Grayscale Submits IPO Application: Cryptocurrency Giant with $35 Billion AUM Finally at the Doorstep of the Stock Market

Original Article Title: "Grayscale, Once Tough SEC, is about to Land on the NYSE"

Original Article Author: Eric, Foresight News

On the evening of November 13th, Beijing time, Grayscale submitted an IPO application to the NYSE, planning to debut on the US stock market through Grayscale Investment, Inc. This IPO is led by Morgan Stanley, BofA Securities, Jefferies, and Cantor.

It is worth noting that Grayscale's listing this time adopts an Umbrella Partnership structure (Up-C). In this structure, Grayscale's operational and controlling entity, Grayscale Operating, LLC, is not the listing entity. Instead, the IPO is conducted through a newly established listing entity, Grayscale Investment, Inc., which acquires a portion of LLC's equity to facilitate public trading. The company's founders and early investors can convert their LLC interests into shares of the listing entity, enjoying capital gains tax benefits in the process by only paying personal income tax. IPO investors, on the other hand, need to pay taxes on corporate profits and personal income tax on stock dividends.

Such a listing structure not only benefits the company's "elders" in terms of taxation but also allows for post-listing absolute control through dual-class shares. The S-1 filing shows that Grayscale is wholly owned by its parent company DCG, and Grayscale explicitly states that post-listing, the DCG parent company will retain decision-making control over Grayscale through 100% ownership of B class shares with greater voting rights. The funds raised through the IPO will also be used entirely to purchase equity from the LLC.

Everyone is no stranger to Grayscale, which first launched Bitcoin and Ethereum investment products and, through a tough battle with the SEC, achieved the conversion of Bitcoin and Ethereum trusts into spot ETFs. Its launch of the Digital Large Cap Fund also had the power of a "cryptocurrency version of the S&P 500." During the last bull market cycle, every adjustment to the large-cap fund caused significant short-term price fluctuations for the tokens being removed and added.

S-1 filings show that as of September 30th of this year, Grayscale's total AUM reached $35 billion, making it the world's largest cryptocurrency asset manager. It has over 40 different digital asset investment products covering more than 45 cryptocurrencies. The $35 billion includes $33.9 billion in AUM of ETPs and ETFs (primarily Bitcoin, Ethereum, SOL-related products) and $1.1 billion in private funds (primarily altcoin investment products).

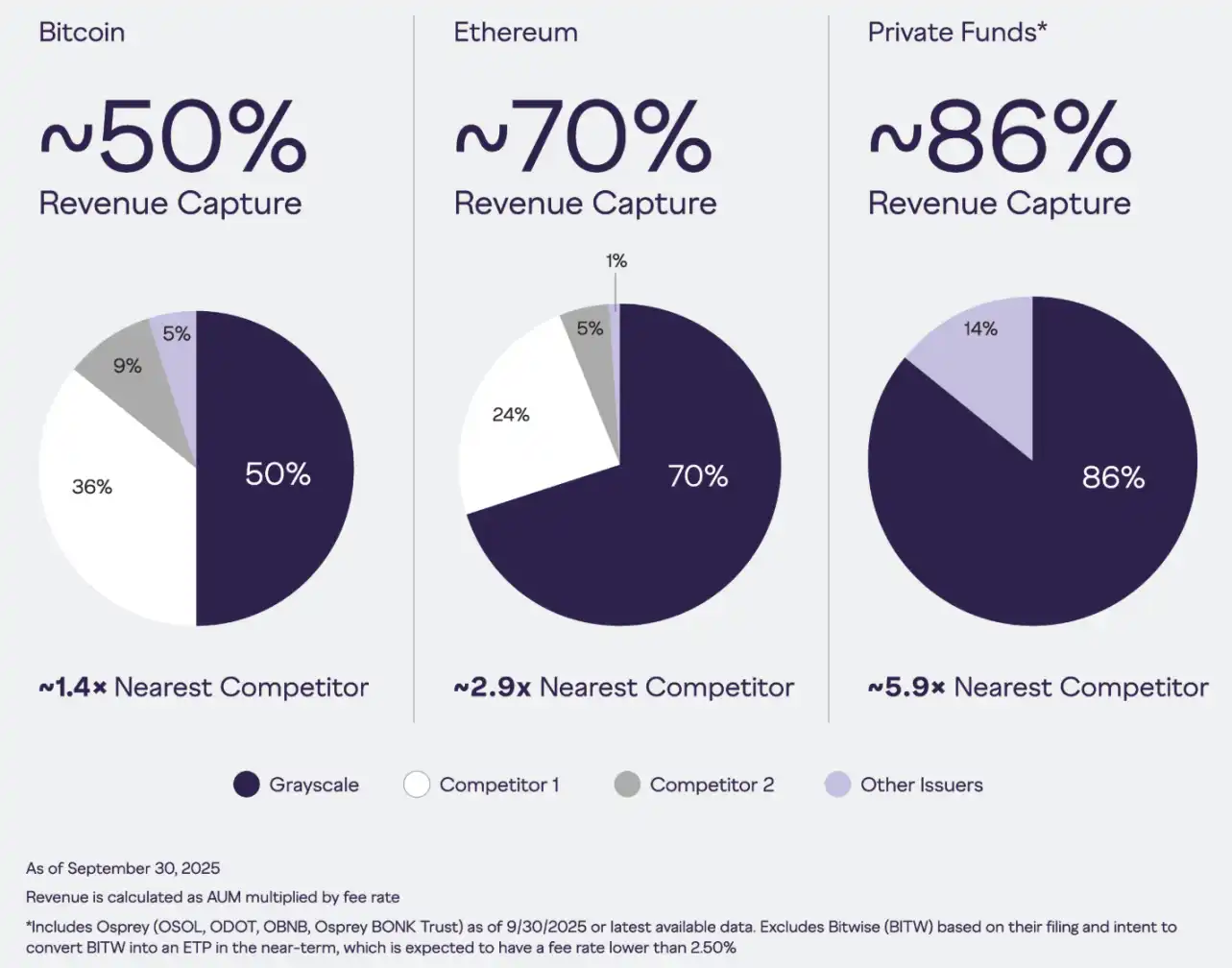

In addition, purely in terms of revenue, Grayscale's main investment products have a stronger revenue-generating capability compared to its primary competitors. However, this is mainly due to the previously non-redeemable trust accumulation of AUM and an above-peer-average management fee.

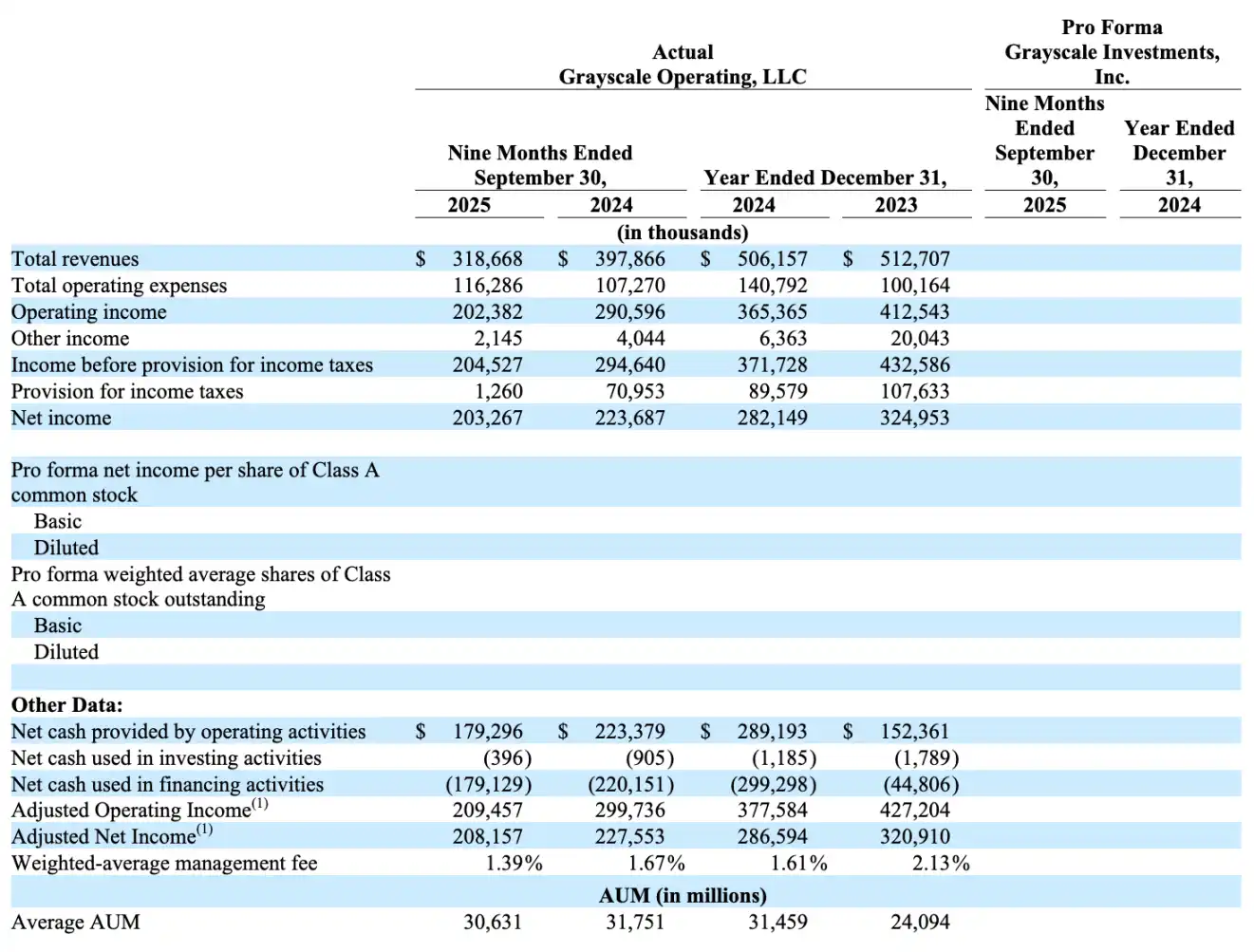

Financially, for the nine months ending September 30, 2025, Grayscale's operating revenue was approximately $3.19 billion, a 20% year-over-year decrease. Operating expenses were around $1.16 billion, an 8.4% year-over-year increase. Operating profit stood at about $2.02 billion, a 30.4% year-over-year decrease. Including other income and deducting the provision for income taxes, the net profit was approximately $2.03 billion, down 9.1% year-over-year. Additionally, average AUM data indicates a possible decrease in AUM compared to last year.

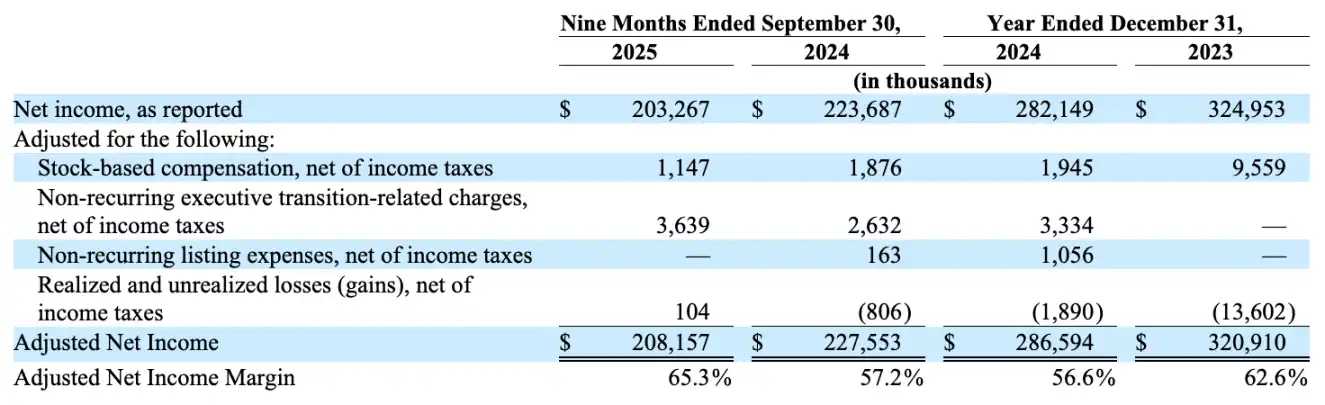

Excluding non-recurring items, the adjusted net profit for the reporting period was about $2.08 billion, with a net profit margin of 65.3%. Although the former decreased by 8.5% year-over-year, the net profit margin increased compared to the same period last year at 57.2%.

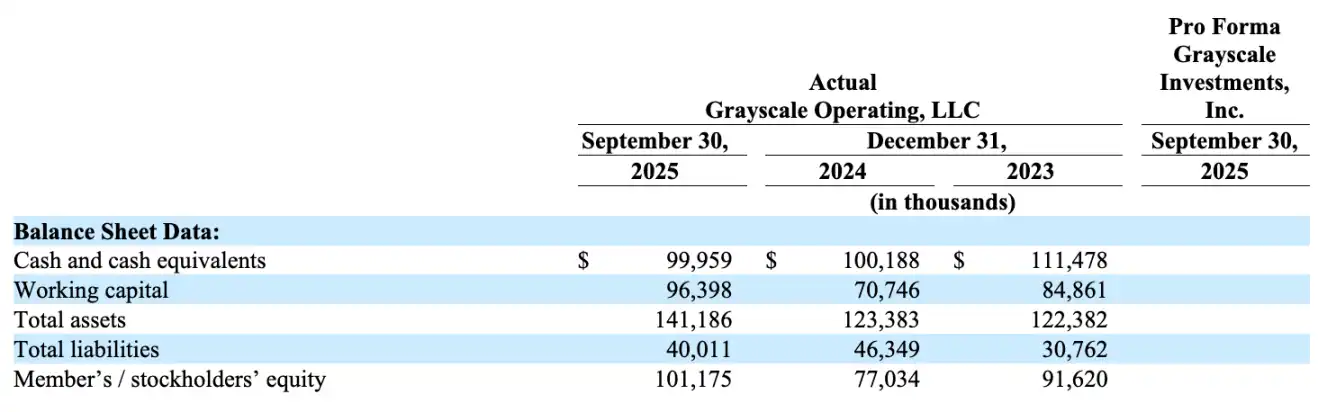

Currently, Grayscale's debt ratio is quite healthy. Despite a decline in revenue and profit, considering the increase in company asset value, decrease in debt, and improvement in profit margin, Grayscale's operational condition is continuously improving.

The S-1 filing also disclosed Grayscale's future development plans, including expanding the types of private funds (introducing more altcoin private investment products); launching active management products to complement passive investment products (ETFs, ETPs); conducting active investments targeting its own investment products, cryptocurrencies, or other assets.

Regarding expanding distribution channels, Grayscale disclosed that it has completed due diligence on three broker-dealers with a total AUM of $14.2 trillion and recently launched Bitcoin and Ethereum mini ETFs on the platform of a large independent broker-dealer with over 17,500 financial advisors and consulting and brokerage assets exceeding $1 trillion. In August of this year, Grayscale partnered with the iCapital Network, a network of 6,700 advisory firms, under which Grayscale will provide digital asset investment channels through its active management strategies to the network companies in the future.

Overall, the information disclosed by Grayscale indicates that the company is a relatively stable asset management firm, with the main revenue source being management fees from investment products, offering limited room for imagination. However, given the precedents of traditional asset management companies going public, the expectations for Grayscale's market value, P/E ratio, etc., are somewhat foreseeable, providing a relatively predictable investment target.

You may also like

ETH Ecosystem Month: A $1.5 Million Trading Opportunity Focused on Ethereum Assets

Explore ETH trading opportunities on WEEX with ETH Ecosystem Month. A $1.5M campaign covering ETH spot trading, ETH futures rewards, leaderboards, and referral incentives across the Ethereum ecosystem.

Bitcoin 30-Day Realized Losses and Gold Reaching Record Highs

Key Takeaways Bitcoin holders have experienced a rare stretch of 30-day realized losses for the first time since…

Central banks vs Bitcoin: Who truly earns the public’s trust?

Key Takeaways The debate over trust between central banks and Bitcoin continues, receiving global attention at the World…

Kaspa is Expected to Decline to $0.032939 by January 26, 2026

Key Takeaways Kaspa’s price is projected to drop 23.07% within the next five days. Current market sentiment for…

Bitcoin Fills New Year CME Gap with Sub-$88K BTC Price Drop

Key Takeaways Bitcoin’s price has closed a significant CME gap that appeared at the beginning of the year,…

Bitcoin Exhibits Resilience at $92K Amidst Economic Fluctuations: Is the Downturn Over?

Key Takeaways: Bitcoin remains robust at $92,000, though ETF outflows and geopolitical concerns loom. BTC futures premium close…

Crypto Mortgages in the US Tackle Valuation Risks and Regulatory Challenges

Key Takeaways The adoption of crypto mortgages is facing challenges around valuation risks and regulatory uncertainties in the…

Can Bitcoin Regain $90K? Bulls at Risk as Long-Term Holders Increase Selling

Key Takeaways: Bitcoin has declined below the $90,000 mark amid increased selling pressure from whales and long-term holders.…

Michael Saylor’s Strategy Surpasses 700,000 Bitcoin with a New $2.1B Acquisition

Key Takeaways: Michael Saylor’s Strategy has significantly increased its Bitcoin holdings to an impressive 709,715 BTC after purchasing…

Bitcoin Pursues $90K: Trump to Fast-Track Crypto Legislation

Key Takeaways Bitcoin is gaining momentum as President Trump indicates imminent crypto-friendly legislation. Trump’s World Economic Forum speech…

Crypto’s Next Challenge: Privacy and the Chicken-Egg Dilemma

Key Takeaways Privacy is becoming a central issue as cryptocurrencies move into traditional banking and state-backed systems. Regulatory…

Trump Takes on the Fed, Italy Warns Financial Influencers: A Global Overview

Key Takeaways President Trump initiates criminal charges against the Fed Chairman, potentially impacting U.S. monetary policy. Coinbase halts…

What Happened in Crypto Today: Key Updates and Insights

Key Takeaways A crucial crypto bill’s progress is delayed as the Senate pivots its focus to broader affordability…

Crypto’s Decentralization Dream Falters at Interoperability

Key Takeaways The promise of decentralization in the crypto industry is hindered by centralized intermediaries managing interoperability between…

Ethereum Price Prediction – ETH Price Estimated to Reach $ 3,660.02 By Jan 23, 2026

Key Takeaways Ethereum’s price is currently at $3,203.60 with a predicted increase to $3,660.02, marking a potential rise…

Midnight Price Prediction – NIGHT Price Anticipated to Decline to $ 0.047821 By January 25, 2026

Key Takeaways Midnight’s price is anticipated to decrease by 23.24% in the following five days, with a prediction…

AI News Today: Can AI Make Blockchain Systems More Reliable in Live Crypto Markets?

Learn how AI is used in blockchain systems to detect risks, improve reliability, and support secure crypto trading in live crypto market environments.

ETHGas Airdrop Eligibility Scrubbing, WLFI Proposal Sparks Controversy, What's Today's Overseas Crypto Community Buzzing About?

ETH Ecosystem Month: A $1.5 Million Trading Opportunity Focused on Ethereum Assets

Explore ETH trading opportunities on WEEX with ETH Ecosystem Month. A $1.5M campaign covering ETH spot trading, ETH futures rewards, leaderboards, and referral incentives across the Ethereum ecosystem.

Bitcoin 30-Day Realized Losses and Gold Reaching Record Highs

Key Takeaways Bitcoin holders have experienced a rare stretch of 30-day realized losses for the first time since…

Central banks vs Bitcoin: Who truly earns the public’s trust?

Key Takeaways The debate over trust between central banks and Bitcoin continues, receiving global attention at the World…

Kaspa is Expected to Decline to $0.032939 by January 26, 2026

Key Takeaways Kaspa’s price is projected to drop 23.07% within the next five days. Current market sentiment for…

Bitcoin Fills New Year CME Gap with Sub-$88K BTC Price Drop

Key Takeaways Bitcoin’s price has closed a significant CME gap that appeared at the beginning of the year,…

Bitcoin Exhibits Resilience at $92K Amidst Economic Fluctuations: Is the Downturn Over?

Key Takeaways: Bitcoin remains robust at $92,000, though ETF outflows and geopolitical concerns loom. BTC futures premium close…