Deep Moment, Coin Soaring

Original Article Title: "The Deep Moment, Riding the Wave of Coin Stocks"

Original Article Author: Bread, BB Research

Investment Highlights

· Amid the Bitcoin investment frenzy, the development of the coin stock industry is gaining attention. This article will address two main questions: 1) What is the competitive landscape of the Bitcoin asset management industry, and will the future involve concentration or differentiated competition? 2) How can coin stock industry public companies become a significant force in the financial sector, and what are the challenges of active asset management? Note: The discussion focuses on coin stock public companies as a mainstream player in the industry.

· Envisioning the Competitive Landscape of the Bitcoin Asset Management Industry: Competition in Quantity and Scenarios

The global Bitcoin asset management industry competition will be characterized by differentiation but with high concentration. Leading companies maintain an advantage, while emerging companies also participate in the competition with unique strengths. The main reasons are:

1) Why is the concentration high? The asset management industry requires substantial capital and a professional team, but the usage cost is low and declining rapidly, leading to large companies leveraging funding and resource advantages to lead, while small and medium-sized companies find it challenging to participate.

2) How is differentiated competition achieved? Competition among Bitcoin public companies is divided into three dimensions: quantity, scenarios, and functions. The giants are similar in scenarios and functions but differ in quantity. Key to quantity competition is speed and scenarios. Companies that rapidly accumulate Bitcoin can optimize models, and those with strategies supported by suitable scenarios are stronger. Early mover advantage is also crucial as early-stage companies can gain more experience and resources.

· Envisioning the Development Space of the Coin Stock Industry: The Future Transformation of the Coin Stock Industry

Bitcoin investment brings development opportunities and transformation to public companies. Its low correlation helps in risk diversification and portfolio optimization. Additionally, Bitcoin facilitates companies in exploring new technologies and business models. It is projected that in the next three years, globally, over 200 companies will hold more than 1000 Bitcoin each. By 2025, a coin stock ETF index will be launched, coin stock investments will become mainstream, injecting new vitality into the industry.

· Investment Recommendation

We believe that Bitcoin investment is poised to bring new growth drivers to public companies, the coin stock industry has enormous development potential, and we closely monitor the disruptive opportunities brought by the combination of the coin stock industry and Bitcoin investment.

1) Industry Pioneer Opportunity: Aggressive investors may focus on companies like MicroStrategy. During Bitcoin market corrections, consider buying the dip, sharing its growth potential; at the same time, pay attention to emerging technology and financial companies' Bitcoin strategies to capture early opportunities, but be sure to set stop-loss orders to mitigate risks.

2) Established Company Opportunity: Conservative investors should consider companies like Tesla with significant Bitcoin holdings. When the market trend is clear and policies are stable, combine technical and fundamental research, participate moderately in Bitcoin when the price is reasonable, focus on long-term holding, leverage company management and diversified business to cushion against price volatility, achieve asset appreciation; at the same time, allocate to traditional safe-haven assets such as gold, high-quality bonds, etc., to optimize the investment portfolio.

3) Indirect Investment Opportunity: Risk-averse investors may focus on Bitcoin-related financial products, such as compliant Bitcoin ETFs. When the market sentiment is positive, there is capital inflow, and technical indicators are favorable, consider making small exploratory investments, control the investment exposure, ensure the safety of the principal, and share the industry's growth dividends.

· Risk Warning

1) Bitcoin Price Volatility: Bitcoin's price is highly volatile, as seen in the significant fluctuations in 2017-2018 and 2021-2022, leading to fluctuations in the asset value held by listed companies, impacting financial statements and market value management, denting investor confidence, and making investment returns uncertain.

2) Regulatory Policy Risk: Global attitudes towards cryptocurrency regulation vary and change dynamically, with some U.S. states endorsing it but federal oversight being strict, China banning related activities, and the EU continuously enhancing regulatory frameworks. Tightening regulations may lead to the devaluation and sale of listed companies' Bitcoin assets, business disruptions, affecting normal operations and investment value.

3) Market Acceptance and Application Risk: Bitcoin, as a payment method, faces challenges such as long transaction confirmation times and significant price fluctuations, with cross-border transactions subject to policy and regulatory constraints. This limits Bitcoin's application in listed company operations and market penetration, hindering the full realization of its market value and potentially impacting the industry's development process.

1 Industry Overview

1.1 Bitcoin Development History Review

Bitcoin was born in the context of the 2008 global financial crisis, proposed by Satoshi Nakamoto, and the genesis block was mined on January 3, 2009, marking its formal launch. Initially, Bitcoin circulated only among cryptography geeks and technology enthusiasts, with almost no value. In May 2010, American programmer Laszlo Hanyecz used 10,000 Bitcoins to purchase two pizzas, marking the first commercial transaction with Bitcoin, with the price of Bitcoin at the time being around $0.003. Subsequently, with the rise of Bitcoin exchanges such as Mt. Gox, its price was gradually determined by the market. In 2013, the price of Bitcoin once surpassed $1,000, attracting global attention; in December 2017, it skyrocketed to nearly $20,000, reaching a historical high, drawing the focus of many investors and the media. Although it later experienced significant pullbacks and periods of volatility, Bitcoin's market value and influence continued to rise, gradually entering mainstream investment perspectives, becoming an undeniable force in the financial field, prompting more listed companies to consider its strategic significance and potential value.

The development of Bitcoin has been marked by many key milestones and important events, which have deeply influenced its price trends and market perception. The years 2009 to 2010 were the nascent stage of Bitcoin, with the creation of the genesis block marking the beginning of a new era of decentralized cryptocurrency. At this point, transactions were very niche, with no clear market price. Bitcoin was mainly circulating among tech enthusiasts in small amounts for testing and experimentation, serving more as a proof of concept. The years 2011 to 2013 saw an early growth period with price volatility. Bitcoin's price surpassed key psychological levels such as $1, $10, and $100 for the first time, attracting tech innovators and early investors. Platforms like Mt. Gox emerged to facilitate price discovery and market trading. In 2013, the Cyprus financial crisis led European citizens to seek refuge in Bitcoin, propelling the price above $1,000 and gaining mainstream media attention.

The years 2014 to 2016 were characterized by a bear market correction. The Mt. Gox hack, where 850,000 bitcoins were stolen, severely damaged market confidence. Bitcoin's price experienced a significant retreat from its highs, regulatory uncertainty increased, and several countries strengthened their regulatory stance, even moving to ban Bitcoin trading. Market trading activity decreased, investor sentiment turned cautious, and the mining industry faced restructuring due to low prices and rising mining difficulty, leading to a reshaping of the mining landscape. The years 2017 to 2018 saw another period of intense bull market followed by a deep correction. The Initial Coin Offering (ICO) frenzy emerged, attracting substantial funds into the crypto market. Bitcoin, as the "digital gold" benchmark, saw its price surge from around $1,000 at the beginning of the year to nearly $20,000. However, by the end of the year, as the ICO bubble burst and various countries enforced strict regulations, the price collapsed, plummeting back to the $3,000 to $4,000 range within a few months. Many investors suffered losses, and market panic spread.

The years 2019 to 2021 ushered in a phase of recovery and new prosperity. After stabilizing in the $3,000 to $10,000 range, Bitcoin embarked on a new uptrend, with institutional investors entering the space rapidly. Entities like the Grayscale Bitcoin Trust continued to accumulate, and publicly traded companies like MicroStrategy made significant Bitcoin allocations. Bitcoin's status as a new alternative asset strengthened, and in April 2021, the price of Bitcoin surpassed $60,000, driving market enthusiasm. The ecosystem expanded rapidly with applications in payments, lending, derivatives, and more. From 2022 to 2024, Bitcoin has experienced a period of volatility and consolidation. Following the bursting of the previous bull market bubble, prices plummeted significantly due to factors such as Federal Reserve interest rate hikes, global macroeconomic recession concerns, and dipped below $16,000. However, with shifts in macroeconomic policies, clearer industry regulations, and advancements in technology such as the anticipated approval of a Bitcoin spot ETF and scaling solutions like the Lightning Network, prices gradually stabilized and began to rise. In 2024, Bitcoin broke through the $100,000 mark after fluctuating between $30,000 and $70,000 throughout the year. The price of Bitcoin in 2024 surged by 120.88% for the year, breaking through the $80,000, $90,000, and $100,000 milestones within a month after Trump's re-election. Subsequently, after hitting a peak of $109,000, the price gradually declined and currently hovers around $105,000. Market participants are becoming more rational, and the industry is moving towards compliance and diversification.

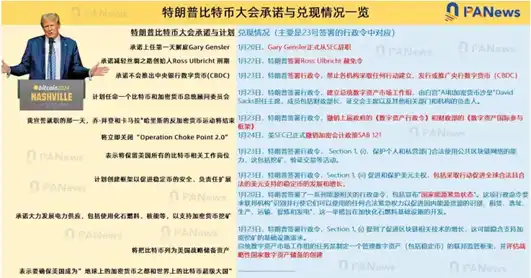

Figure 1 Overview of Trump Bitcoin Conference Commitment and Redemption Status Source: PA News

Table 1: Comparison of Bitcoin New Year's Day Prices in the Last Ten Years Source: OpenAI Official Website, BB Research

As shown in Table 1, on January 1, 2025, the price reached $93,500, which is approximately 297 times the price on January 1, 2015.

Figure 2 Trend Chart Source: BB Research

From a price perspective, in the early days, Bitcoin, due to its few participants and shallow market depth, was highly susceptible to minor supply and demand changes and technical community dynamics, leading to intense and unpredictable price fluctuations; in its growth stage, driven by a mix of macroeconomic events, regulatory policies, and technological innovation iterations, it exhibited cyclical significant price swings, with rapid and remarkable increases in bull markets and sharp pullbacks in bear markets; in recent years, with a maturing market and institutional participation, although still volatile, the price trend has increasingly been dictated by macroeconomic fundamentals, monetary policies, industry supply and demand, showing enhanced correlation with traditional financial markets. However, the unique halving mechanism continues to introduce a special variable to its price cycles, as the halving event every four years reduces new Bitcoin supply, providing momentum for price increases from a fundamental supply-demand perspective, stimulating periodic market expectations and investment enthusiasm.

Recently, several key figures in the U.S. political and business sectors have expressed their respective stances on Bitcoin, influencing market trends and investor sentiment. After Trump was re-elected as U.S. President in November 2024, he pledged to make the U.S. the "Global Cryptocurrency Capital" and considered incorporating Bitcoin into the national reserves. Upon his inauguration on January 21, 2025, Bitcoin surged past $109,000, reaching a historic high. The "Trump meme coin" saw its market value exceed $20 billion in a single day. Musk has always been a strong supporter of cryptocurrencies and endorses Trump's cryptocurrency-friendly policies, believing they will foster technological innovation and economic growth. Federal Reserve Chair Powell recently made it clear at a press conference that the Fed has no intention of holding Bitcoin and emphasized that under the Federal Reserve Act, the Fed is prohibited from holding such assets. He also stated that the Fed will not seek to change this law, with Powell's position on monetary policy seen as having an indirect impact on the Bitcoin market.

Gold is a mature reserve asset with a long history and price stability, but it has physical limitations. Bitcoin is an emerging store of value tool with scarcity, convenience, and technological potential, but it has high volatility and uncertainty. In the future, Bitcoin and gold may coexist: gold will continue to serve as a traditional reserve asset, while Bitcoin will find its place in the digital economy and with young investors. The specific choice will depend on investors' balance of needs for stability and growth potential. If more central banks and institutions around the world start adopting Bitcoin, its status as a reserve asset may see a significant increase in the next decade.

1.2 Background of Public Companies Entering the Bitcoin Space

From a macroeconomic perspective, global economic growth volatility, traditional monetary policy fluctuations, and inflation concerns are the main reasons. For example, after the 2008 financial crisis, the long-term quantitative easing in Europe and the United States led to currency overissuance, raising doubts about the store of value function of fiat currency. Due to characteristics such as a fixed total supply of 21 million coins and decentralization, Bitcoin has been seen by some public companies as a new option for hedging against inflation and asset preservation. Companies like MicroStrategy have openly stated that they bought Bitcoin to hedge against the depreciation of the U.S. dollar.

From a financial market perspective, on the one hand, traditional investment fields such as the stock market and the bond market have experienced large return volatility in recent years. In a low-interest-rate environment, bond yields are meager, and the stock market is prone to frequent and significant fluctuations due to trade frictions, geopolitical issues, and other impacts. On the other hand, there is an urgent need for portfolio diversification, and Bitcoin has a low correlation with traditional assets, allowing for effective risk diversification. According to statistics, the average correlation between Bitcoin and assets such as stocks and bonds from 2015 to 2020 was only 0.11. To pursue stable returns and optimize asset allocation, public companies have begun to explore new opportunities in the Bitcoin field.

2 In-Depth Analysis of Typical Cases

2.1 MicroStrategy: A Pioneer in Bitcoin Investment

As one of the public companies holding the most Bitcoin globally, MicroStrategy embarked on its Bitcoin investment journey in August 2020. At that time, the global economy was hit by the pandemic, the traditional financial markets were in turmoil, and expectations of U.S. dollar devaluation were rising. The company invested $250 million in Bitcoin as a treasury asset, accurately capturing a key turning point in the macroeconomic environment. Since then, its hodling strategy has been consistently aggressive. For example, during periods such as September 2020 and the first quarter of 2021, it made large purchases multiple times. During this process, the company's stock price was significantly correlated with the price of Bitcoin. During the Bitcoin bull market, the expected massive gains attracted a large number of investors, driving up the stock price, which soared by over 500% in 2024. However, during a deep correction in the Bitcoin price, the stock price also experienced significant fluctuations. For instance, in 2022 when the cryptocurrency price retreated, the company's market value evaporated by billions, showcasing the high-risk, high-return nature and deeply affecting the sentiment and fund flows of investors in the crypto and traditional financial markets.

2.2 Tesla: The Boundary-Crossing Disruptor

At the beginning of 2021, Tesla entered the scene with a $1.5 billion investment in Bitcoin, instantly igniting market enthusiasm. The Bitcoin price surged significantly in the short term due to this massive influx of funds, with Musk's tweets serving as a "catalyst" for price fluctuations. On one hand, investing in Bitcoin allowed the company to seek value enhancement for its idle funds, mitigating the low-interest-rate environment's funding income dilemma. On the other hand, in March of the same year, Tesla announced that it would accept Bitcoin for car purchases, attempting to bridge the gap between crypto payments and car sales. Although this initiative was later canceled due to Bitcoin's energy consumption controversy and price volatility, it successfully shaped Tesla's image as a tech pioneer and an innovator, extending the crypto frenzy to its automotive business. This move attracted the attention of the younger generation and tech enthusiasts, stimulating vehicle orders. During the peak period of Bitcoin transactions, Tesla's financial report was brightened by substantial gains. Despite a shift in strategy towards caution later on, Tesla maintained its influence in the crypto space through its remaining holdings.

2.3 Meitu: The Emerging Force Representative

From March to April 2021, Meitu made three separate bold moves, investing $100 million to acquire over 940 Bitcoins and 31,000 Ethereums, making a strong entry into the crypto arena. From a business perspective, as an imaging tech company facing fierce competition in its traditional business, Meitu aimed to embrace new technological trends through crypto investments, exploring the intersection of digital content and blockchain. For example, it launched a blockchain-based creative work copyright protection application. Financially, the appreciation of crypto assets in the initial stages helped optimize its balance sheet, resulting in significant unrealized gains and a short-term increase in stock price. However, when the bear market hit in 2022, asset devaluation put pressure on its performance, leading to a sharp increase in net losses. Enduring the tough times, Meitu seized the opportunity to sell when the market rebounded in 2023-2024, realizing profits of around $79.63 million. It successfully retrieved the funds to re-focus on its core imaging business, using crypto investments as a stepping stone for transformation, accumulating experience in emerging fields, and exploring new paths for business diversification and financial stability.

3 Investment Motivation Insights

3.1 Asset Diversification Demand

Within the traditional portfolio theory framework, asset diversification is key to reducing unsystematic risk. The asset allocation of public companies is heavily concentrated in areas such as stocks, bonds, and cash. For example, during the 2008 financial crisis, stock markets plummeted, and bond markets were turbulent, causing significant asset shrinkage for many companies. Due to its unique properties, Bitcoin has become the "new favorite" for risk diversification. According to Bloomberg data, the average correlation between Bitcoin and the S&P 500 index from 2010 to 2020 was only 0.08, with nearly zero correlation to bonds. Before MicroStrategy entered the scene, its asset allocation heavily relied on assets related to its commercial software business, facing risks of industry cyclicality and intense market competition. After introducing Bitcoin, the asset portfolio became diversified, with multiple income streams. During the 2021 crypto bull market, Bitcoin investment returns exceeded those from the core software business, smoothing out fluctuations in a single business. Without sacrificing too much expected return, this diversification reduced overall risk exposure, laying a solid foundation for corporate financial stability.

Figure 3 Asset Allocation Chart Source: OPEN AI Official Website, BB Research

3.2 Inflation Hedge Considerations

Within the global economic cycle fluctuations, inflation is the "Sword of Damocles." Especially after 2020, under the impact of the COVID-19 pandemic, countries around the world implemented quantitative easing, leading to monetary expansion and high inflation, with the U.S. CPI exceeding 9% at one point in 2022. Traditional inflation-hedging assets such as gold and real estate are constrained, with gold being influenced by geopolitical factors and central bank sell-offs, and real estate facing regulation and liquidity bottlenecks. Bitcoin, with its fixed total supply of 21 million coins and decentralized nature, theoretically has strong inflation-hedging properties. Based on empirical data from a long-term perspective spanning from 2009 to 2023, compared to U.S. inflation data, the price of Bitcoin has far outpaced the inflation rate, with some periods such as 2013 to 2017 seeing Bitcoin's annualized growth rate exceed 200% during periods of moderate inflation. Corporations purchasing Bitcoin can hedge against the erosion of purchasing power due to price hikes at the asset balance sheet level, maintain shareholder equity, and safeguard against the impact of inflation. Many resource-based and consumer-facing companies are significantly affected by inflation driven by upstream costs and are exploring Bitcoin as a hedge to control costs and stabilize profits, seeking new avenues.

3.3 Strategic Deployment Intent

Amidst the emerging technological wave, blockchain and the crypto economy are seen as the frontier of future transformation, prompting some publicly listed companies to strategically acquire Bitcoin to seize opportunities. Technology company Reddit's purchase of Bitcoin strengthens community support for the crypto ecosystem, explores new models, and uses "community tokens + Bitcoin" to attract user participation, injecting vitality into the platform's development. Financial institution Grayscale's entry into compliant Bitcoin trusts absorbs funds, accumulates experience, shapes standards, and transitions from traditional asset management to digital asset management. Traditional company Tesla's investment in Bitcoin, along with involvement in crypto payments, integrates into a multi-domain collaborative ecosystem, expands its business boundaries, engages in heat marketing, attracts customers, and enhances its brand image. Pioneers in various industries use Bitcoin as a strategic "pathfinder stone" to explore new "territories."

4 Crypto Asset Holding Industry Development Trends Outlook

4.1 Market Size Forecast

Based on the rapid growth trend of global publicly traded companies holding Bitcoin in recent years, the future scale expansion is robust. In terms of the holdings' market value, although currently only a small number of companies hold large positions, with the central price of Bitcoin moving up and more companies entering the space, the market is expected to exponentially rise. According to OKG Research's estimate, if approximately $2.28 trillion flows into the Bitcoin market within the next year, driving the price to $200,000, the market value of Bitcoin holdings by publicly traded companies will surge simultaneously, with flagship companies like MicroStrategy potentially surpassing a billion-dollar asset scale. In terms of the number of companies holding Bitcoin, both emerging markets and traditional industries are accelerating their penetration, with a growth rate of about 15% over the past five years, expected to increase at a rate of 20% in the next five years, especially in the financial and technology sectors where new startups are attracted by the crypto culture and investment returns, running to join the trend. From the current 80+ companies, they are expected to reach 200 companies, completely reshaping the industry landscape, as Bitcoin moves from a "niche embellishment" on corporate balance sheets to a "mainstream weight."

Figure 4 Prediction Chart of Coin Stock Company Listing Source: OPEN AI Official Website, BB Research

4.2 Industry Landscape Evolution

The competition between new and old players is intensifying. Old giants such as MicroStrategy and Tesla are consolidating their positions through their first-mover advantage, capital, and brand strength. MicroStrategy is continuously expanding its position, either by leveraging its professional crypto investment team to develop Bitcoin-related financial services or by building a "Bitcoin Asset Management Empire." Tesla, using cash flow from its core car business, is opportunistically increasing its holdings to strengthen the synergy between cryptocurrency and the automotive ecosystem. Emerging forces are not to be underestimated. FinTech startups are competing for market share with innovative products and flexible strategies, such as launching Bitcoin yield optimization financial products to attract retail investors indirectly. Traditional industry giants are disrupting the industry by entering the field, with energy and retail companies utilizing upstream and downstream resources to explore Bitcoin payments and supply chain finance innovation. In the short term, industry concentration will be diluted due to new players entering the market. However, in the long run, those with strong resources, technology, and brand advantage will stand out, reshaping the industry's leading echelon and forming a new multipolar competitive landscape.

4.3 Prospects for Integration with the Blockchain Ecosystem

The deep involvement of publicly listed companies in blockchain infrastructure construction is an overarching trend. Technology companies are investing in research and development to optimize blockchain performance centered around Bitcoin, reducing transaction costs and shortening confirmation times. They are exploring the commercial application of the Lightning Network to normalize small, high-frequency payments and expand Bitcoin's use in everyday consumption scenarios. Financial institutions are building compliant Bitcoin custody and settlement platforms based on blockchain to facilitate institutional entry into the space, promoting Bitcoin's transition from "wild" to "tamed." At the application development level, companies are exploring value beyond Bitcoin as a "currency," such as in supply chain traceability and the copyright field, integrating with NFTs. By anchoring value with Bitcoin, they empower digital asset rights and circulation, achieving the bidirectional flow between the virtualization of the virtual economy and the realization of the virtual entity in the real economy. Riding on the blockchain trend, Bitcoin is breaking free from being merely an investment asset and integrating into the core of the global business value creation network, empowering the digital transformation of various industries.

5 Coin Stock Industry Development Trends

5.1 We Address Two Key Questions of This Round of Coin Stock Industry Revolution: Landscape and Space

5.1.1 Coin Holding Publicly Listed Companies Competition Landscape: Future will present a high fixed cost, low marginal cost structure leading to high concentration

Coin holding publicly listed companies refer to enterprises that include Bitcoin on their balance sheets and publicly trade on the capital market. They may view Bitcoin as a reserve asset, part of their investment portfolio, or as a strategic technological asset. The cryptocurrency industry revolution brought about by U.S. predictable policies such as the Bitcoin National Reserve Strategy Act series is becoming the starting point of the next technological revolution, changing the financial landscape and breaking through the arms race paradigm.

For publicly traded companies holding assets in the asset management industry, the fixed cost investment requirement is relatively high, but the marginal cost of use is relatively low and showing a rapid downward trend. This implies a high level of industry concentration, which is expected to gradually develop into a scenario of top-tier competition.

We believe that the global competitive landscape will tend towards diversified competition. On the one hand, this is due to Bitcoin transactions leading to a high market concentration and certain industry barriers. On the other hand, early Bitcoin asset management methods are fundamentally tending towards homogenization, but there are differences in accumulated industry experience. Bitcoin asset management capability will become a core competitive advantage for enterprises, and those at the forefront of mastering Bitcoin-enhanced return strategies will gain this advantage.

(1) Competitive Elements of Publicly Traded Companies Holding Assets: The value of holding assets and storing value is homogenized, with the amount of Bitcoin held becoming the company's core competitive advantage.

We divide the competition of publicly traded companies holding Bitcoin assets into three dimensions: quantity, scenario, and function. Then we can see that for giants, scenarios and functions exhibit a high degree of homogeneity, with only the quantity dimension showing significant differentiation in competition. We believe that in the ultimate competition, quantity is key, and furthermore, first-mover advantage and unique scenarios will prevail.

Figure 5 Asset Allocation Diagram Source: OPEN AI Official Website, BB Research

(2) Homogenized Competition in Asset Storage Value

a. Scenario Level: The core reason is that the Bitcoin blockchain cannot support the deployment of new financial applications as Ethereum does, making it difficult to become an ideal financial infrastructure.

b. Function Level: Early Bitcoin whales tend to be risk-averse in their investment philosophy, lacking vetted complex structures and risk hedging strategies, making it difficult to meet investors' demands for diversified returns and risks.

(3) Competition in Quantity: First-Mover Advantage and Scenario Advantage

Quantity presents significant differentiation and will be the core competitive element determining the outcome among competitors. We believe the essence of quantity competition lies in the competition of speed and scenarios. First, whether one can quickly hold a significant quantity of Bitcoin to benefit from the model optimization brought about by quantity flywheels; second, whether there are suitable scenarios to support the accumulation of a sufficient quantity of Bitcoin for strategic enhancement.

a. Flywheel Effect of Bitcoin Quantity: Interaction between Bitcoin Quantity and Asset Management Model

The more Bitcoin is held, the more interactions between investors and asset management models, leading to better optimization of the model. In theory, 1) the larger the data volume, the richer and more comprehensive the investment levels and dimensions, and the more timely the updates, the better the investment model's performance; 2) for large models following the Bitcoin-enhanced investment strategy route (using feedback from the market for reinforcement learning), model tuning is a core part of model optimization. It can be said that the quantity of Bitcoin held affects the actual usage scenarios of asset management models, and the scale of holdings is crucial in promoting the optimization of asset management models.

b. Uniqueness of Data and Scenarios Drives Differentiation Opportunities

Bitcoin Enhanced Strategy Application: 1) Enhance strategy robustness in extreme market conditions through AI-optimized model adaptability; 2) Design and implement innovative strategies using tools provided by decentralized finance (DeFi) platforms (such as AMM, decentralized lending); 3) Large-scale development of security use cases and exploration of new ecosystem revenue streams. For a long time, Bitcoin applications and revenue generation have seemed insufficient, leading top-listed companies to only consider Bitcoin as a value storage tool.

(4) Number of Holding Companies and Geographic Distribution

According to data from institutions such as CoinGecko and OKG Research, as of 2024, there are approximately 80 public listed companies globally holding Bitcoin. The North American region dominates, with over 60% of relevant companies, where the United States leads with over 50 companies, including industry giants like MicroStrategy and Tesla. Europe closely follows, representing about 20%, with countries like the UK and Germany participating due to their relaxed financial regulatory environment. The Asian region holds around 15%, with Japan and South Korea as representatives. Japan, driven by the legalization of cryptocurrency trading, has about 10 companies investing in Bitcoin, while Korean companies purchase Bitcoin to expand payment and asset appreciation channels due to the developed internet and gaming industries. Companies from other continents have lower participation rates, mainly due to financial infrastructure and regulatory uncertainty.

Figure 6 Asset Allocation Chart Data Source: OPEN AI Official Website, BB Research

(5) Differences in Industry Categories

Many public listed companies invest in Bitcoin, with tech companies leading at over 40%. Software giant MicroStrategy has been optimizing its asset structure through Bitcoin, making continuous purchases since 2020 and holding over 400,000 coins by 2024, viewing Bitcoin as a tool to combat inflation and digitize wealth reserves. Payment companies like Square and PayPal are exploring new settlement methods through Bitcoin payment ecosystem development. Internet and e-commerce companies like Rakuten and Meitu seek new business opportunities and traffic monetization through cryptocurrency purchases.

The financial industry accounts for 30%, with asset management institutions holding Bitcoin on a large scale through GBTC trust. Cryptocurrency hedge funds and quantitative investment firms leverage algorithms for arbitrage in price fluctuations, while some banks are researching cryptocurrency-related businesses to explore compliant participation in the Bitcoin financial ecosystem.

Mining companies account for 20%, with players like Marathon and Riot Platforms leveraging their hash power advantage to accumulate a large reserve of Bitcoin. Their strategy, influenced by various factors, including equipment manufacturers and mining pools, impacts the Bitcoin supply beyond their operational and debt repayment activities.

Traditional industries such as manufacturing and consumer goods represent less than 10%. For example, although Tesla is primarily engaged in car manufacturing, Musk's visionary outlook led the company to invest $1.5 billion in Bitcoin for asset diversification and brand promotion. Despite adjustments in the strategy, Tesla still holds over 10,000 bitcoins, setting an example for new-age manufacturing enterprises integrating into the crypto economy. The Bitcoin investments across different industries reflect varying perspectives on industry transformation, asset appreciation, and user demand.

Table 2 Main Categories of Bitcoin-Holding Public Companies

(6) Scale of Holdings and Asset Allocation

Public companies exhibit a wide disparity in their holdings. MicroStrategy holds 446,400 bitcoins, valued at over $50 billion, far exceeding other companies. Companies like Tesla, Galaxy Digital, and Hut 8 hold thousands to tens of thousands of bitcoins, valued at hundreds of millions to tens of billions. Over half of the companies hold less than a thousand bitcoins.

In terms of asset allocation, over 70% of MicroStrategy's portfolio is in Bitcoin, showing a deep strategic inclination towards the crypto ecosystem. Medium-sized companies like Meitu allocate approximately 10% - 20% of their assets to Bitcoin as a supplementary investment in emerging technologies. Smaller or more conservative companies allocate less than 5% to Bitcoin, primarily for experimental purposes. The scale of holdings and asset allocation demonstrates companies' varying attitudes towards crypto assets and foreshadows the diversity of Bitcoin's role in the corporate future.

5.1.2 Industry Space Perspective

(1) Bitcoin ETFs, actively managed Bitcoin funds cover staking, CeDeFi fee arbitrage, and maximizing Bitcoin's intrinsic value through DeFi or being replaced by other recommended means. Here, we include all entries based on passive Bitcoin ETFs and active asset management for defining Bitcoin, including Coinbase (ETF), MARA (mining company), MSTR (Bitcoin treasury-listed company), which may be replaced by newcomers in the industry;

(2) Some veteran Bitcoin whales generally hold conservative investment philosophies with a high degree of risk aversion;

(3) While Bitcoin serves as a robust store of value, at the financial management level, it falls short of meeting investors' diversified needs for returns and risks.

Table 3 Competitive Landscape of Publicly Listed Companies Holding Crypto Assets (as of 2025.1.1) Data Source: Google Finance, Bloomberg, BB Research

5.2 Financial Performance of Bitcoin-Holding Public Companies

5.2.1 Balance Sheet Impact: Bitcoin is usually recognized as an "intangible asset" on financial statements, with its value constrained by accounting standards. During a bear market, companies may face asset impairment, while in a bull market, the increase in asset value may not be fully reflected in financial reports.

5.2.2 Correlation of Stock Price and Bitcoin Price: The stock price of Bitcoin-holding companies typically fluctuates in close relation to the price of Bitcoin. For example, MicroStrategy's stock price surged during the Bitcoin bull market and declined during the bear market.

5.2.3 Investor Sentiment and Market Value: Bitcoin-holding companies attract specific investors due to their exposure to digital assets, but they also bear additional market volatility risks as a result.

Table 4 Crypto-Holding Public Companies Index (First Release by BB Research) Data Source: Google Finance, Bloomberg, BB Research

5.3 Valuation Model for Crypto-Holding Public Companies

Based on global data on crypto-holding companies as of December 31, 2024, a valuation model for four public companies holding crypto assets was constructed.

5.3.1 Market Value Premium Rate

This model relies on the Market Value Premium Rate, leveraging equity dilution financing to increase the amount of Bitcoin held, raise the per-share BTC holding, and consequently boost the company's market value.

Market Value Premium Rate Model = (Market Price - Intrinsic Value) / Intrinsic Value × 100%

Using Formula (1), calculate the market premium rates for MSTR, NANO, MARA, and Bohai Interactive.

Table 5 Market Premium Rates Data Source: BB Research

Figure 7 Market Premium Rate of MSTR, NANO, MARA, and Boya Interaction Source: BB Research

As shown in Table 4, in 2024, MSTR's Bitcoin holding is 402,100 coins, with a price of $82,100 per Bitcoin. Its Bitcoin intrinsic value is $33 billion, and its market value is $89 billion. Calculated by Formula 1, the market premium rate is 1.70;

In 2024, NANO's Bitcoin holding is 30 coins, with a price of $99,700 per Bitcoin. Its Bitcoin intrinsic value is $36 million, and its market value is $94 million. Calculated by Formula 1, the market premium rate is 1.61;

In 2024, MARA's Bitcoin holding is 404,000 coins, with a price of $87,205 per Bitcoin. Its Bitcoin intrinsic value is $35.26 billion, and its market value is $58.66 billion. Calculated by Formula 1, the market premium rate is 0.66;

In 2024, Boya Interaction's Bitcoin holding is 31.83 coins, with a price of $57,724 per Bitcoin. Its Bitcoin intrinsic value is $2.98 billion and its market value is $4.44 billion. Calculated by Formula 1, the market premium rate is 0.49.

Envisioning the Competitive Landscape of the Holding Sector: A Battle of Speed and Premium Rate: Leading MSTR with a market premium rate of 1.70; Emerging NANO with a market premium rate of 1.61.

Table 6 Median Industry Market Value Premium Rate Source: Google Finance, Bloomberg Official Website, BB Research

The median of the market premium rate is 1.82, serving as the central estimation value of the Token-Stock Index.

Reviewing the volatility of holding sector companies, it can be seen that when marginal net buying increases, the premium rate can remain high; when marginal net buying weakens, the premium rate begins to decline; and when there is marginal net selling, the premium rate will quickly turn negative.

The ability of token-stock companies represented by MSTR to maintain a high premium rate depends on: 1) The height and duration of the BTC bull market; 2) The sustainability of marginal BTC net buying; 3) The continuous marketing ability of the company's founder.

5.3.2 Net Asset Value (NAV) Premium Model

The company's value is estimated based on the net value of Bitcoin assets held by the company, combined with the market's assigned premium multiple.

Table 7 Company Value Source: Google Finance, Bloomberg Website, BB Research

Company Value = Premium Multiple * Bitcoin Net Asset

Figure 8 Company Value of MSTR, NANO, MARA, and BHY Interactive Source: BB Research

As shown in Table 5, in 2024, MSTR's Bitcoin value is $375.9635 billion, liabilities are $45.7 billion, Bitcoin net assets are $330.26 billion, the premium multiple is 1.70, and the company value is 560.45;

In 2024, NANO's Bitcoin value is $0.3366 billion, liabilities are $0.08 billion, Bitcoin net assets are $0.26 billion, the premium multiple is 1.61, and the company value is 0.41;

In 2024, MARA's Bitcoin value is $37.815 billion, liabilities are $0.13 billion, Bitcoin net assets are $37.68 billion, the premium multiple is 0.66, and the company value is 25.00;

In 2024, BHY Interactive's Bitcoin value is $2.98 billion, liabilities are $0.46 billion, Bitcoin net assets are $2.52 billion, the premium multiple is 0.49, and the company value is 1.24.

The median company value is 0.27, serving as the centroid of industry valuation.

Table 8 Company Value Source: BB Research

5.3.3 Bitcoin Price Sensitivity Model

Valuation based on the impact of each change in Bitcoin price on the company's market capitalization.

Table 9 Market Cap Increase Source: BB Research

Market Cap Change = Sensitivity Coefficient * Bitcoin Price

As shown in Table 6, in 2024, MSTR has a price sensitivity coefficient of 1.51%, with every 1% increase in Bitcoin price, the company's market cap increases by $861 million;

In 2024, NANO has a price sensitivity coefficient of 2.96%, with every 1% increase in Bitcoin price, the company's market cap increases by $0.01 billion;

In 2024, MARA has a price sensitivity coefficient of -0.53%, with every 1% increase in Bitcoin price, the company's market cap decreases by $0.13 billion;

In 2024, BOYA Interactive has a price sensitivity coefficient of 1.04%, with every 1% increase in Bitcoin price, the company's market cap increases by $0.01 billion.

Table 10 Market Cap Increase Source: BB Research

The median market cap increase is 0.01, serving as the central point of industry valuation.

Buying holding company shares is equivalent to capturing the expected growth of Bitcoin plus the listed company's performance multiplier. First, since coin-stock companies can borrow to leverage, secondly, they can multiply by the PE Ratio. During a Bitcoin bull market, MSTR can maintain leverage of around 2x.

Currently, there is no perpetual motion machine for holding companies. After a certain limit of MSTR's BTC holdings (such as Grayscale's 200,000 BTC), the premium rate will inevitably decline. It is more advantageous to reasonably allocate coin-stock ETFs to obtain long-term stable returns.

Finally, the research finds that when the historical MSTR turnover rate exceeds 30%, a phase-wise peak signal appears.

6 Conclusion and Recommendation

6.1 Research Summary

Although the global group of publicly traded companies holding Bitcoin is still in its development stage, it has demonstrated vitality and enormous potential.

From the perspective of development features, the geography is concentrated in North America, and the industries span across technology, finance, mining, and other diverse fields. The scale of holdings and asset allocation strategies are diverse, with some companies embracing aggressively and others cautiously dipping their toes in the water.

From an opportunity perspective, Bitcoin brings asset diversification and a new tool for hedging inflation to listed companies, aligning with strategic transformation needs and poised to take the lead in the emerging technology wave. However, the challenges are not to be underestimated, as price volatility, unclear regulatory policies, and limited market acceptance all pose uncertainties for companies in terms of finance, operations, and strategic implementation.

By 2025, there will be the launch of a holding stock ETF index, with mainstream institutions covering holding stock investments. All holding stock companies will issue coins, and all coins will issue stocks. The integration of holding stock-listed companies with Bitcoin enhancement strategies will bring about disruptive investment opportunities.

Overall, Bitcoin investment has become a key path for listed companies to explore new growth and respond to a complex economic environment. However, a careful balance of pros and cons and precise risk management are required.

6.2 Investment Recommendations

For risk-seeking aggressive investors, it is advisable to focus on industry pioneers such as MicroStrategy and emerging players like Nano, especially during Bitcoin market corrections, spreading panic, or when prices touch key support levels. Consider gradually establishing positions on dips to share in their high growth potential. At the same time, closely monitor the dynamics of emerging technology and financial companies' Bitcoin derivative products, as well as holding stock index ETF layouts, to seize early entry opportunities and capitalize on industry growth dividends. Nevertheless, it is crucial to set strict stop-loss orders to guard against black swan events.

Conservative investors should prioritize monitoring the dynamic holdings of large, mature listed companies in Bitcoin, such as Tesla. Wait for the market trend to become clear, the policy environment to stabilize, and then combine technical analysis with fundamental research. When Bitcoin prices pull back to a reasonable valuation range, participate moderately with a small proportion of funds, emphasize long-term holding, leverage professional corporate management, and diversified business to cushion price volatility, and achieve steady asset appreciation. Additionally, complement with traditional safe-haven assets like gold and quality bonds to optimize portfolio risk-return ratios.

For conservative investors, indirect participation can be considered by focusing on Bitcoin-related financial products, such as compliant Bitcoin ETFs (in regions where approved). Monitor the trends of professional asset management institutions and, when market sentiment is optimistic, funds continue to flow in, and technical indicators are favorable, make small exploratory investments while adhering to asset allocation discipline. Maintain Bitcoin investment exposure at a very low level to ensure capital safety and, under the premise of protecting principal, mildly participate in sharing industry growth dividends.

6.3 Risk Factor Identification

Bitcoin has experienced significant price fluctuations since its inception, which has had a severe impact on listed companies holding Bitcoin. Taking MicroStrategy as an example, during the Bitcoin price decline in 2022, the company's asset impairment losses significantly increased, leading to a substantial expansion of net losses in financial reports and a sharp drop in market capitalization and stock price. The abrupt price changes have filled listed companies with uncertainties in financial and market value management, also affecting investor confidence.

The global regulatory stance on Bitcoin varies widely and has been constantly evolving. Some states in the United States recognize Bitcoin as legal, but federal agencies impose strict regulations. Approval for a Bitcoin ETF is difficult to obtain, and publicly listed companies holding Bitcoin face rigorous compliance reviews and disclosure requirements. Since 2017, China has banned virtual currency-related activities, limiting domestic corporate Bitcoin investments. The European Union, on the other hand, continues to refine its cryptocurrency regulatory framework. The direction of regulatory policies affects the legitimacy and operation models of publicly listed companies holding Bitcoin. Once regulations tighten, the Bitcoin assets of publicly listed companies may depreciate, facing selling pressure, and their business and strategic plans may be hindered.

In daily business scenarios, Bitcoin faces many challenges as a payment method. Its transaction confirmation time can be as long as 10 to 60 minutes, making it difficult to meet the instant transaction needs of retail fast-moving consumer goods. Price volatility also exposes merchants to high exchange rate risks. While theoretically Bitcoin can bypass foreign exchange controls and reduce remittance costs in cross-border transactions, practical operations are restricted by various countries' exchange rate policies and anti-money laundering regulations. The flow of funds in and out is hindered, exchange rate conversions are complex, liquidity is insufficient, limiting its role in expanding cross-border business and fund circulation for publicly listed companies, hindering Bitcoin's market adoption.

6.4 Industry Outlook

Looking ahead, publicly listed companies globally holding Bitcoin are expected to continue expanding the boundaries of financial innovation. On one hand, promoting the diversification of Bitcoin financial products, moving from simple holding towards innovating complex derivatives such as Bitcoin futures, options, structured notes, etc., to meet different risk appetite demands; on the other hand, deepening integration with blockchain to assist in Bitcoin's underlying technology upgrades, accelerating the implementation of applications like the Lightning Network, enhancing transaction efficiency, expanding commercial use cases. In terms of market leadership, leading companies with resources, technology, and brand accumulation become industry standard setters, guiding regulatory policy improvements. Emerging companies stimulate a shark effect with innovative vitality, prompting industry diversification, healthy development, collectively propelling Bitcoin from the periphery to the mainstream, integrating into the core of the global financial ecosystem, reshaping the asset allocation, payment clearing, and value storage landscape, injecting lasting momentum into economic digital transformation.

In the future, "All coin stocks will issue coins, and all coins will issue stocks," coin stocks will form a new industry—the Capital Market WEB3.0 Carnival, riding the wind and breaking through the thousands of miles, a promising future awaits.

Coin Stock Investment Rating Explanation

Within the 6 months following the reporting date, based on the relative price change compared to the Coin Stock ETF Index, the definitions are as follows:

1. Buy: Performance is +20% or more compared to the Coin Stock ETF Index;

2. Hold: Performance is +10% to +20% compared to the Coin Stock ETF Index;

3. Neutral: Fluctuation between -10% and +10% relative to the Coin Stock ETF Index performance;

4. Underweight: Performance relative to the Coin Stock ETF Index is below -10%.

Industry Investment Ratings:

Based on the industry index's performance relative to the Coin Stock Index in the six months following the reporting date, the definitions are as follows:

1. Overweight: Industry index performance is +10% or higher relative to the Coin Stock Index;

2. Neutral: Industry index performance is between -10% and +10% relative to the Coin Stock Index;

3. Underweight: Industry index performance is below -10% relative to the Coin Stock Index.

We would like to remind you that different securities research institutions use different rating terms and criteria. We employ a relative rating system, indicating the relative weight of the investment.

Advice: Investors' decisions to buy or sell coin stocks depend on individual circumstances, such as current holdings and other factors to consider. Investors should not rely solely on investment ratings to draw conclusions.

Legal Disclaimer and Risk Warning

This report is produced by CoinFire Research Institute. The information in this report is derived from publicly available sources that we believe to be reliable, but CoinFire Research Institute and its affiliated entities (hereinafter collectively referred to as "we") make no guarantee as to the truth, accuracy, or completeness of this information, nor do we guarantee that the information and recommendations contained herein will remain unchanged. We are under no obligation to update recipients of the report with changed information and recommendations.

This report is for reference purposes for clients of our institute only. We do not consider recipients of this report as our institute's clients by default.

This report reflects the views and judgments of the report author as of the issuance date. Under no circumstances does the information in this report or the opinions expressed constitute investment advice to anyone. Investors should independently evaluate the information and opinions in this report and also consider their own investment objectives, financial situation, and specific needs. We and/or our affiliated personnel do not bear any legal liability for any consequences resulting from relying on or using this report.

Our traders and other professionals may provide market comments and/or trading views orally or in writing that are inconsistent with the opinions and recommendations in this report based on different assumptions, standards, and analytical methods. We are not obligated to update these opinions and recommendations to all recipients of the report. Our asset management company, proprietary trading desks, and other investment business units may independently make investment decisions that are inconsistent with the opinions or recommendations in this report.

This report is the copyright of our institution. Without prior written authorization from us, no organization or individual may copy, publish, or disseminate all or part of the content of this report in any form. If authorized to publish, forward, or excerpt this report, the publisher should indicate the issuer of this report and the publication date, and highlight the risks of using this report. Unauthorized reproduction or publication of this report, or publication that does not meet the requirements, may incur legal liability. Our institution reserves the right to hold such infringers legally responsible.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Pharos, deeply integrated with AntChain, is about to launch. How can we get involved?

$COIN Joins S&P 500, but Coinbase Isn't Celebrating

On May 13, S&P Dow Jones Indices announced that Coinbase would officially replace Discover Financial Services in the S&P 500 on May 19. While other companies like Block and MicroStrategy, closely tied to Bitcoin, were already part of the S&P 500, Coinbase became the first cryptocurrency exchange whose primary business is in the index. This also signifies that cryptocurrency is gradually moving from the fringes to the mainstream in the U.S.

On the day of the announcement, Coinbase's stock price surged by 23%, surpassing the $250 mark. However, just 3 days later, Coinbase was hit by two consecutive events: a hack where employees were bribed to steal customer data and a demand for a $20 million ransom, and an investigation by the U.S. Securities and Exchange Commission (SEC) into the authenticity of its claim of having over 100 million "verified users" in its securities filings and marketing materials. These two events acted as mini-bombs, and at the time of writing, Coinbase's stock had already dropped by over 7.3%.

Coincidentally, Discover Financial Services, being replaced by Coinbase, can also be considered the "Coinbase" of the previous payment era. Discover is a U.S.-based digital banking and payment services company headquartered in Illinois, founded in 1960. Its payment network, Discover Network, is the fourth largest payment network apart from Visa, Mastercard, and American Express.

In April, after the approval of the acquisition of Discover by the sixth-largest U.S. bank, Capital One, this well-established digital banking company of over 60 years smoothly handed over its S&P 500 "seat" to this emerging cryptocurrency "bank." This unexpected coincidence also portrayed the handover between the new and old eras in Coinbase's entry into the S&P 500, resembling a relay race scene. However, this relay baton also brought Coinbase's accumulated "external troubles and internal strife" to a tipping point.

Over the past decade, cryptocurrency exchanges have been the most stable "profit machines." They play a role in providing liquidity to the entire industry and rely on trading fees to sustain their operations. However, with the comprehensive rollout of ETF products in the U.S. market, this profit model is facing unprecedented challenges. As the leader in the "American stack," with over 80% of its business coming from the U.S., Coinbase is most affected by this.

Starting from the approval of Bitcoin and Ethereum spot ETFs, traditional financial capital has significantly onboarded users and funds that originally belonged to exchanges in a more cost-effective, compliant, and transparent manner. The transaction fee revenue of cryptocurrency exchanges has started to decline, and this trend may further intensify in the coming months.

According to Coinbase's 2024 Q4 financial report, the platform's total trading revenue was $417 million, a 45% year-on-year decrease. The contribution of BTC and ETH's trading revenue dropped from 65% in the same period last year to less than 50%.

This decline is not a result of a decrease in market enthusiasm. In fact, since the approval of the Bitcoin ETF in January 2024, the inflow of BTC into the U.S. market has continued to reach new highs, with asset management giants like BlackRock and Fidelity rapidly expanding their management scale. Data shows that BlackRock's iShares Bitcoin ETF (IBIT) alone has surpassed $17 billion in assets under management. As of mid-May 2025, the cumulative net inflow of 11 major institutional Bitcoin spot ETFs on the market has exceeded $41.5 billion, with a total net asset value of $1214.69 billion, accounting for approximately 5.91% of the total Bitcoin market capitalization.

Institutional investors and some retail investors are shifting towards ETF products, partly due to compliance and tax considerations. On one hand, ETFs have much lower trading costs compared to cryptocurrency exchanges. While Coinbase's spot trading fee rate varies annually in a tiered manner but averages around 1.49%, for example, the management fee for IBIT ETF is only 0.25%, and the majority of ETF institution fees fluctuate around 0.15% to 0.25%.

In other words, the more rational users are, the more likely they are to move from exchanges to ETF products, especially for investors aiming for long-term holdings.

According to multiple sources, several institutions, including VanEck and Grayscale, have submitted applications to the SEC for a Solana (SOL) ETF, with some institutions also planning to submit an XRP ETF proposal. Once approved, this may trigger a new round of fund migration. According to a report submitted by Coinbase to the SEC, as of April, the platform's trading revenue from XRP and Solana accounted for 18% and 10%, nearly one-third of the platform's fee revenue.

However, the Bitcoin and Ethereum ETFs passed in 2024 also reduced the fees for these two tokens on Coinbase from 30% and 15% to 26% and 10%, respectively. If the SOL and XRP ETFs are approved, it will further undermine the core fee revenue of exchanges like Coinbase.

The expansion of ETF products is gradually weakening the financial intermediary status of cryptocurrency exchanges. From their original roles as matchmakers and clearers to now gradually becoming mere "on-ramps and off-ramps" for funds, exchanges are seeing their marginal value squeezed by ETFs.

On May 12, 2025, SEC Chairman Paul S. Atkins gave a keynote speech at the Tokenization and Cryptocurrency Working Group roundtable. The theme of his speech revolved around "It is a new day at the SEC," where he indicated that the SEC would not approach enforcement and regulation the same way as before but would instead pave the way for cryptocurrency assets in the U.S. market.

With signs of cryptocurrency compliance such as the SEC's "NEW DAY" declaration, an increasing number of traditional brokerages are attempting to enter the cryptocurrency industry. One of the most representative cases is the well-known U.S. brokerage Robinhood, which began expanding its crypto business in 2018. By the time of its IPO in 2021, Robinhood's crypto business revenue accounted for over 50% of the company, with a significant boost from the Dogecoin "moonshot" promoted by Musk.

In Q1 2025 earnings report, Robinhood showcased strong growth, especially in revenue from cryptocurrency and options trading. Fueled by Trump's Memecoin, cryptocurrency-related revenue reached $250 million, nearly doubling year-over-year. Consequently, Robinhood Gold subscription users reached 3.5 million, a 90% increase from the previous year, with the rapid growth of Robinhood Gold providing the company with a stable source of income.

Meanwhile, RobinHood is actively pursuing acquisitions in the cryptocurrency space. In 2024, it announced a $2 billion acquisition of the long-standing European cryptocurrency exchange Bitstamp. Additionally, Canada's largest cryptocurrency CEX, WonderFi, which recently went public on the Toronto Stock Exchange, also announced its integration with RobinHood Crypto. After obtaining virtual asset licenses in the UK, Canada, Singapore, and other markets, RobinHood has taken a proactive approach in the compliant cryptocurrency trading market.

Furthermore, an increasing number of brokerage firms are exploring the same path. Futu Securities, Tiger Brokers, and others are also dipping their toes into cryptocurrency trading, with some having applied for or obtained the VA license from the Hong Kong SFC. Although their user bases are currently small, traditional brokerages have a natural advantage in user trust, regulatory licenses, and low fee structures. This could pose a threat to native cryptocurrency platforms in the future.

In April 2025, security researchers discovered that some Coinbase user data was leaked on the dark web. While the platform initially responded by attributing it to a "technical misinformation," it still raised concerns among users regarding its security and privacy protection. Just two days before Dow Jones Indexes announced Coinbase's addition to the S&P 500 Index, on May 11, 2025, Coinbase received an email from an unknown threat actor claiming to have obtained customer account information and internal documents, demanding a $20 million ransom to keep the data private. Subsequent investigations confirmed the data breach.

Cybercriminals obtained the data by bribing overseas customer service agents and support staff, mainly in "non-U.S. regions such as India." These agents abused their access to Coinbase's internal customer support system and stole customer data. As early as February this year, blockchain detective ZachXBT revealed on X platform that between December 2024 and January 2025, Coinbase users lost over $65 million to social engineering scams, with the actual amount potentially higher.

Among the victims was a well-known figure, 67-year-old Ed Suman, an established artist in the art world for nearly two decades, having been involved in the creation of artworks such as Jeff Koons' "Balloon Dog" sculpture. Earlier this year, he fell victim to an impersonation scam involving fake Coinbase customer support, resulting in a loss of over $2 million in cryptocurrency. ZachXBT critiqued Coinbase for its inadequate handling of such scams, noting that other major exchanges have not faced similar issues and recommending Coinbase to enhance its security measures.

Amidst a series of ongoing social engineering incidents, although there has not been any impact on user assets at the technical level so far, it has raised concerns among many retail and institutional investors. Especially institutions holding massive assets on Coinbase. Just considering the U.S. BTC ETF institutions, as of mid-May 2025, they collectively hold nearly 840,000 BTC, and 75% of these are custodied by Coinbase. If we price BTC at $100,000, this amount reaches a staggering $63 billion, which is equivalent to the nominal GDP of two Iceland in the year 2024.

In addition, Coinbase Custody also serves over 300 institutional clients, including hedge funds, family offices, pension funds, and endowments. As of the Q1 2025 financial report, Coinbase's total assets under management (including institutional and retail clients) reached $404 billion. The specific amount of institutional custodied assets was not explicitly disclosed in the latest report, but it should still be over 50% based on the Q4 2024 report.

Once this security barrier is breached, not only could the rate of user attrition far exceed expectations, but more importantly, institutional trust in it would undermine the foundation of its business. Therefore, after a hacking event, Coinbase's stock price plummeted significantly.

Facing a decline in spot trading fee revenue, Coinbase is also accelerating its transformation, attempting to find growth opportunities in derivatives and emerging assets. Coinbase acquired a stake in the options platform Deribit at the end of 2024 and announced the official launch of perpetual contract products in 2025. This acquisition fills in Coinbase's gap in options trading and its relatively small global market share.

Deribit has a strong presence in non-U.S. markets, especially in Asia and Europe. The acquisition has enabled Coinbase to gain a dominant position in bitcoin and ethereum options trading on Deribit, accounting for approximately 80% of the global options trading volume, with daily trading volume remaining above $2 billion.

Meanwhile, 80-90% of Deribit's customer base consists of institutional investors, with their professionalism and liquidity in the Bitcoin and Ethereum options market highly favored by institutions. Coinbase's compliance advantage, coupled with its already robust institutional ecosystem, makes it even more suitable. By using institutions as an entry point, it can face the squeeze from giants like Binance and OKX in the derivatives market.

Facing a similar dilemma is Kraken, which is attempting to replicate Binance Futures' model in non-U.S. markets. Since the derivatives market relies more on professional users, fee rates are relatively higher and stickiness is stronger, making it a significant source of revenue for exchanges. In the first half of 2025, Kraken completed the acquisition of TradeStation Crypto and a futures exchange, aiming to build a complete derivatives trading ecosystem to hedge the risk of declining spot transaction fee income.

With the surge of Memecoin in 2024, Binance, OKX, and various CEX platforms began massively listing small-market-cap, highly volatile tokens to activate active trading users. Due to the wealth effect and trading activity of Memecoins, Coinbase was also forced to join the battle, successively listing popular tokens from the Solana ecosystem such as BOOK OF MEME and Dogwifhat. Although these coins are controversial, they are frequently traded, with fee rates several times higher than mainstream coins, serving as a "blood-boosting" method for spot trading.

However, due to its status as a publicly traded company, this practice is a riskier endeavor for Coinbase. Even in the current crypto-friendly environment, the SEC is still investigating whether tokens like SOL, ADA, and SAND constitute securities.

In addition to the forced transformation strategies carried out by the aforementioned CEXs, they are also starting to lay out RWAs and the most talked-about stablecoin payment fields, such as the PYUSD launched through a collaboration between Coinbase and Paypal, Coinbase's support for the Euro stablecoin EURC by Circle that complies with EU MiCA regulatory requirements, or the USD1 launched through a collaboration between Binance and WIFL. In the increasingly crowded trading field, many CEXs have shifted their focus from just the trading market to the application field.

The golden age of transaction fees has quietly ended, and the second half of the crypto exchange platform game has silently begun.

Arthur Hayes: Why I'm Betting on ETH While the Market Is Obsessed with SOL

May 16 Key Market Information Gap, A Must-Read! | Alpha Morning Report

The End and Rebirth of NFTs: How the Meme Coin Craze Ended the PFP Era?

Key Market Intelligence on May 14th, how much did you miss out on?

1.Binance Alpha Launches HIPPO, BLUE, and Other Tokens

2.Believe Ecosystem Tokens See General Rise, LAUNCHCOIN Surges Over 250% in 24 Hours

3.Tiger Securities Introduces Cryptocurrency Deposit and Withdrawal Service, Supports Mainstream Cryptocurrencies such as BTC and ETH

4.Current Bitcoin Rally Possibly Driven by Institutions, Retail Traders Yet to Join

5.Binance Wallet's New TGE Privasea AI Participation Requires a 198 Point Threshold, with a Point Consumption of 15

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on its new creator revenue-sharing model: the platform will allocate 50% of PumpSwap revenue to token creators, sparking varied reactions from users. Some criticize the move as insufficient or even misleading, while others view it as a positive step the platform is taking to reward creators. Meanwhile, PUMP faces market pressure from emerging competitors like LetsBONKfun and Raydium, which are rapidly gaining market share. Users also express concerns about PUMP's sustainability and potential regulatory risks in the U.S., with discussions extending to the platform's impact on the entire memecoin ecosystem.

COINBASE: Today, Coinbase became the first crypto company to join the S&P 500 Index, replacing Discover Financial Services, sparking widespread industry attention. The entire crypto community views this milestone as a significant development, signaling that crypto assets are further integrating into the mainstream financial system. The news has sparked lively discussions on Twitter, with many users pointing out that this may attract more institutional investors to enter the Bitcoin and other cryptocurrency markets.

XRP: XRP became the focal point of today's crypto discussion, with its significant market movements and strategic advances drawing attention. XRP has surpassed USDT to become the third-largest cryptocurrency by market capitalization, sparking market excitement and discussions about its future potential. The surge in market capitalization and price is believed to be related to increasing institutional interest, deepening strategic partnerships, and its role in the crypto ecosystem. Additionally, XRP's integration into multiple financial systems and its potential as a macro asset class are also seen as key factors driving the current market sentiment.

DYDX: Today's discussions about DYDX mainly focused on the dYdX Yapper Leaderboard launched by KaitoAI. The leaderboard aims to identify the most active community participants, with a total of $150,000 in rewards to be distributed over the first three seasons. This initiative has sparked broad community participation, with many users discussing the potential rewards and the incentive effect on the DYDX ecosystem. Meanwhile, progress on the ethDYDX to dYdX native chain migration and historical airdrop events have also been topics of discussion.

1. "What Is 'ICM'? Holding Up the $4 Billion Market Cap Solana's New Narrative"

Overnight, the hottest narrative in the crypto space has become "Internet Capital Markets," with a host of crypto projects and founders, led by the Solana ecosystem's new Launchpad platform Believe, releasing this phrase. Together with "Believe in something," it has become the new slogan heralding the onset of a bull market. What exactly is the so-called "Internet Capital Market," will it become a short-lived hype phrase like the Base ecosystem's previous Content Coin, and what related targets are available for selection?2.《LaunchCoin Surges 20x in One Day, How Did Believe Create a $200M Market Cap Shiba Inu After Going to Zero?|100x Retrospective》

LAUNCHCOIN broke through a $200 million market cap today, with the long-lost liquidity and such a high market cap "Memecoin" almost bringing half of the on-chain crypto community CT into the fray. The community is crazily discussing this token, with half of it being FOMO and the other half being FUD. This token, originally issued by Believe founder Ben Pasternak under his personal identity, transformed into a new platform token after a renaming. From once going to zero to a $200 million market cap, what happened in between?May 14 On-chain Fund Flow

Within 24 hours, GOONC's market cap soared to 70 million, could GOONC be the next billion-dollar dog on the Believe platform?

Bitcoin has broken $100,000, Ethereum has surpassed 2500, and is Solana's hot streak about to make a comeback?

The current market is in a state of macro euphoria, with GOONC riding the wave today, skyrocketing 10x in just a few hours, reaching a market cap of tens of millions of dollars, trading volume soaring past 50 million, and rumors swirling that the developer may be from OpenAI (unconfirmed but intriguing enough).

A ludicrous and absurd Solana meme that some actually buy into.

GOONC is a meme coin that has sprouted from the "gooning" subculture, offering no technological innovation or practical use, its sole function being speculation.

It takes inspiration from an NSFW term "gooning," which refers to a person being deeply immersed in certain content (you know what), eventually entering a nearly religious-like trance.

In Reddit (such as r/GOONED, r/GoonCaves) and some counterculture media outlets (such as MEL Magazine in 2020), "gooning" has gradually transitioned from an adult label to a meme-addicted, digital content and virtual self-indulgence synonym, arguably the epitome of Degen spirit.

GOONC is playing around with this concept, packaging the addictive nature, uselessness, and irony of gooning into a tradable financial product. The project team has made it clear: "We do not solve blockchain problems, we only trade absurdity." Blunt but oddly genuine.

GOONC launched on May 13, 2025, using the meme coin launch platform Believe App's LaunchCoin module on Solana. This tool is highly Degen: zero technical barriers, a few clicks to create a coin, perfect for projects like GOONC that can come up with ideas out of the blue.

The mastermind behind GOONC is also quite something and is the most talked-about, with KOL @basedalexandoor on X platform (alias "Pata van Goon") personally involved. His profile even caught the attention of Marc Andreessen, co-founder of a16z, making onlookers unable to resist speculating if GOONC has a hint of OpenAI lineage.

While this 'OpenAI Endorsement' is currently just community speculation, it is definitely a good card to play to fuel hype. Saying "we are pure speculation" on one hand, while tagging a few "AI + a16z" on the other.

GOONC took off as soon as it launched. After its launch on May 13, 2025, its market capitalization skyrocketed to $22 million within 4 hours, with a trading volume exceeding $25.6 million in 24 hours. According to platform data, the first day of trading saw an astonishing +41,100% surge, soaring from $0.0000001 to $0.02, becoming a "missed-the-boat" situation.

GOONC quickly formed an active trading community post-launch, with a lot of discussion and trading signals appearing on X platform (such as the 292x return signal provided by DeBot). Liquidity pools on exchanges like Raydium and Meteora grew rapidly, supporting high trading volumes and price increases.

The real climax occurred between May 13 and May 14, with the market cap rising to $5.5 million in the morning and directly surpassing $55 million in the afternoon. By the 14th, it briefly approached a $70 million market cap, with the trading volume soaring to $59 million. Some community members even posted screenshots claiming an increase of +85,000%, creating a new myth out of the ruins.

As of 1:30 pm on May 14, the price stabilized around $0.039, with a total market cap and FDV both around $39.6 million, and a 24-hour trading volume of $5.43 million. Active platforms include XT.COM, LBank, Meteora, and others.

Although there was a slight pullback from the peak ($0.07), the coin's popularity remains strong. For a coin that relies purely on "irony + community + X post" to thrive, this performance is already at a stellar level.