Key Market Intelligence on November 13th, how much did you miss out on?

Featured News

1. Trump Signs Bill, Ending U.S. Government Shutdown

2. Polymarket Quietly Relaunches U.S. Trading Platform in Beta Mode

3. "Hakimi" Surges Over 50% in 24 Hours, Reaching a Market Cap of $25.91 Million

4. Shitcoin ETF Candidate Sees Massive Surge in 24-Hour Trading Volume, XRP Volume Up Over 60%

5. Pre-Market Crypto Concept Stocks in U.S. Rise Across the Board, SharpLink Up 3.28%

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

Here is the English translation of the original content:

[HYPERLIQUID]

Hyperliquid became the focus of the market today due to a significant event: a $3 million withdrawal from OKX was split among 19 wallets and used to leverage long on POPCAT on the platform. This ultimately led to rapid liquidation resulting in a $4.9 million loss for HLP. Following the event, Hyperliquid paused its cross-chain bridge for maintenance.

Additionally, Hyperliquid launched NVDA-PERP, the first-ever permissionless perpetual contract for an individual stock in the crypto space, seen as a significant innovation. The platform's innovative features and collaboration with Polymarket's prediction markets have also sparked discussions, highlighting its impact in the crypto ecosystem.

[POPCAT]

POPCAT experienced intense fluctuations today, stemming from malicious manipulation on Hyperliquid. A trader withdrew $3 million USDC from OKX, split it among 19 wallets, and established long positions ranging from $20 million to $30 million, creating a false buy wall at $0.21. After the buy wall was removed, the price plummeted, resulting in a total of $63 million in liquidations and a $4.9 million loss for HLP. The event is linked to previous manipulation activities, prompting Hyperliquid to pause the Arbitrum cross-chain bridge and sparking widespread discussions on high leverage risks and the security of decentralized exchanges.

[POL]

Today's POL discussion focuses on the integration of Polygon, a leading global fund network Calastone, aiming to tokenize fund shares for 4,500 financial institutions across 58 markets. This move highlights Polygon's role in on-chain institutional finance, providing faster settlement, lower costs, and greater transparency. Additionally, Polygon's impact in the Latin American market, stablecoin adoption, and rising transaction fees (indicating increased network activity) are also under scrutiny.

[ORD]

ORD's hot topic today is the launch of ZapApp, a self-custodial crypto app based on Solana that supports KYC-free, gas-free transactions. Following the launch of ZapApp, the official distribution of $DOG tokens as part of the celebration has sparked market enthusiasm. The app aims to streamline the trading process and challenge the traditional exchange model by waiving listing fees, sparking discussions on exchange fairness and the potential disruptive nature of ZapApp.

Featured Articles

1. "A New Era of Token Financing: Milestone in U.S. Compliance Financing"

The upcoming ICO of Monad on Coinbase has been a hot topic this week. Apart from discussions on whether the sale at a $25 billion fully diluted valuation is worth participating in, the "compliance level" as Coinbase's first ICO has also sparked widespread discussions, seen as a landmark event of compliance in the crypto world. Stablecoin issuer Circle mentioned in its recent Q3 financial report that it is exploring the possibility of issuing native tokens on the Arc Network. Coinbase also hinted at launching the Base token in an interview with Jesse Pollak, co-founder of Base Chain, around 2 years after its collaboration. All signs point to a compliant new era in asset issuance in the crypto world.

2. "Major Adjustment in U.S. Crypto Regulation: CFTC May Fully Take Over the Spot Market"

The long-standing ambiguous regulatory boundaries of crypto in the U.S. are being redrawn. With Mike Selig nominated as CFTC chairman and new legislation advancing in Congress, the delineation between the SEC and CFTC is emerging at the policy level for the first time, showing a rare clear trend in regulatory structure: SEC focusing on securities; CFTC focusing on the digital commodity spot market.

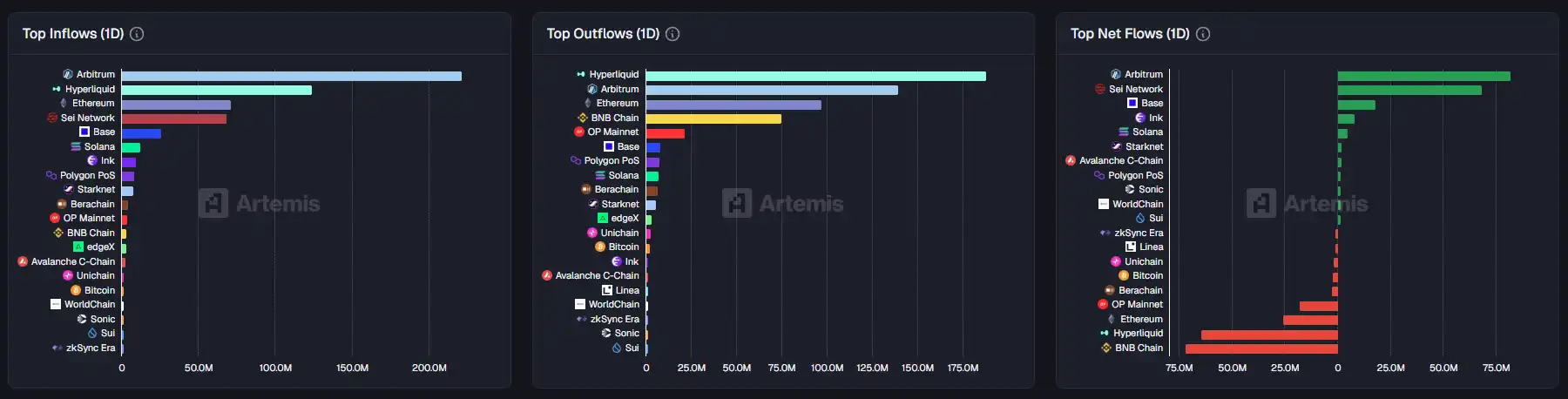

On-chain Data

On-chain Fund Flow for the week of November 13

You may also like

Trade Finance: Unleashing Blockchain’s Most Potent Opportunity

Key Takeaways Blockchain technology has the potential to revolutionize the $9.7-trillion global trade finance market by addressing its…

Revolut Pursues Banking Expansion in Peru Amid Latin America Remittance Strategies

Key Takeaways Revolut seeks a banking license in Peru as part of its strategic expansion across Latin America,…

Trump Takes on the Fed, Italy Warns Financial Influencers: A Global Overview

Key Takeaways President Trump initiates criminal charges against the Fed Chairman, potentially impacting U.S. monetary policy. Coinbase halts…

Crypto’s Decentralization Dream Falters at Interoperability

Key Takeaways The promise of decentralization in the crypto industry is hindered by centralized intermediaries managing interoperability between…

Tokenomics' Year of Reckoning

CLARITY Act Stalls: Why Has the Interest-Bearing Stablecoin Become a Bank’s “Thorn in the Side”?

Key Takeaways The debate surrounding the CLARITY Act is primarily focused on interest-bearing stablecoins and their implications for…

Wintermute: The Four-Year Cycle is Dead, Crypto Breakthrough 2026, Where to Next?

Key Takeaways The traditional four-year crypto cycle, once deemed a fundamental market principle, is becoming obsolete as market…

Trump Targets Fed Chair, Crypto Challenges, and MiCA Regulations

Key Takeaways President Trump has initiated criminal charges against the current Federal Reserve Chairman, alleging financial mismanagement in…

The New York Stock Exchange is moving toward 24/7 stock trading. The world is becoming one giant exchange.

The Earth never sleeps — why should the markets?

Hyperliquid Introduces Direct ETH Deposits and Withdrawals for Enhanced Spot Trading

Key Takeaways Hyperliquid has officially rolled out direct Ethereum deposits and withdrawals, streamlining its spot trading capabilities. The…

Hyperliquid Revolutionizes DeFi with Advanced Blockchain Solutions

Key Takeaways Hyperliquid is transforming decentralized finance (DeFi) with high-performance solutions and an emphasis on perpetual futures trading.…

Market Correction Impacts Meme Coins: WhiteWhale Declines by 75%

Key Takeaways WhiteWhale has experienced a significant drop, losing 32.3% of its value in the past 24 hours,…

Backers Seek Refunds as Trove Abandons Hyperliquid Integration for Solana

Key Takeaways: Trove pivots to Solana after raising over $11.5 million for Hyperliquid integration, leading to refund demands.…

XRP Price Prediction: $1.28B ETF Inflows Counter Bearish Signals Near $2.05

Key Takeaways: Despite a $1.28 billion inflow into XRP ETFs, XRP is facing a decline within a bearish…

Mortgage Lender Newrez Embraces Crypto Assets in Loan Decisions

Key Takeaways: Newrez plans to incorporate cryptocurrency holdings as qualifying assets in its mortgage underwriting process, potentially opening…

XRP Price Prediction: Golden Cross at $2.07 Shows Breakout Toward $2.35 Resistance

Key Takeaways XRP’s recent golden cross signals potential bullish momentum, pointing towards an upward price trend. Support levels…

XRP Price Prediction: While the Crypto Market Faces a Downturn, Substantial Investments Quietly Stream into XRP—What is Being Foreseen?

Key Takeaways Significant inflows into XRP-linked ETFs suggest a bullish outlook despite recent market declines. XRP’s rising ETF…

New ChatGPT Predicts the Price of XRP, PEPE, and Ethereum By the End of 2026

Key Takeaways ChatGPT predicts a significant rise in XRP, potentially reaching $12 by 2027, driven by positive regulatory…

Trade Finance: Unleashing Blockchain’s Most Potent Opportunity

Key Takeaways Blockchain technology has the potential to revolutionize the $9.7-trillion global trade finance market by addressing its…

Revolut Pursues Banking Expansion in Peru Amid Latin America Remittance Strategies

Key Takeaways Revolut seeks a banking license in Peru as part of its strategic expansion across Latin America,…

Trump Takes on the Fed, Italy Warns Financial Influencers: A Global Overview

Key Takeaways President Trump initiates criminal charges against the Fed Chairman, potentially impacting U.S. monetary policy. Coinbase halts…

Crypto’s Decentralization Dream Falters at Interoperability

Key Takeaways The promise of decentralization in the crypto industry is hindered by centralized intermediaries managing interoperability between…

Tokenomics' Year of Reckoning

CLARITY Act Stalls: Why Has the Interest-Bearing Stablecoin Become a Bank’s “Thorn in the Side”?

Key Takeaways The debate surrounding the CLARITY Act is primarily focused on interest-bearing stablecoins and their implications for…