A “sexy casino,” where real-estate speculation has moved online.

Polymarket rose to prominence in 2024 by letting users bet on the U.S. presidential election, with trading volume hitting record highs on the night of Trump’s victory.

In November 2025, it signed a partnership with the UFC and entered sports betting. Then, on January 5, 2026, it announced a new experiment:

Betting on home prices.

Polymarket had previously offered markets tied to mortgage rates, but those were essentially derivatives on Federal Reserve policy. This time is different. The new markets allow users to directly bet on whether a specific city’s home price index will rise or fall.

The partner is Parcl, a real-estate data protocol on Solana. The mechanics are simple: choose a city and predict whether its home price index will go up or down next month.

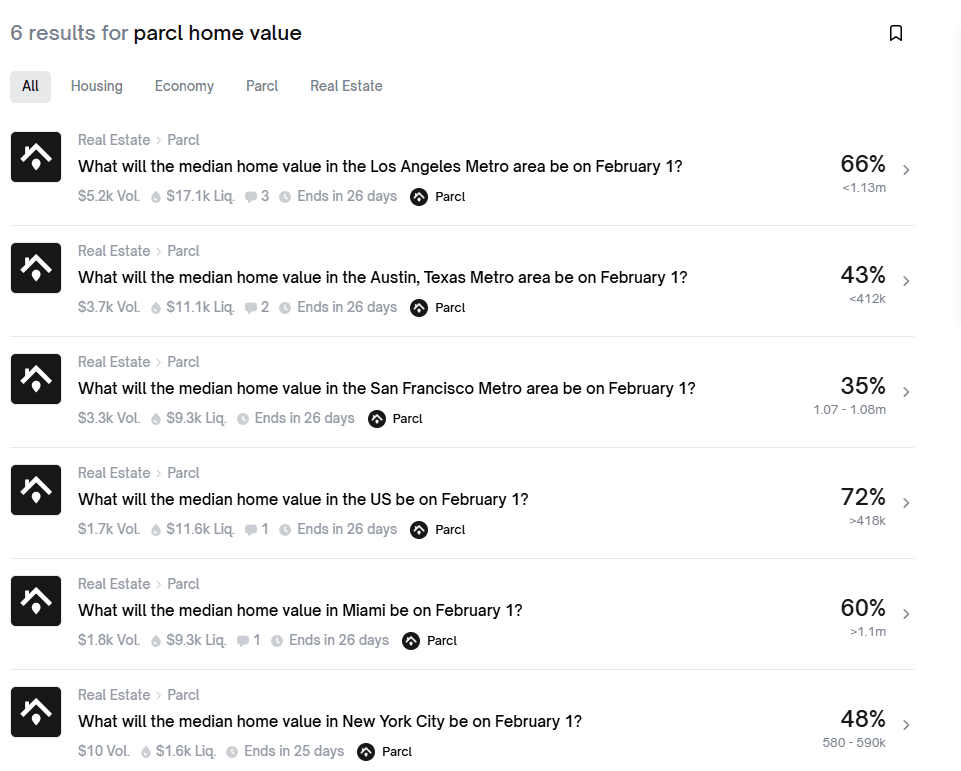

The initial markets include Austin, San Francisco, Miami, New York, plus a national U.S. index.

No down payment.

No mortgage application.

No dealing with agents.

Bet USD 100. Get it right and double your money. Get it wrong and it goes to zero.

Polymarket’s CMO argues that real estate is the world’s largest asset class—worth USD 400 trillion—and therefore deserves to be a “first-class citizen” in prediction markets.

A USD 400 trillion casino, with the entry ticket now reduced to:

The price of a cup of coffee.

This is not entirely new.

Back in 2008, the UK betting exchange Betfair already offered markets on a housing crash. What happened that year needs no retelling. Wall Street was trading CDS, MBS, and CDOs—acronyms few ordinary people understood, but everyone ended up paying for them.

Polymarket has simply translated the same idea into plain language:

Will Miami home prices rise or fall before February 1? Pick one.

According to the partnership announcement, settlement data is provided by Parcl and updated daily—faster than traditional housing indices. Each market comes with a dedicated settlement page detailing final values, historical trends, and calculation methodology.

Transparent. Public. Verifiable on-chain.

It sounds appealing. But current market data tells a quieter story. Even the most liquid market barely has USD 17,000 in liquidity. New York’s market sits at around USD 1,600, and after two days online, total trading volume there was just USD 10.

People are enthusiastic about betting on presidents. Betting on housing prices? It seems most haven’t figured out how to play yet.

For now, this looks less like a mass market—and more like an early adopter playground. Or, put differently:

A hunting ground for whales.

Parcl raised two funding rounds in 2022, with investors including Dragonfly, Coinbase Ventures, and Solana Ventures, totaling over USD 11 million.

Its earlier products were far more aggressive: long and short positions on housing indices, up to 10x leverage, perpetual contracts.

Yes—real estate trading with leverage.

After partnering with Polymarket, the design became more restrained. No leverage. No perpetuals. Just simple binary options: up or down, settle at expiry.

Polymarket itself has been expanding rapidly. Valued at USD 1.2 billion in 2024, by the end of 2025 the parent company of the NYSE, ICE, announced plans to invest USD 2 billion, pushing its valuation close to USD 9 billion.

From betting on presidents, to boxing, to home prices—the catalog keeps expanding. What’s next is unclear. Divorce rates? Birth rates? How long the bubble tea shop downstairs can survive?

As long as there is a data source, anything can become a market.

On-chain analytics have already shown that nearly 70% of Polymarket users lose money, with profits concentrated in a very small number of wallets.

That ratio looks familiar—to crypto trading, and to stock trading as well.

The difference is this: election outcomes are discrete and definitive. You win or you lose. Housing data is not. It comes with lags, noise, seasonality, and methodological disputes. You may think you are making a judgment, but in reality you are betting against statistical definitions.

The traditional logic of buying a home is straightforward: 30% down, a 30-year mortgage, monthly payments that may exceed your salary—but at least the house is yours.

The Polymarket version of “buying a home” is different: bet USD 100, wait a month, double it or lose everything. The house is never yours. It never was.

Which one looks more like gambling?

The last wave of financialized real estate ended with the subprime crisis in 2008. This time, retail traders are allowed at the table.

What progress.

You may also like

80% of oil income settled in stablecoins, Venezuela makes USDT its second currency

Key Market Intelligence on January 13th, how much did you miss?

After Stepping Down as Mayor of New York City, He Pivoted to Selling Cryptocurrency

A computation bug that allowed Truebit to be hacked for 8535 ETH

Life Candlestick Drama Escalates: Fund Established, 'Cyber Altruism Box' Feature Launched; Founder Denies Meme Coin Issuance

Binance Lists United Stables as a New Trading Option

Key Takeaways Binance is adding United Stables (U) to its platform, expanding its offerings in digital currencies. United…

Space Featured in Binance Research Ecosystem Report: Key Signals of the Predictive Market Leverage Layer are Emerging

2026 Top Transaction Themes: Trump's Sore-Loser Attitude, the End of the International Order

The A-share market frenzy crashed servers, and cryptocurrencies are waiting for Twitter to come to the rescue

The market is never short of entry points, but it lacks the profit-making effect—people will naturally flock to it if there is profit, and even the best platform and functions cannot save it if there is no profit.

a16z Raises $15 Billion in New Fund: Long Criticized, Why Has It Become the "Best Storytelling" Venture Capitalist?

Most US debanking cases stem from government pressure, says report

Key Takeaways A report from the Cato Institute indicates that most debanking incidents in the US originate from…

UK Lawmakers Urge Ban on Political Donations in Crypto

Key Takeaways: A group of senior UK lawmakers is pushing for a legislative ban on political donations in…

Russia Targets Illegal Crypto Miners; India Advocates for CBDCs: A Global Overview

Key Takeaways Russia is intensifying efforts to regulate illegal cryptocurrency mining, proposing significant fines and penalties. India’s Reserve…

Crypto Rich Threaten to Depart California Amid New Tax Proposal

Key Takeaways Proposed California tax imposes a 5% assets tax on residents with over $1 billion, sparking debate…

Coinbase May Withdraw Support for CLARITY Act Amid Stablecoin Rewards Ban Debate

Key Takeaways Potential Withdrawal: Coinbase is considering withdrawing support for the CLARITY Act if it restricts stablecoin rewards.…

Crypto Crucial: Will Tax Threats Push California’s Wealthiest to Flee?

Crypto billionaires in California are contemplating relocation due to a proposed wealth tax targeting assets over $1 billion.…

SEC now fully Republican, set for pro-crypto rulemaking in 2026

Key Takeaways The SEC is now completely under Republican control following the departure of Caroline Crenshaw, indicating a…

Top UK Lawmakers Advocate for Ban on Crypto Political Donations

Key Takeaways Seven UK parliamentary committee chairs call for legislation to ban crypto donations, citing concerns over transparency…

80% of oil income settled in stablecoins, Venezuela makes USDT its second currency

Key Market Intelligence on January 13th, how much did you miss?

After Stepping Down as Mayor of New York City, He Pivoted to Selling Cryptocurrency

A computation bug that allowed Truebit to be hacked for 8535 ETH

Life Candlestick Drama Escalates: Fund Established, 'Cyber Altruism Box' Feature Launched; Founder Denies Meme Coin Issuance

Binance Lists United Stables as a New Trading Option

Key Takeaways Binance is adding United Stables (U) to its platform, expanding its offerings in digital currencies. United…