From Panic to Reversal, BTC Surges to $93K: Has the Structural Turning Point Arrived?

Original Article Title: "BTC Returns to $93,000: Four Major Macro Signals Resonate, Crypto Market May Welcome a Structural Turning Point"

Original Article Author: Dingdang, Odaily Star Daily

Over the past 48 hours, the crypto market once again reminded everyone in an almost dramatic way: here, "plunges" and "bull returns" are always just a day's trading apart. BTC staged a strong rebound to near $93,000, with a 24-hour gain of close to 7%; ETH returned above $3,000; SOL also retested $140.

After the U.S. stock market opened, the crypto sector also showed a general rise. BitMine, an ETH treasury company, saw its stock price rise by 11.6% in 24 hours, and Strategy, the largest BTC corporate holder, saw a 6.2% increase.

In terms of derivatives, the total liquidation amount in the past 24 hours reached $430 million, with long liquidations totaling $70 million and short liquidations totaling $360 million. The main liquidation was a short position, and the largest single liquidation occurred on Bybit - BTCUSD, with a position value of $13 million.

In terms of market sentiment, according to Alternative.me data, today's cryptocurrency fear and greed index has risen to 28, still in the "fear" zone, but compared to yesterday's 23 (extreme fear), sentiment has clearly improved, and the market is showing signs of a slight recovery.

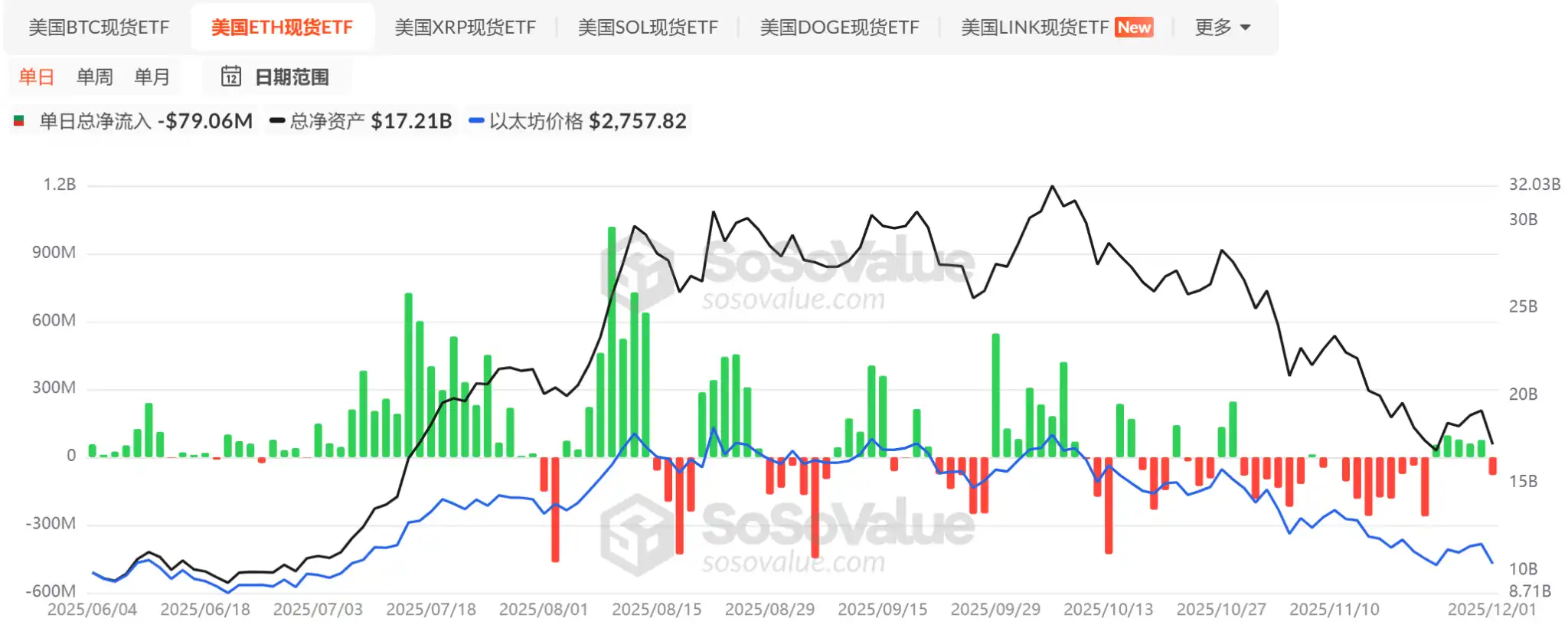

Regarding fund inflows, according to sosovalue.com data, after BTC spot ETFs experienced intense outflows for four consecutive weeks, they finally saw modest inflows for four consecutive trading days; ETH spot ETFs, on the other hand, turned into net outflows of $79 million after five consecutive inflows. Overall, the current momentum of fund inflows is still relatively weak.

Meanwhile, altcoin ETFs have accelerated their approvals under policy dividends, with XRP, SOL, LTC, DOGE, and other ETFs being listed intensively. Among them, although the XRP ETF was later than the SOL ETF, its performance was even more remarkable. Its current total net inflow has reached $824 million, surpassing the SOL ETF, and in the short term has become the "institutional representative work" of altcoins.

Superficially, the recent surge in the crypto market seems to lack a significant direct catalyst, but in reality, forces beneath the surface are synchronously building up──from rate expectations to liquidity inflection, and to the restructuring of institutional allocation logic, each is potent enough to steer the market direction.

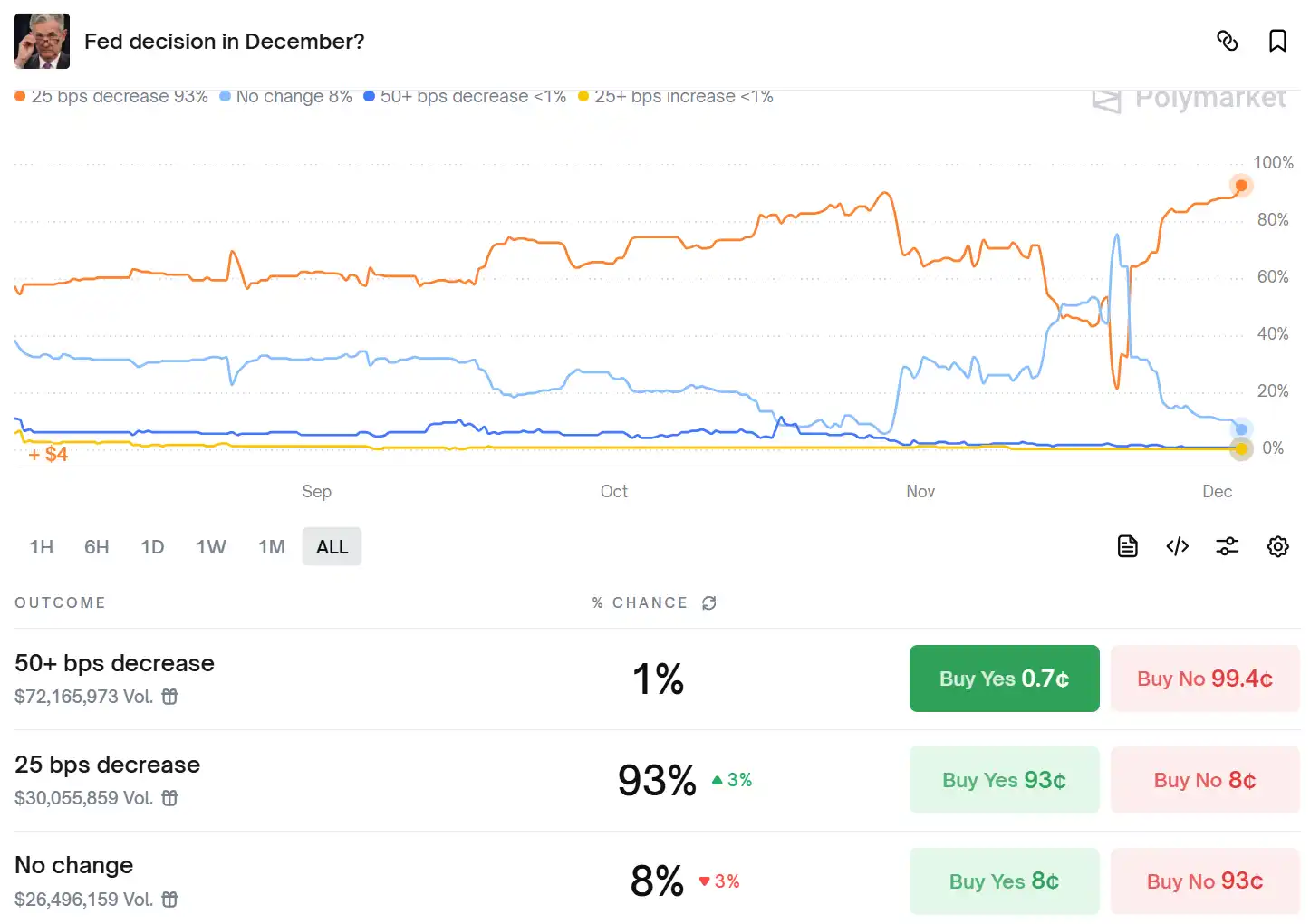

Forecast Reversal: December Rate Cut Appears Set in Stone

Analysts at Goldman Sachs' Fixed Income, Currency, and Commodities (FICC) division believe that an interest rate cut by the Federal Reserve at the upcoming December meeting has essentially become a done deal. Similarly, Bank of America's Global Research division indicates that due to the soft labor market conditions and recent hints from policymakers suggesting an early rate cut, they now expect the Fed to cut rates by 25 basis points at the December meeting. This is a shift from the bank's previous expectation of the Fed maintaining rates at the December meeting. At the same time, the bank currently forecasts rate cuts of 25 basis points each in June and July 2026, bringing the final rate to a range of 3.00%-3.25%.

Polymarket data shows that the probability of the Fed cutting rates by 25 basis points next week has risen to 93%, with the total trading volume in this prediction pool reaching $300 million.

Liquidity Shift: QT Conclusion and $135 Billion Infusion

A more crucial signal comes from the Federal Reserve's balance sheet operations. Quantitative Tightening (QT) officially concluded on December 1, having previously withdrawn over $2.4 trillion in liquidity from the system, stabilizing the Fed's balance sheet around $6.57 trillion.

Of more significance, on the same day, the Fed injected $135 billion in liquidity into the market through overnight repo tools, marking the second-largest single-day liquidity injection since the pandemic, aimed at alleviating short-term funding pressures in banks. However, this is not quantitative easing (QE) but rather temporary liquidity support.

Powell's Successor: Political Variable Before Christmas

Beyond liquidity and rates, another thread affecting market sentiment comes from politics. With Powell's term set to end in May next year, the search for the next Federal Reserve Chair has fully commenced, with five candidates currently vying for arguably the most crucial position in the U.S. economy. These contenders include Federal Reserve Governors Christopher Waller, Michelle Bowman, former Fed Governor Kevin Warsh, BlackRock's Rick Rieder, and NEC Director Haslett. U.S. Treasury Secretary Bassett, who oversees the selection process, stated last week that Trump may announce his nominee before the Christmas holiday.

Insiders say Trump trusts Hassett and believes he shares his desire for a more aggressive rate cut by the central bank. Hassett has indicated he would accept the position if offered.

Asset Management Giants Easing Up: Crypto ETF Officially Enters "Mainstream Wealth Management"

Over the past few years, traditional giants like Vanguard and Merrill Lynch have always kept their distance from crypto ETFs—not because they don't understand, but because they are "risk-averse." However, this week, as Vanguard and Merrill announced expanded client access to crypto ETFs and Charles Schwab planned to open Bitcoin trading in the first half of 2026, this landscape has finally started to loosen up.

Importantly, the style of traditional institutions has always been "prefer to miss out than step on a landmine." Their loosening grip is not a short-term trading signal but a long-term strategic shift. If the above institutions allocate just 0.25% of their funds to BTC, it also means there will be approximately $750 billion of structural incremental buying pressure in the next 12-24 months. Coupled with relaxed monetary conditions, 2026 is poised for strong growth.

Furthermore, one of the largest financial institutions in the U.S., Bank of America, has allowed wealth advisors to recommend allocating 1%-4% to crypto assets to clients starting from January 2025, with the initial recommended assets being IBIT, FBTC, BITB, and BTC—meaning BTC has officially entered the "standard allocation" list of traditional U.S. wealth management. This move aligns Bank of America's wealth management platform with major institutions like BlackRock and Morgan Stanley. For Wells Fargo and Goldman Sachs, which have been slow to act, industry pressure is rapidly mounting.

Conclusion

The rebound in this market is not solely driven by a single positive development, but more like multiple macro clues resonating at the same time: clear rate cut expectations, liquidity inflow, approaching political variables, and asset management giants easing up. More importantly, crypto assets are transitioning from "allowed to trade" to "acknowledged allocation," propelling them towards a more sustainable fund-driven cycle.

You may also like

AI Wars: WEEX Alpha Awakens – Insights, Top Strategies, and Real-Market Execution Takeaways

WEEX Labs has officially launched the preliminary round of its global AI trading hackathon, AI Wars: WEEX Alpha Awakens, bringing together hundreds of elite teams to compete in real-market conditions. With a record-breaking $1.88 million prize pool and backing from top-tier sponsors like AWS, the event has quickly become a global proving ground for AI-powered trading strategies. As competition intensifies and standout teams emerge on the leaderboard, the hackathon not only showcases cutting-edge AI execution and risk management, but also offers valuable insights and inspiration for traders looking to build or refine their own AI-driven systems.

WEEX P2P now supports Polish zloty (PLN)—new users and merchant rewards

To make crypto deposits easier, WEEX has officially launched its P2P trading platform and continues to expand fiat support. We're excited to announce that the Polish Zloty (PLN) is now available on WEEX P2P!

Layoffs of 30%, But Spending $250 Million to Buy a Company - What Is Polygon Thinking?

AI in the Crypto Market: How Artificial Intelligence is Changing Trading Strategies

This article explores how AI contributes to these movements and share practical strategies to help you navigate an AI-powered crypto market.

Cross-chain Collaboration: Tom Lee Invests $200 Million, Joins Forces with Global Top Streamer Mr. Beast

Trump Waves Hand, Stirs Venezuela's Game Hurricane

Fact Check: How Much Money Did the University of Chicago Lose in its Crypto Investment?

VanEck Q1 Market Outlook: Long-Term Bullish on Cryptocurrency, Strong Gold Demand

ThunderChain Resumes Legal Battle as Former CEO Chen Lei Accused of Embezzlement for Cryptocurrency Speculation - What Happened Back Then?

Key Market Intelligence for January 15th, how much did you miss out on?

$200K Annual Salary Hiring, Predicting Market Will See Wall Street Players

Senate Committee Delays Crypto Bill Due to Coinbase’s Objections

Key Takeaways The Senate Banking Committee has postponed its planned markup of a major crypto market structure bill…

Eric Adams Denies “Rug Pull” Allegations Linked to NYC Token Despite Significant Losses

Key Takeaways: Eric Adams firmly denies allegations implying that money was moved out of the NYC Token. Market…

XRP Price Action: Crypto Bill Could Grant XRP the Same Legal Designation as Bitcoin

Key Takeaways A new legislative draft in the United States might classify XRP alongside Bitcoin (BTC) and Ethereum…

Asia Market Open: Bitcoin Nears $96K Amid Mixed Asian Stocks and Wall Street Slump

Key Takeaways Bitcoin’s price edges closer to $96,000 amid mixed signals from Asian stock markets and a recent…

Transforming the Cryptocurrency Landscape: A 2026 Outlook

Key Takeaways Cryptocurrency systems have seen expansive growth and technological innovation. The introduction of new regulations has reshaped…

Pi Coin Price Prediction: Mainnet Tokens Just Unlocked – What Does This Mean for Holders?

Key Takeaways Daily token unlocks are increasing the supply of Pi Coin, affecting its short-term price stability. Pi…

Best Crypto to Buy Now January 14 – XRP, PEPE, Internet Computer

Key Takeaways The current crypto landscape is at a pivotal junction with potential changes in U.S. regulations offering…

AI Wars: WEEX Alpha Awakens – Insights, Top Strategies, and Real-Market Execution Takeaways

WEEX Labs has officially launched the preliminary round of its global AI trading hackathon, AI Wars: WEEX Alpha Awakens, bringing together hundreds of elite teams to compete in real-market conditions. With a record-breaking $1.88 million prize pool and backing from top-tier sponsors like AWS, the event has quickly become a global proving ground for AI-powered trading strategies. As competition intensifies and standout teams emerge on the leaderboard, the hackathon not only showcases cutting-edge AI execution and risk management, but also offers valuable insights and inspiration for traders looking to build or refine their own AI-driven systems.

WEEX P2P now supports Polish zloty (PLN)—new users and merchant rewards

To make crypto deposits easier, WEEX has officially launched its P2P trading platform and continues to expand fiat support. We're excited to announce that the Polish Zloty (PLN) is now available on WEEX P2P!

Layoffs of 30%, But Spending $250 Million to Buy a Company - What Is Polygon Thinking?

AI in the Crypto Market: How Artificial Intelligence is Changing Trading Strategies

This article explores how AI contributes to these movements and share practical strategies to help you navigate an AI-powered crypto market.