Wintermute Outlook: Funding Stagnation, Market Enters Zero-Sum Game Phase

Original Title: Liquidity, the lifeblood of crypto

Original Source: Wintermute

Original Translation: Azuma, Odaily Planet Daily

Key Takeaways

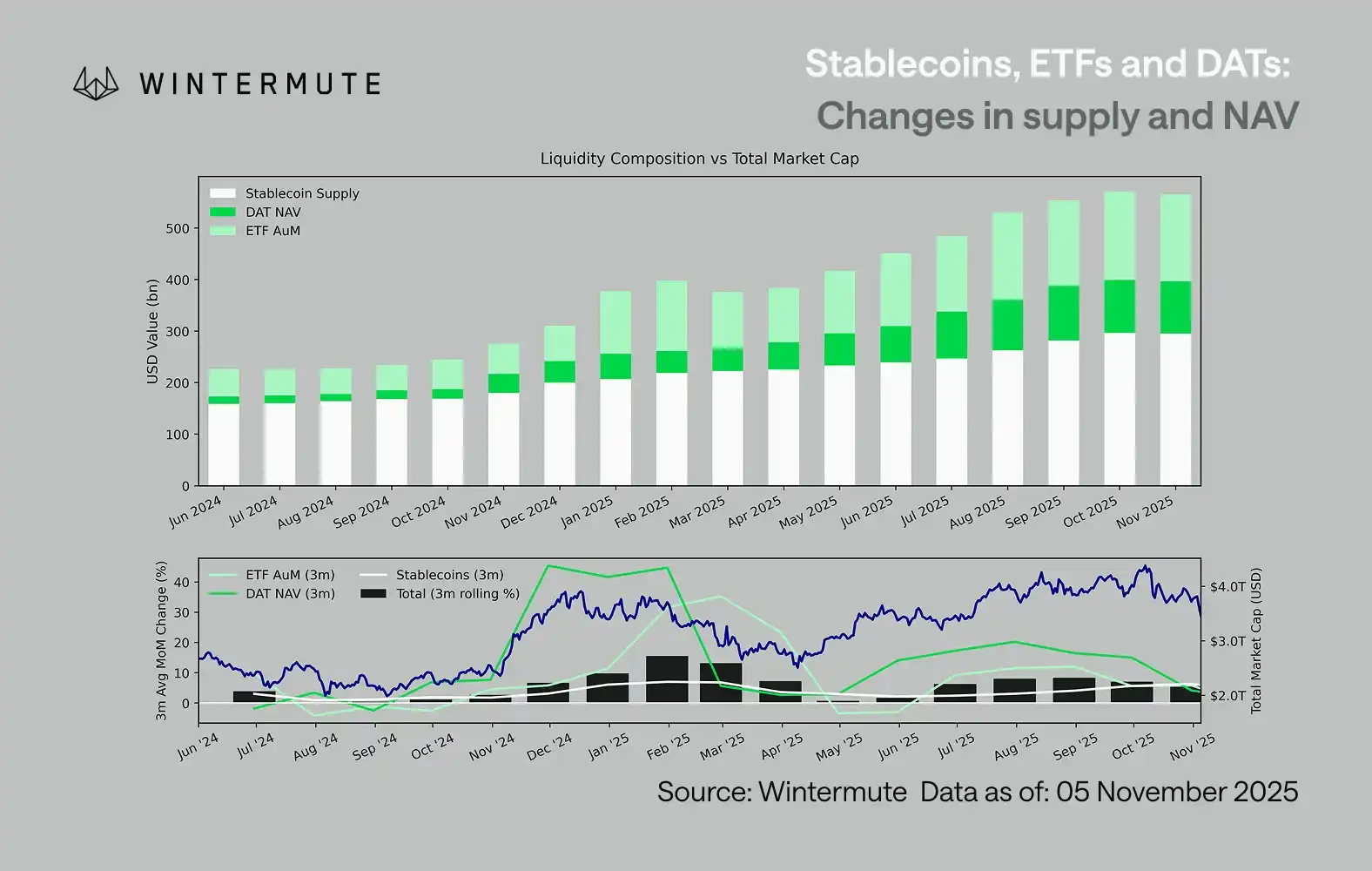

1. Liquidity drives the market cycles of the crypto sector, with inflows from stablecoins, ETFs, and DATs (Digital Asset Treasuries) slowing down.

2. Global liquidity remains ample, but higher SOFR rates are keeping funds parked in short-term treasuries (T-bills) rather than flowing into the crypto market.

3. The crypto market is in a phase of "self-circulation" — funds are circulating internally until new external funds re-enter.

The Dominant Role of Liquidity

Liquidity often dictates the cyclical nature of each cryptocurrency market cycle. While adoption in the long run may shape the narrative of the cryptocurrency industry, what truly drives price changes is the direction of fund flows.

Over the past few months, the momentum of this fund flow has notably slowed down. Capital entering the ecosystem through the three main channels — stablecoins, ETFs, and Digital Asset Treasuries (DAT) — has seen its velocity synchronized weakening, shifting the crypto market from an expansion phase to a stock fund-supported phase.

While technological adoption is crucial, liquidity is the key driver behind the market's cyclical shifts. It is not just a matter of market depth but also of fund availability. When global monetary supply expands or real interest rates decline, excess liquidity will inevitably seek risk assets, with crypto assets historically (especially during the 2021 cycle) being among the largest beneficiaries.

In previous cycles, liquidity primarily entered digital assets through stablecoin issuance, which is the most fundamental fiat on-ramp. As the market matures, three major liquidity funnels have gradually emerged, determining the path for new capital to enter the crypto market:

· Digital Asset Treasuries (DATs): Tokenized funds with yield structures, used to bridge traditional assets with on-chain liquidity.

· Stablecoins: On-chain forms of fiat liquidity, serving as the base collateral for leverage and trading activity.

· ETF: Provides a BTC and ETH exposure channel for traditional financial institutions and passive funds.

Combining the ETF's Assets Under Management (AUM), the DAT's Net Asset Value (NAV), and the circulating supply of stablecoins can serve as a reasonable metric to gauge the inflow of total digital asset capital.

The chart below illustrates the changes in these components over the past 18 months. The bottom chart demonstrates that the variation in this total amount is highly correlated with the overall digital asset market capitalization—when inflows accelerate, prices also rise.

Which inflow path has slowed down?

An important insight reflected in the chart is that the momentum of inflows into DAT and ETF has significantly weakened. These two paths showed strong performance in the fourth quarter of 2024 and the first quarter of 2025, experienced a brief recovery in early summer, but the momentum has gradually dissipated since. Liquidity (M2) is no longer naturally flowing into the crypto ecosystem as it did at the beginning of the year. Since early 2024, the combined size of DAT and ETF has increased from around $400 billion to $2.7 trillion, while stablecoin supply has doubled from about $1.4 trillion to $2.9 trillion. This demonstrates structural growth but also indicates a clear "plateau."

Observing the deceleration pace of different paths is crucial as each path reflects distinct sources of liquidity: Stablecoins reflect the native risk appetite of the crypto market; DAT embodies institutional demand for yield assets; and ETFs map the allocation trend of traditional financial funds; with all three slowing down simultaneously, it suggests that new capital deployment is universally decelerating, not just rotating between products.

Stockpile Game Market

Liquidity has not vanished; it is merely circulating within the system, rather than expanding continuously.

From a broader macro perspective, overall economic liquidity (M2) outside the crypto market has not stalled. While higher SOFR rates may temporarily constrain liquidity—making cash returns more attractive, keeping funds in the treasury market—the world is still in an accommodative phase, and the U.S. quantitative tightening (QT) has officially ended. The structural backdrop remains supportive; it's just that liquidity is currently flowing more toward other risk expression forms, such as the stock market.

Due to a decrease in external funding inflows, the market dynamics have become more closed-off. Funds mostly rotate between large-cap coins and altcoins, creating an environment of internal PvP (player versus player). This explains why bull market rallies are always short-lived and why market breadth continues to narrow even when the total asset under management remains stable. Currently, the surge in market volatility is primarily driven by a cascade of liquidations rather than sustained trend-following.

Looking ahead, if any of the liquidity pathways see a substantial recovery — whether it's a resurgence in stablecoin minting, a renewed interest in ETFs, or a rebound in DeFi Activity Token (DAT) volume — it would signify that macro liquidity is flowing back into the digital asset space.

Until then, the crypto market will remain in a "self-sustaining" phase where funds circulate internally rather than compounding growth.

You may also like

X Pulls the Plug — the Era of “Talking Your Way to Traffic” Comes to an End.

Other people’s traffic will always belong to them—not to you.

First Zero, First Revival: A Real Story from the WEEX Global AI Trading Hackathon Preliminary Round

WEEX Labs, the innovation arm of the global crypto exchange WEEX, launched the preliminary round of its flagship AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by world-class sponsors including AWS, the prize pool has reached $1.88 million, with a Bentley Bentayga S awaiting the champion in Dubai. Already, 788 elite teams worldwide are battling for a spot in the finals. This is more than a hackathon — it is a real-market stress test for AI trading. Registration remains open until January 18. If you want your AI to face real volatility, this is your moment.

Cross-chain Collaboration: Tom Lee Invests $200 Million, Joins Forces with Global Top Streamer Mr. Beast

The Genius Stopping Law: Why Did Coinbase Backpedal at the Eleventh Hour?

Fact Check: How Much Money Did the University of Chicago Lose in its Crypto Investment?

Rumor has it that Coinbase is set to acquire Farcaster, still an Acquihire.

VanEck Q1 Market Outlook: Long-Term Bullish on Cryptocurrency, Strong Gold Demand

Matrixdock releases latest semi-annual physical gold audit report, strengthening physical gold transparency practices

Former Star Public Blockchain Berachain in Crisis: Price Collapse, Layoffs, Developer Exodus

Coinbase CEO Raises Red Flags Regarding US Crypto Bill

Key Takeaways Coinbase CEO Brian Armstrong voices opposition to the proposed Senate crypto bill, citing significant concerns. The…

Transforming the Cryptocurrency Landscape: A 2026 Outlook

Key Takeaways Cryptocurrency systems have seen expansive growth and technological innovation. The introduction of new regulations has reshaped…

New ChatGPT Forecasts for XRP, Ethereum, and Solana by 2026

Key Takeaways ChatGPT predicts a potential bull market for XRP, Ethereum, and Solana by 2026, supported by the…

An Insight into the Dynamics of Crypto Market Trends

Key Takeaways The article provides a comprehensive look at the latest developments in the cryptocurrency market. Insight is…

Senate Crypto Bill Markup Rescheduled to January 27 Amid Legislative Momentum

Key Takeaways The Senate Agriculture Committee has rescheduled the release of the legislative text for crypto market structure…

CLARITY Act Hearing Suddenly Postponed – Where Does the Disagreement Lie?

YO Protocol’s Automated Conversion Error Resolves $3.7 Million Shortfall

Key Takeaways YO Protocol, a decentralized finance platform, recently experienced an automated conversion operation error, resulting in a…

Sonic Labs Recovers and Redistributes Millions in Stolen Assets

Key Takeaways Sonic Labs has successfully recovered 5,829,196 stolen S tokens after a November 2025 exploit. These recovered…

Dolomite Surges with Prominent Integrations Boosting Market Value

Key Takeaways Dolomite (DOLO) has seen a significant 24.60% price increase in the last 24 hours, currently trading…

X Pulls the Plug — the Era of “Talking Your Way to Traffic” Comes to an End.

Other people’s traffic will always belong to them—not to you.

First Zero, First Revival: A Real Story from the WEEX Global AI Trading Hackathon Preliminary Round

WEEX Labs, the innovation arm of the global crypto exchange WEEX, launched the preliminary round of its flagship AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by world-class sponsors including AWS, the prize pool has reached $1.88 million, with a Bentley Bentayga S awaiting the champion in Dubai. Already, 788 elite teams worldwide are battling for a spot in the finals. This is more than a hackathon — it is a real-market stress test for AI trading. Registration remains open until January 18. If you want your AI to face real volatility, this is your moment.