign up now to supercharge your crypto investments!

+0.01%

+0.01% Website

Website X(Twitter)

X(Twitter)