Best Crypto Futures Trading Platforms in October 2025

Key takeaways

- Choosing the right crypto futures exchange depends heavily on evaluating key aspects such as fee structures, platform usability, range of supported assets, and—most importantly—security measures.

- Trust and security are frequently the top priorities, especially since many exchanges also serve as custodians for users’ digital assets. Key features to look for include Proof-of-Reserves (PoR), two-factor authentication (2FA), and a proven operational track record.

- Regional accessibility is another essential factor. With crypto regulations evolving worldwide, many derivatives platforms limit services to specific countries, and some may only offer a narrow set of markets or trading pairs depending on the user’s location.

What is Crypto Futures Trading?

Crypto futures are derivative contracts that derive their value from an underlying digital asset, such as Bitcoin or Ethereum. Unlike spot trading, futures do not involve immediate transfer of the actual cryptocurrency. Instead, traders agree to buy or sell an asset at a predetermined price on a future date.

While the basic mechanics of futures trading may resemble spot trading, futures open the door to more sophisticated strategies—including leveraged positions and the ability to go long or short. This allows traders to speculate on price movements without owning the underlying asset. In today’s crypto markets, derivatives trading volume consistently surpasses that of spot markets.

Which Crypto Exchange Offers the Best Futures Trading?

Over the past ten years, the cryptocurrency exchange landscape has evolved from rudimentary trading websites into a sophisticated financial ecosystem. Leading platforms now offer advanced trading products coupled with robust security frameworks, serving not only as venues for spot and derivatives trading but also as gateways bridging digital assets with traditional finance.

Selecting a suitable futures trading platform requires careful evaluation, as each exchange offers distinct advantages in areas such as fee models, leverage options, and risk management tools. These differences can significantly influence trading outcomes, risk exposure, and overall user experience. The optimal choice varies by individual, reflecting diverse trading strategies, asset preferences, and risk tolerance levels.

In the assessment that follows, we examine key futures trading platforms based on critical factors including security protocols, product diversity, fee competitiveness, and interface design. This analysis aims to equip traders with the insights needed to identify the exchange that best aligns with their specific trading objectives and operational requirements.

1. WEEX

WEEX stands as an emerging force in the crypto derivatives landscape, establishing its presence through competitive trading conditions and user-centric features. The platform has built a reputation for providing reliable execution capabilities combined with an accessible trading environment suitable for both novice and experienced traders.

The exchange offers substantial leverage options reaching up to 400x across a diverse portfolio of 1700+ trading pairs. Its fee structure remains competitive at 0.02% for maker orders and 0.08% for taker orders. Among its standout features is an industry-leading commission rebate program that offers up to 90% rebates, distributing over $12 million in monthly commission payouts to its user base. The platform's interface design emphasizes simplicity and functionality, delivering an ad-free trading experience that eliminates distractions while maintaining comprehensive tool access.

WEEX demonstrates impressive liquidity metrics, currently ranking second industry-wide in critical depth measurements including order book density and narrow price spreads. The platform's BTC markets can comfortably accommodate transactions of at least 800 BTC within a minimal 0.01% price variance, showcasing robust market depth.

Also, WEEX Liquidity has earned recognition from authoritative platforms like Cryptorank, a testament to our robust market depth. This is exemplified by the ability to trade 800 BTC within a razor-thin 0.01% spread, a feature that directly contributes to lightning-fast, zero-lag trade execution and minimizes slippage for our users.

To master future trading, just read How to Trade Bitcoin Futures on WEEX and do your first future trading now!

Pros

- Easy-to-use interface

- Strong futures and copy trading features

- No KYC for basic use

- Competitive fees

- Transparent reserves and protection fund

Con

- No fiat withdrawals

2. MEXC

MEXC remains one of the largest crypto futures brokers for daily trading volume. It handles several billion dollars each day, providing futures trades with deep liquidity and tight spreads.

The platform offers perpetual futures, which rely on traditional order types but without expiration dates. Over 900 futures markets are listed, including the best meme coins like Pepe, Bonk, and Shiba Inu. MEXC supports linear and inverse contracts, and they settle in USDT or the underlying asset, respectively.

Leverage is available on all crypto futures, with large-cap pairs providing 500x multiples. The exchange reduces leverage limits on markets with weaker liquidity to help traders mitigate risk. The futures dashboard allows full customization, and users deploy drawing tools and technical indicators for real-time analysis.

Research shows that MEXC is one of the best crypto futures trading platforms for low fees. Traders pay just 0.01% per side on limits and 0.04% on markets.

New users register with an email address only and remain anonymous unless they withdraw more than 20,000 USDT daily, or 100,000 USDT monthly.

Pros

- Access over 900 perpetual futures markets

- Choose between linear and inverse contracts

- Pay a maximum futures trading commission of 0.04%

- No KYC when withdrawing under 20,000 USDT daily

Cons

- The platform operates offshore without regulation

- U.S. traders cannot access the exchange

3. Binance

Binance is a good option for traders who prefer traditional delivery futures over perpetuals. The tier-one exchange provides quarterly and bi-quarterly contracts for Bitcoin and Ethereum. These futures contracts, unlike perpetuals, do not incur funding fees. Traders may exit positions early, but they can also hold until the contract expiration date. This structure allows Binance users to trade futures with longer-term strategies.

Binance also caters to perpetual traders, with over 530 available markets. You can access the best altcoins, including Sui, Dogecoin, BNB, and Cardano, with leverage up to 125x.

The platform is known for its advanced trading tools, as Binance traders access multiple timeframes, indicators, deep order books, and automated bots. Accessibility includes desktop and mobile trading, ensuring futures traders monitor positions on the move.

Regarding fees, market makers get the lowest trading commissions of 0.018% per side. Takers pay more than double at 0.045%.

Pros

- Trade delivery futures with quarterly and bi-quarterly expirations

- Suitable for entering longer-term futures trades without funding fees

- Also supports over 530 perpetual markets

- The exchange boasts over 283 million users

Cons

- Delivery futures support Bitcoin and Ethereum only

- Restricts leveraged products in the U.S.

- Often relies on third-party gateways for fiat payments

4. OKX

OKX offers one of the most extensive derivative ecosystems, including a comprehensive range of cryptocurrencies, instruments, and contract types.

Day traders may prefer OKX's perpetual futures market, which covers over 290 digital assets. Users find their favorite coin or token through narrative filters like RWA, AI, meme coins, and Layer 1. Perpetual futures incur funding rates every eight hours, and only longs or shorts are charged.

The next option is delivery futures, with only daily and weekly markets available for Bitcoin and Ethereum. These contracts offer longer-term exposure without funding fees. OKX also supports crypto options for the two market leaders. Seasoned traders access fully-fledged options chains with multiple strike prices and expiration dates, while beginners use the Simple Options tool for an easier trading experience.

OKX's entry-level commission when trading futures via market orders is 0.05% per side. Market makers and those who meet 30-day volume milestones receive lower commissions.

Pros

- Access perpetuals, delivery futures, and options in one safe place

- High-level charting tools with 100+ technical indicators

- Heavily regulated in several global markets

Cons

- U.S. traders can access OKX spot trading but not futures products

- Delivery contracts support daily and weekly expirations only

- Strict onboarding process with enhanced KYC

5. Bybit

If you're looking for the best crypto futures trading platform for supported markets, Bybit is a top choice. With over 600 perpetual contracts, Bybit provides access to a wide range of digital assets. Alongside market leaders like Bitcoin, XRP, BNB, and Ethereum, users trade volatile meme coins such as Popcat, SPX6900, Brett, and Peanut the Squirrel. Traders also speculate on decentralized finance (DeFi) futures contracts, from Zora and Uniswap to Pendle, Aave, and Ondo.

Most futures markets trade with USDT, although select pairs also support USDC. Platform users also choose between linear and inverse contracts, depending on their risk tolerance and trading goals. Bybit offers leverage of up to 200x on major pairs, but these limits decline when trading more volatile markets.

The exchange's fee structure is competitive and transparent. Traders pay 0.02% or 0.055% per side when placing limit or market orders, respectively. The platform also charges a small 0.05% settlement fee.

Pros

- Gain exposure to over 600 digital assets via leveraged futures contracts

- Supports smaller-cap meme coins with high volatility

- Contract specifications include linear and inverse settlement

Cons

- The charting platform may be overwhelming for beginners

- Bybit is not available in the U.S. or the UK

- Its derivative markets are not approved by any regulators

Why Choose WEEX?

Founded in 2018, WEEX has rapidly grown into one of the most trusted crypto exchanges, serving over 6.2 million users across 130+ countries. With a strong emphasis on security, liquidity, and ease of use, WEEX provides over 1,700 trading pairs and up to 400× leverage for futures trading, making it a powerful option for both beginners and pro traders.

Which Crypto Futures Exchange is Right for Me?

With hundreds of crypto futures exchanges to choose from, identifying your best option can be difficult. Ultimately, your trading proficiency, country of residence, and risk tolerance will all play a major part in informing your decision, which will naturally differ from another trader’s.

Trading proficiency: Different venues cater to different trader niches — though most are accessible to all skill levels, some offer unique products or features that are purpose-built for beginners or pro traders. Related is the user experience the exchange provides. The ease with which you can navigate the platform is critical in capitalizing on trades. Traders just getting familiar with how to integrate futures trading into their crypto strategy will likely have a different workflow than a seasoned high-frequency trader capturing arbitrage opportunities. Choosing the best crypto futures exchange for you may depend on your overall proficiency and familiarity with crypto trading to begin with, before you find the platforms that have the right features that match your needs.

Country of residence: With ever-changing global regulations, platforms can rarely offer true global coverage without running afoul of legislation. The same exchange may often need to provide a completely different experience from one country to the next to remain compliant. It’s worth considering exchanges that are proactive and transparent on this front — namely, those that actively strive to obtain the required licenses and comply with regulations.

Risk tolerance: Trusting a third-party with your funds comes with an inherent risk that they could be lost. It’s impossible to engage with a custodial exchange fully trustlessly, though you should familiarize yourself with prospective platforms’ security commitments and the measures they take to reduce your risk. Look for exchanges that implement measures such as Proof-of-Reserves (POR) audits, SOC compliance, and 2FA. Consider their track record and any major security breaches they may have sustained historically.

Trade Now

Time after time, both new and seasoned futures traders turn to WEEX for its seamless trading experience, top-tier security, and diverse product lineup.

Join millions of users who trust WEEX to trade futures and stay ahead in the fast-evolving crypto market. Start now!

You may also like

Which 4 Chinese Meme Coins Are Tredning in January 2026?

Unlike previous cycles driven by Western internet culture, this surge is deeply rooted in Chinese slang, social satire, and high-context humor. Fueled by the low-fee BNB Chain ecosystem, viral narratives, and rapid speculative capital, several projects saw exponential growth in a remarkably short time.

What defined the top Chinese meme coin trend in January 2026 was not just price action, but the unprecedented speed at which these tokens achieved multi-million dollar market capitalizations without any traditional fundamentals. This article analyzes the four names that dominated the narrative: 我踏马来了, 人生K线 , 币安人生, and 哈基米.

Key TakeawaysThe Chinese meme coin market in January 2026 was dominated by tokens leveraging culturally familiar phrases and high-velocity trading on BNB Chain, rather than utility.Narrative strength and cultural resonance proved more critical for short-term momentum than technological innovation or roadmap promises.While generating exponential returns, these assets exhibited extreme volatility. Success required strict risk management due to their reliance on concentrated liquidity and shifting trader sentiment.Chinese Meme Coin Growth in Early 2026The explosive growth in January followed a distinct, observable pattern:

Narrative-First Adoption: Success was built on pre-existing, viral Chinese internet slang, which created instant community recognition and lowered adoption barriers.BNB Chain Efficiency: The low transaction fees and fast confirmations of BNB Chain made it the preferred launchpad, attracting a dense network of active meme coin traders.Speculative Capital Rotation: After periods of consolidation in major assets, speculative capital aggressively rotated into these high-beta, culturally-themed tokens trending on Chinese crypto social media.Sentiment-Driven Valuation: Prices were almost entirely dictated by social media momentum and chart patterns, with traditional fundamentals like whitepapers or utility playing a negligible role.This environment enabled multiple projects to rocket from obscurity to eight-figure market caps within mere days.

Which Chinese Meme Coins are Trending in January 2026?Amidst numerous launches, four tokens distinguished themselves through market cap growth, trading volume, and viral narrative strength.

我踏马来了我踏马来了 became one of the fastest-rising assets of early 2026, surging into a $30–40 million market cap range with sharp volatility. Its growth was fueled by its aggressive, confident phrase which traders adopted as a hype slogan, combined with high on-chain visibility from large wallet movements that drew further attention.

Read More: What Is 我踏马来了? A New Horse Themed Meme Coin

人生K线Briefly approaching a $40+ million market cap, this 人生K线's power lay in its deeply relatable metaphor for traders, comparing life's ups and downs to a candlestick chart. Its chart-centric community fostered intense engagement through shared analysis and parabolic screenshot culture, creating a self-reinforcing momentum loop.

币安人生 (BIANRENSHENG)Reaching a peak market cap of approximately $150 million, 币安人生 was a dominant force in the sector. It benefited from implicit brand association with the leading exchange, which granted it perceived legitimacy and attracted larger traders viewing it as a more stable meme coin exposure compared to micro-cap alternatives.

Read More: What Is 币安人生 (BIANRENSHENG) and How Does It Work?

哈基米 (HAJIMI)Climbing to a $35–37 million market cap, 哈基米(HAJIMI) stood out due to its high meme adaptability. The playful, phonetically fun name was easily remixed into endless social media content, sustaining community engagement and driving consistent trading volume across multiple platforms.

Read More: What is Hajimi (哈基米)?

ConclusionThe January 2026 surge in Chinese meme coins signifies a maturation of meme-driven markets. These assets have evolved into culturally encoded financial instruments, capable of mobilizing significant liquidity through shared language and collective emotion.

The performance of 我踏马来了, 人生K线 , 币安人生, and 哈基米 cements top Chinese meme coins as a distinct and influential segment within the global crypto ecosystem. For participants, understanding the cultural context is now as essential as technical analysis. However, this exponential growth is a double-edged sword; the same velocity that creates immense opportunity also dictates the speed at which trends can reverse, demanding caution and respect for the market's rhythm.

Still wondering where to buy these trending meme coins? Look no further than WEEX. Register now to start trading instantly. Enjoy 0 trading fees and a smooth, seamless trading experience.

Further ReadingIs Dogecoin(DOGE) a Good Investment in 2026? Everything You Should KnowDogecoin(DOGE) Price Prediction: What's Next for Dogecoin(DOGE)?What Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Futures Trading in Crypto: A Beginner’s Guide in 2026

Crypto futures trading has evolved into one of the most dominant ways to engage with digital asset markets, enabling speculation without direct ownership of the underlying coins. By 2026, this domain is no longer exclusive to professionals, thanks to platforms that have democratized access through intuitive tools, deep liquidity, and diverse contract options.

This guide explains the mechanics of crypto futures trading, outlines essential knowledge for beginners, and explores why WEEX exchange has become the go-to choice for traders in the current landscape.

Key TakeawaysCrypto futures contracts allow traders to speculate on price movements in both directions (long and short) using leverage.This form of derivatives trading carries significantly higher risk than spot trading, making strict risk management non-negotiable.Leading platforms distinguish themselves with beginner-friendly interfaces, multiple contract types, and competitive liquidity to ensure efficient trade execution.What Is Crypto Futures Trading?Futures trading is a type of derivatives trading where participants agree to buy or sell an asset at a predetermined future price and date. In crypto, traders speculate on the future price of assets like Bitcoin or Ethereum without holding them.

Key advantages over spot trading include:

The ability to profit from both rising (long positions) and falling (short positions) markets.The use of financial leverage to control large positions with a smaller capital outlay.In 2026, perpetual futures contracts—which have no expiry date and use a funding rate mechanism to track spot prices—are the industry standard for retail traders.Read More: User Guide: What Are Perpetual Futures Contracts?

How Crypto Futures Trading Work?Trading futures requires an understanding of core mechanics. Traders open positions by depositing initial margin, which acts as collateral, not the full trade value.

Essential concepts include:

Leverage: A multiplier that increases both potential profits and losses (e.g., 10x leverage means a $100 margin controls a $1,000 position).Margin Requirements: Maintenance margin levels determine when a liquidation occurs if the trade moves against you.Funding Rates: Periodic payments exchanged between long and short traders to keep the perpetual contract price aligned with the spot market.Mastering these mechanics is fundamental before engaging in futures markets.

Why Crypto Futures Trading Is Popular in 2026?The growth of crypto futures is driven by market evolution and trader demand. Primary factors include:

Market Volatility: Creates frequent, high-potential trading opportunities.Hedging Capability: Allows spot portfolio holders to protect against downside risk.Capital Efficiency: Leverage enables greater market exposure with less capital.Short-Selling Access: Provides an easy way to profit from market declines without borrowing assets.In bearish or ranging markets, futures often present more viable strategies than spot trading alone.

WEEX Guide: Risk Management for BeginnersEffective risk management is the most critical skill in futures trading. Foundational principles include:

Using stop-loss orders on every position.Never risking a high percentage of total capital on a single trade.Avoiding over-leveraging.Maintaining emotional discipline during volatility.Modern platforms provide essential tools like stop-loss, take-profit orders, and real-time margin calculators to help implement these strategies.

WEEX Guide: Common Mistakes Beginners MakeNew traders often fall into predictable traps. Frequent errors include:

Overusing Leverage: The fastest path to significant losses.Trading Without a Plan: Entering markets based on emotion or hype.Ignoring Funding Rates: Can erode profits on held positions.Revenge Trading: Trying to immediately recoup losses, often leading to worse outcomes.Platform tools aid monitoring, but personal discipline is the ultimate safeguard.

Why Choose WEEX Futures?WEEX Futures stands out in the competitive cryptocurrency landscape by delivering a professional-grade trading experience tailored for both novice and experienced traders. Our platform combines industry-leading security measures with exceptional liquidity depth, ensuring reliable order execution even during volatile market conditions.

Read Also: User Guide: How to Choose a Reliable Platform for Crypto Futures Trading?

How to Start Futures Trading on WEEX?Now that you understand the basics, let's walk through the process of trading Bitcoin futures on WEEX. If you've already followed our guide on how to create an account on WEEX and set up 2FA for added security, you’re well-prepared to start futures trading.

Step 1: Log into Your WEEX AccountIf you don’t already have an account, follow our step-by-step guide on creating an account on WEEX. Once you’re logged in, navigate to the Futures Trading section from your dashboard.

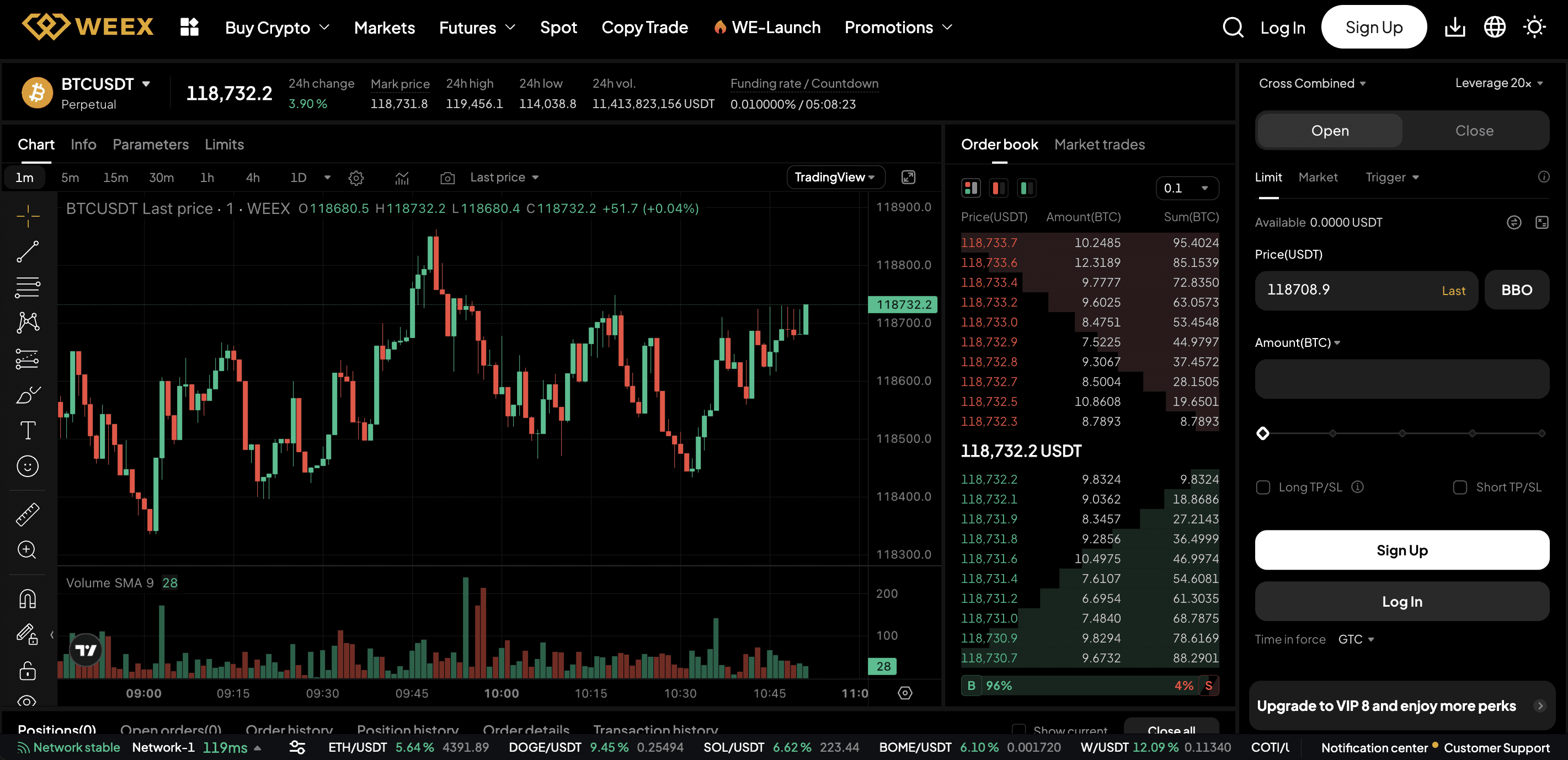

Step 2: Familiarize Yourself with the Futures Market InterfaceWhen you enter the futures trading section, you'll notice a more advanced interface compared to spot trading. Key features of the interface include:

Order Book : Displays all open buy and sell orders for the selected futures contract.Position Information: Shows the details of your open futures positions, including leverage, margin, and unrealized profit/loss.Trading Pair: Select the crypto futures pair you want to trade (e.g., BTC/USDT).Charts & Data: Real-time price charts and indicators to help you analyze the market and make informed trading decisions.Step 3: Make Your First TradeSelect the BTC/USDT Futures to trade at the top left side of the page.

Use the [Price Chart] to identify potential trading setups based on patterns or any other technical indicator available on WEEX Futures.

Select the [Margin Mode], which will only apply to the selected Futures Contract, then choose between [Cross] and [Isolated] and click [Confirm].

Now, you need to [Adjust Leverage] and click [Confirm]. Please note that using high leverage carries high risks and shouldn’t be done without a robust risk management strategy.

Pro Tip: When trading with leverage, be aware of the liquidation risk. If the market moves against you too far, your position may be liquidated, meaning you lose your initial investment.

Select [Type of Order] - [Price] - [Size], toggle the [TP/SL] feature to set up your [Take Profit] and [Stop Loss] orders, and choose between a [Open/Long] or [Open/Short] position.

Is Futures Trading Suitable for Everyone?No, futures trading is not for all investors. It is a high-risk activity suited for:

Active, disciplined traders who can adhere to a plan.Those seeking to hedge existing spot portfolios.Individuals thoroughly comfortable with the mechanics of leverage and margin.It is generally not suitable for passive, long-term investors or those with a low risk tolerance.

ConclusionCrypto futures trading is an integral, powerful component of the digital asset ecosystem in 2026. It offers unparalleled flexibility but demands respect, education, and ironclad risk management.

By providing accessible tools within a secure and liquid environment, WEEX exchange has lowered the barrier to entry. For traders committed to continuous learning and disciplined strategy execution, futures markets offer a dynamic arena for engagement, provided one navigates them with caution and clarity.

Ready to start your futures trading journey? Register on WEEX now and begin trading instantly. Experience a powerful, secure, and user-friendly platform designed for your success.

What Is Brevis (BREV) and How Does It Work?

When building decentralized applications (DApps), developers face two primary constraints: smart contracts cannot natively access historical blockchain data or information from external blockchains without introducing trusted oracles. Furthermore, executing complex computational tasks directly on mainnets like Ethereum is prohibitively expensive.

Brevis directly addresses these limitations of scalability and interoperability by introducing a Zero-Knowledge (ZK) Coprocessor. Functioning like a GPU for a blockchain, Brevis operates as a co-processor, handling intensive data computation off-chain. This enables developers to create powerful, data-driven DApps that can securely utilize any on-chain data across multiple blockchains, all without adding new trust assumptions to their applications.

What Is Brevis (BREV)?Brevis (BREV) is the native utility and governance asset of the Brevis network, designed to align incentives among all ecosystem participants.

Token Utility:

Proof Fees: Developers pay fees in BREV to request and verify proofs within the ProverNet system.Staking and Security: Network provers are required to stake BREV tokens as collateral. Malicious behavior or service failure can result in slashing, securing network integrity.Governance: Brevis (BREV) holders can participate in protocol governance, influencing parameters and future development.Future Gas Token: Upon migration to its dedicated rollup, BREV is slated to become the native gas token for the Brevis network.Brevis (BREV) TokenomicsBrevis has a fixed total supply of 1,000,000,000 (1 billion) Brevis (BREV). The allocation strategy prioritizes long-term ecosystem growth and community engagement.

Token Allocation:

Ecosystem Growth: 37%Community Incentives: 32.20%Team: 20%Seed Investors: 10.80%How Does Brevis Work?Brevis fundamentally separates computation from verification. It offloads heavy data-processing workloads from the main blockchain to its specialized environment. After processing, it returns a succinct cryptographic proof that verifiably attests to the correctness of the result, which the main chain can efficiently validate.

The ZK Coprocessor ModelWithin this model, a smart contract on a main chain (such as Ethereum) submits a request for a specific computation or data query. Brevis's off-chain system processes this request and generates a Zero-Knowledge Proof (ZKP). This proof is then submitted back to the requesting contract. The contract can cryptographically verify the proof's validity in a fraction of the time and cost it would take to re-execute the computation, ensuring trustless correctness.

ProverNetThe operational core of Brevis is ProverNet, a decentralized network of participants who compete to generate proofs for computation requests. This marketplace ensures that proof generation remains decentralized, secure, and cost-efficient. Initially deployed on the Base blockchain, the architecture is designed for a future migration to a dedicated Brevis rollup, further optimizing performance and sovereignty.

Key Features of BrevisBrevis enhances Web3 development through several key architectural innovations:

Omnichain Data Access: DApps can seamlessly query and utilize verified on-chain data from any supported blockchain. This unlocks novel use cases like cross-chain reputation systems, historical financial analysis, and sophisticated multi-chain DeFi strategies.Trust-Free Verification: By relying on mathematically verifiable ZK proofs, Brevis removes the need to trust any intermediary. The destination blockchain cryptographically verifies the proof's integrity, not the prover's reputation.High-Performance zkVM: The platform utilizes the Pico zkVM, engineered for high-speed proof generation. This efficiency is critical for supporting real-time DApps that require low-latency data processing.ConclusionBrevis represents a pivotal advancement in modular blockchain infrastructure. By providing a ZK-powered coprocessor, it liberates smart contracts from their inherent data and computation limits. Developers gain the ability to build more intelligent, interconnected, and powerful DApps that can leverage the full breadth of blockchain data, all while maintaining the core tenets of security and decentralization.

Ready to trade Brevis (BREV) and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingWhat is Snowball (SNOWBALL)?Why POPCAT Crashes? A Complete ExplanationWhat Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Which Crypto Exchanges Has the Best Customer Service in 2026?

When selecting a crypto exchange, customer support should be a primary consideration, not an afterthought. Reliable support is crucial for resolving urgent issues. Consider these essential criteria:

24/7 Availability: Since crypto markets never sleep, 24/7 human support is essential for handling urgent problems like failed withdrawals or security alerts at any hour.Support Channels: The best platforms provide multiple avenues, including live chat (the fastest option), email/ticket systems, and, in select cases, phone support.Response Speed and Resolution Quality: Quick automated replies are one thing, but the real test is how swiftly and effectively a knowledgeable human agent can resolve your issue.Language and Regional Coverage: Multilingual support from regionally distributed teams ensures clear communication and timely help for a global user base.User Reputation: Consistent positive feedback in user reviews and third-party evaluations offers real-world insight into an exchange's support performance.Which Crypto Exchanges Has the Best Customer Service in 2026?In the fast-paced world of cryptocurrency, where markets never close and security is paramount, reliable customer support is no longer a luxury—it's a necessity. For traders and investors, the ability to get timely, effective help during a volatile market move or a withdrawal issue can be the difference between securing a profit and sustaining a loss. As we move into 2026, the leading exchanges have refined their support models, but their approaches and effectiveness vary significantly. The following platforms stand out for their commitment to user assistance, each offering a unique blend of technology, accessibility, and human expertise to serve their global communities.

WEEXCustomer Service Highlights:

24/7 AvaliableMultilingual supportRapid escalationWEEX offers comprehensive 24/7 customer support through live chat and a dedicated ticket system, ensuring users can access assistance at any time. The platform is designed with a strong emphasis on being user-friendly, featuring an intuitive help center and clear guidance for common issues.

Support is provided in multiple languages, catering to a diverse global user base and facilitating clear communication. While initial inquiries may be routed through efficient automated responses for speed, the system is structured for quick escalation to human agents to resolve more complex or urgent matters, particularly those related to account security, withdrawals, or trading execution.

Read More: Where to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026?

BitgetCustomer Service Highlights:

24/7 live chatMultilingual support.Bitget is the benchmark for customer support in 2026. It has built its entire support model around a simple, user-centric principle: you should always be able to reach a real human agent when you need help. This focus on fast human escalation drastically cuts down resolution times for critical issues, whether related to account access, withdrawals, or trading during market volatility.

BybitCustomer Service Highlights:

24/7 AvalibaleMultilingual assistance.Bybit, a major global exchange, offers 24/7 customer support primarily through live chat and email tickets. Its system typically uses automated tools for initial contact before escalating to human agents. The support is effective for routine account and trading inquiries and is available in multiple languages to serve its international user base.

BinanceCustomer Service Highlights:

24/7 AvaliableExtensive multilingual coverage.As the world's largest exchange, Binance provides 24/7 support via live chat and a ticket system. Reflecting its vast global reach, it offers assistance in a wide array of languages. While generally accessible and comprehensive, response times and resolution depth can vary based on issue complexity and overall platform demand, with initial interactions often handled by automated systems.

CoinbaseCustomer Service Highlights:

24/7 AvaliableMulti-channel assistanceThe U.S.-based Coinbase emphasizes regulatory compliance and user security. Its 24/7 customer support includes live chat, email, and—a key differentiator—phone support in select regions. The process typically starts with automation before moving to human agents. This structured, multi-channel approach is highly valued by users who prefer direct communication options.

Which Crypto Exchange Has the Fastest Response Times for Customer Service?Response time is a critical metric for support quality, especially during emergencies or high volatility. Simply offering 24/7 support isn't enough; what matters is how quickly you connect with a person who can help.

Among top exchanges, WEEX consistently provides the fastest access to human agents, with live chat responses often in minutes.

ConclusionIn the maturing crypto market of 2026, customer support has become a decisive competitive edge. While most major exchanges now offer 24/7 assistance, their effectiveness in terms of response speed, human agent access, and global consistency differs significantly.

Among all of the best crypto exchanges, WEEX distinguishes itself by combining the fastest human response times with truly integrated support across its expansive crypto. For investors who prioritize reliability, accessibility, and comprehensive service, WEEX represents the strongest overall choice for customer support in 2026.

Ready to join the crypto world? Register now on WEEX and start trading seamlessly. Enjoy zero trading fees and experience a platform built for your success.

Further ReadingBest Crypto Exchange in 2026: What to Know Before You TradeWhich Crypto Will Go 1000x in 2026?Which 2 Cryptocurrencies Will Hit $100 Billion Market Cap in Q1 2026?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What Is 我踏马来了? A New Horse Themed Meme Coin

我踏马来了 has emerged as a notable horse-themed meme coin within the vibrant and often unpredictable meme asset market. Moving beyond pure humor, this project taps into deep-seated cultural symbolism, presenting it through a dynamic, animated format that resonates with modern internet communities.

This article explores what 我踏马来了 represents, analyzes the enduring appeal of animal-themed meme coins, and discusses how traders can engage with such tokens.

Key Takeaways我踏马来了 is built upon traditional Chinese horse symbolism, reimagined in an animated, meme-friendly style.Animal-themed meme coins maintain popularity due to strong precedents like Dogecoin and Shiba Inu, offering simple, globally recognizable branding.Traders should prioritize platforms with robust security, clear tools, and reliable liquidity when engaging with highly volatile emerging assets.What is 我踏马来了?我踏马来了 is a meme coin centered on the image of a horse, drawing from rich cultural meanings that extend far beyond its visual design. In Chinese art and tradition, horses symbolize power, vitality, success, and perseverance. These themes are historically linked to imperial authority, military strength, and relentless forward progress. Over time, this symbolism has expanded into concepts of good fortune and continuous advancement.

The project translates these traditional associations into a contemporary animated form. Instead of a static image, the horse is presented as dynamic and expressive, making the cultural symbol more accessible and engaging for online communities. This allows 我踏马来了 to maintain narrative depth while fitting seamlessly into meme-driven crypto culture.

Official Contract Address: 0xc51A9250795c0186a6FB4A7D20A90330651e4444Traders must always verify this address directly through the project's official channels before any transaction to avoid counterfeit assets and scams.Why Do Animal-Themed Meme Coins Remain Popular?Animal-themed meme coins continue to capture significant attention in the crypto space for several key reasons:

Simplicity and Recognition: Animals are universally recognizable symbols that transcend language and cultural barriers. Projects like Dogecoin and Shiba Inu established that a familiar, friendly animal can become a powerful and enduring brand identity.Community and Emotion: These tokens facilitate community building around a shared, emotionally engaging mascot. Participation is driven more by shared identity and collective narrative than by complex technical fundamentals.Distinct Branding: 我踏马来了 utilizes the horse, which carries connotations of strength, endurance, and momentum—a different emotional profile compared to dog-based tokens focused on humor and loyalty. This allows it to carve out a unique niche within the broader meme coin ecosystem.However, this popularity does not eliminate risk. Meme coins are notoriously volatile, and their value is heavily influenced by social media trends and community sentiment. Understanding their appeal is crucial, but it must be paired with acute risk awareness.

How Can 我踏马来了 Be Traded?Engaging with tokens like 我踏马来了 requires access to exchanges that list them. When choosing a platform, traders should prioritize several factors to navigate the inherent volatility safely:

Security and Reputation: Opt for established exchanges with a strong track record of security, transparency, and regulatory compliance.Liquidity and Execution: Sufficient trading volume is crucial for minimizing slippage and ensuring orders are filled at expected prices, especially for volatile assets.Risk Management Tools: Platforms offering integrated features like stop-loss orders are vital for traders to manage downside risk proactively.User Experience: A clear and intuitive trading interface helps traders execute strategies efficiently and monitor positions effectively.Always conduct thorough due diligence (DYOR) on both the token and the exchange. Verify contract addresses, research the team and community, and never invest more than you can afford to lose.

Conclusion我踏马来了 represents a fusion of traditional cultural symbolism with the mechanics of modern meme coin culture. While the enduring appeal of animal-themed tokens provides a recognizable framework for community engagement, they remain high-risk, speculative assets.

Success in this space requires more than catching a trend; it demands realistic expectations, disciplined risk management, and careful platform selection. Traders should focus on securing their assets on reputable platforms and making informed decisions based on both market sentiment and fundamental security practices.

Ready to trade 我踏马来了 and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

FAQQ1: What is 我踏马来了?A: 我踏马来了 is a horse themed meme coin inspired by traditional Chinese symbolism and presented in an animated digital format.

Q2: Why is the horse used as the main theme?A: In Chinese culture, horses symbolise strength, progress, perseverance, prosperity, and career advancement.

Q3: Where can I Buy 我踏马来了?A: The token can be accessed on WEEX Exchange.

WEEX Trade to Earn Phase 2: Trading Discipline and Risk Management in Uncertain Crypto Futures Markets

As 2026 begins, many traders are facing a familiar frustration: the market keeps moving, but clarity doesn’t. Short, volatile swings in Bitcoin and Ethereum put pressure even on experienced traders, often leading to hesitation, overtrading, or reactive decisions that undermine longer-term strategy.

In this environment, the real challenge isn’t just predicting market direction — it’s managing one’s own reactions. Emotional responses can magnify minor price movements, especially in leveraged futures trading. Consistency, however, is often overlooked.

This is where structured reinforcement becomes relevant. Initiatives such as WEEX Trade to Earn emphasize consistent participation, encouraging discipline without influencing individual trading decisions.

From Emotional Reaction to Risk ManagementWhen markets lack clear direction, emotional reactions often step in. Left unchecked, they tend to influence execution rather than strategy, adding unnecessary friction in volatile conditions.

This is where risk management becomes essential — not as theory, but as a practical framework for maintaining consistency in uncertain markets. In crypto, volatility is inevitable, but disciplined risk management helps reduce emotional errors and support more stable execution over time.

Core principles include:

Setting realistic position sizes and stop-loss levelsDiversifying exposure across multiple assetsAvoiding impulsive trades driven by short-term price swingsA structured approach does not eliminate volatility, but it helps traders navigate it with greater discipline and consistency. How does this translate into real trading behavior during volatile moments?

Staying Calm in Volatile Markets: Real ScenariosConsider a day when Bitcoin moves 3% within an hour. Traders reacting emotionally may exit positions too early or enter impulsively. If you’ve ever closed a trade, only to watch price move exactly as planned, this scenario likely feels familiar. Traders who stick to their plan, however, maintain execution discipline and avoid unnecessary losses.

In this context, programs that offer incremental recognition for consistent execution can serve as a subtle psychological buffer. By reinforcing measured decision-making, they support disciplined behavior without interfering with the underlying strategy.

This approach is particularly valuable for moderate leverage users or those exploring algorithmic strategies, where structured reinforcement helps reduce stress and maintain rational execution during short-term swings.

A Subtle Advantage: Trade to Earn Phase 2Structured reinforcement can play a meaningful role in helping traders maintain discipline during volatile periods. By offering small, visible incentives tied to consistent execution, such mechanisms encourage steadier behavior and reduce the tendency to react impulsively to short-term market fluctuations.

One example of this approach is WEEX Trade to Earn Phase 2. The program does not alter trading strategies or risk exposure, but provides tiered recognition in WXT tokens for consistent futures participation — reinforcing disciplined execution without interfering with decision-making.

The value lies not in the reward itself, but in its psychological effect: supporting composure, confidence, and adherence to a well-defined trading plan during periods of market uncertainty.

Key Takeaways for Rational TradingTo navigate early 2026 markets more effectively:

Treat price swings as signals, not threatsAdhere to pre-defined risk limits and execution rulesSupport consistent execution through structured, participation-based mechanismsPrioritize long-term consistency over avoiding every short-term lossThese principles are increasingly reflected in exchange-level mechanisms that emphasize consistency and disciplined participation, rather than short-term risk-taking.

By combining sound strategy with emotional control, traders can navigate volatile conditions with greater clarity, resilience, and execution quality over time.

Conclusion: Consistency Over ReactionIn range-bound markets, consistency depends less on prediction and more on execution quality. Effective risk control and emotional discipline are essential — particularly in leveraged futures trading.

Mechanisms like WEEX Trade to Earn Phase 2 reinforce disciplined participation through structured recognition, supporting composure without altering strategy or increasing risk.

Over time, progress comes not from trading more, but from executing calmly, minimizing emotional errors, and allowing consistency to compound.

About WEEXFounded in 2018, WEEX has grown into one of the world’s most trusted and innovative cryptocurrency exchanges, serving over 6.2 million users across 150+ countries and regions. With more than 2,000 trading pairs and up to 400× leverage, WEEX is known for its deep liquidity, smooth trading experience, and steadfast transparency. The platform’s 1,000 BTC Protection Fund reflects its unwavering commitment to user safety and reliability.

Beyond trading, WEEX continues to lead the frontier of intelligent finance — from launching the AI Trading Hackathon to fostering a global community of traders, builders, and innovators to shape the markets of tomorrow.

Risk & Disclaimer

-Futures trading involves risk. Please manage leverage and position sizes carefully.

-All rewards are subject to the official event rules and will be distributed after the event ends.

-This article is for educational and informational purposes only and does not constitute financial, investment, legal, tax, or other professional advice.

Follow WEEX on social media:X: @WEEX_Official

Instagram: @WEEX Exchange

TikTok: @weex_global

YouTube: @WEEX_Global

Discord: WEEX Community

Telegram: WeexGlobal Group

What is Bitcoin OTC and How to Buy BTC OTC With PKR on WEEX Exchange?

Bitcoin remains the cornerstone of the cryptocurrency market, prized by individual and institutional investors alike. For those looking to trade significant amounts of BTC with fiat currency, over-the-counter trading provides a powerful and efficient channel. This guide explains Bitcoin OTC crypto, details how an OTC desk works, and walks you through trading BTC with Pakistani Rupees (PKR) on the WEEX OTC platform.

What is the Bitcoin OTC Crypto?Bitcoin OTC (Over-The-Counter) trading is the direct, private purchase or sale of BTC between two parties, facilitated outside of public exchange order books. These transactions are typically arranged through specialized brokers or dedicated OTC desks that connect large buyers and sellers directly.

The primary appeal of Bitcoin OTC trading is its ability to execute large-volume orders without causing adverse market movement. On a standard exchange, a substantial BTC buy order can create price slippage, increasing the average cost as the order fills. OTC trading eliminates this risk by allowing parties to agree on a fixed price privately. This ensures price certainty, minimizes market impact, and offers a higher degree of privacy, making it the method of choice for institutions, high-net-worth individuals, and funds managing sizable Bitcoin portfolios.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, often referred to as an OTC desk, is a specialized platform that facilitates private, bilateral transactions. Unlike public spot markets where prices are set by a visible order book, an OTC desk provides clients with a firm, fixed quote for their specific trade size, which does not fluctuate during execution.

This model offers three key strategic benefits. First, it serves as the fastest fiat on-ramp, enabling rapid conversion of traditional bank capital into crypto to capitalize on immediate market opportunities. Second, it guarantees zero slippage; the final execution price is locked in at the quote, protecting large orders from intra-second volatility. Third, robust OTC platforms support multi-currency and multi-payment infrastructures, seamlessly bridging local banking systems—like Pakistan's—with global digital asset liquidity for smooth cross-border settlements.

What is WEEX OTC Crypto Trading Exchange?WEEX is a global cryptocurrency exchange that offers a dedicated, secure OTC trading desk as a core service. The WEEX OTC platform is engineered to provide a streamlined and confidential pathway for converting fiat currency into Bitcoin and other major cryptocurrencies.

Central to this service is the WEEX OTC Quick Buy feature, designed to make the purchase process exceptionally straightforward. The platform supports instant transactions, allowing users to acquire crypto from anywhere at any time in just a few clicks. It achieves reliable execution by aggregating deep liquidity and integrating a wide array of mainstream global and local payment methods, effectively bridging the gap between traditional finance and the digital asset ecosystem.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Bitcoin with PKR on WEEX OTC Crypto Exchange?Buy Bitcoin OTC with PKR on WEEX (Web)Step 1: Select [PKR] fiat currency and [BTC] crypto, then select the payment method.

Step 2: Input the PKR payment amount, then click [Buy BTC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Bitcoin OTC with PKR on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [PKR] fiat currency and [BTC] crypto.

Step 3: Input the PKR payment amount, then click [Buy BTC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC Bitcoin trading?OTC Bitcoin trading is the process of buying or selling BTC directly between two parties, facilitated by a broker or a dedicated desk, rather than on a public exchange order book. It is specifically designed for large transactions to ensure price stability, privacy, and to prevent moving the market price.

How does buying BTC OTC work?The process begins when a client contacts an OTC desk with their desired trade size. The desk provides a fixed quote based on current market liquidity. Once agreed upon, the desk facilitates the direct settlement between the buyer and seller off the public order book, ensuring the price is locked in and the trade is executed privately.

What is an OTC crypto exchange?An OTC crypto exchange is a specialized trading service that focuses on executing high-volume trades directly between counterparties away from public markets. It operates as a private desk, providing liquidity, personalized service, and firm price quotes for transactions that are too large for the public order books.

Is OTC crypto trading legal?Yes, OTC crypto trading is legal in most jurisdictions when conducted through reputable, regulated platforms that comply with local financial regulations. Exchanges like WEEX adhere to strict KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to ensure all operations are transparent and lawful.

Does WEEX charge fees for OTC trading?WEEX applies variable fees that depend on the specific trading pair and the payment method selected by the user. The platform's system is designed to automatically recommend the most cost-effective payment channel available. Notably, during special promotional events, OTC trading can often be conducted with zero fees (no fees).

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Ethereum OTC and How to Buy ETH OTC With PKR on WEEX Exchange?

Ethereum is the foundational platform for decentralized applications and smart contracts, making ETH a core holding for many investors. For those executing substantial trades, over-the-counter trading offers a strategic advantage. This guide explains Ethereum OTC crypto, how an OTC desk functions, and provides a clear walkthrough for trading ETH with Pakistani Rupees (PKR) on the WEEX OTC platform.

What is the Ethereum OTC Crypto?Ethereum OTC (Over-The-Counter) trading refers to the direct, off-exchange purchase or sale of ETH tokens between two parties. These transactions are privately negotiated and facilitated by specialized brokers or OTC desks, bypassing the public order books of traditional cryptocurrency exchanges.

The main draw of OTC trading for Ethereum is its efficiency in handling large-volume orders. On a standard exchange, a significant ETH trade can move the market price, leading to slippage and a higher average cost. The OTC model solves this by allowing parties to agree on a fixed price in advance. This guarantees price certainty, minimizes market impact, and provides a higher level of privacy, making it the preferred channel for institutions, venture capital funds, and large-scale traders managing substantial Ethereum positions.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange is a specialized service, often called an OTC desk, that arranges private cryptocurrency transactions. Unlike public spot markets, it does not use an open order book. Instead, it provides clients with a firm, non-fluctuating quote for their specific trade, which is locked in until execution.

This approach delivers three critical benefits for sophisticated market participants. First, it acts as an ultra-fast fiat gateway, enabling the quick conversion of traditional capital into crypto to act on time-sensitive opportunities. Second, it ensures zero slippage; the final execution price matches the quoted price exactly, protecting large capital allocations. Third, leading OTC desks feature multi-currency infrastructure, seamlessly connecting local banking systems like Pakistan's to the global digital asset market for efficient cross-border settlement.

What is WEEX OTC Crypto Trading Exchange?WEEX is a global cryptocurrency exchange that provides a dedicated and secure OTC trading desk. The WEEX OTC platform is designed to offer a streamlined, confidential path for converting fiat currency into Ethereum and other leading digital assets.

Central to its user-friendly design is the WEEX OTC Quick Buy feature, which simplifies the entire purchasing workflow. The platform facilitates instant transactions, allowing users to buy crypto anytime, anywhere in just a few steps. It achieves reliable and efficient service by aggregating deep liquidity and integrating a wide range of mainstream global and regional payment methods, effectively bridging traditional finance with the Web3 ecosystem.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Ethereum with PKR on WEEX OTC Crypto Exchange?Buy Ethereum OTC with PKR on WEEX (Web)Step 1: Select [PKR] fiat currency and [ETH] crypto, then select the payment method.

Step 2: Input the PKR payment amount, then click [Buy ETH] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Ethereum OTC with VND on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [PKR] fiat currency and [ETH] crypto.

Step 3: Input the PKR payment amount, then click [Buy ETH] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is Ethereum OTC?Ethereum OTC is the process of buying or selling ETH directly between two parties through a private broker or trading desk, rather than on a public exchange. It is tailored for large transactions to ensure price stability, avoid market impact, and maintain a higher degree of privacy for the participants.

How does the OTC process in crypto work?In the OTC process, a client contacts a desk with their trade requirements. The desk provides a fixed price quote based on current market conditions. Upon agreement, the desk facilitates the direct settlement between the buyer and seller off the public order book, ensuring the trade is executed at the pre-agreed price without slippage.

What is an OTC crypto desk?An OTC crypto desk is a specialized unit within a financial institution or exchange that handles large-volume cryptocurrency trades directly between counterparties. It operates privately to provide liquidity, negotiate custom terms, and ensure discreet and efficient execution of trades that would be disruptive on public markets.

Is OTC crypto legal?Yes, OTC crypto trading is legal in most countries when conducted through compliant and regulated platforms. Reputable exchanges like WEEX operate within legal frameworks, implementing necessary KYC (Know Your Customer) and AML (Anti-Money Laundering) checks to ensure transparency and regulatory adherence.

Does WEEX charge fees for OTC trading?WEEX applies variable fees that depend on the specific trading pair and the chosen payment method. The platform's system is designed to automatically suggest the most advantageous payment channel for the user. Importantly, during special promotional campaigns, OTC trading can often be conducted with zero手续费 (no fees).

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Dogecoin OTC and How to Buy DOGE OTC With PKR on WEEX Exchange?

Dogecoin, the popular meme-inspired cryptocurrency, has grown into a widely traded digital asset with a vibrant community. For traders and investors looking to execute large DOGE transactions efficiently, over-the-counter trading offers a strategic path. This guide explains Dogecoin OTC crypto, details how an OTC exchange functions, and provides a clear walkthrough for trading DOGE with Pakistani Rupees (PKR) on the WEEX OTC platform.

What is the Dogecoin OTC Crypto?Dogecoin OTC (Over-The-Counter) trading involves the direct, private purchase or sale of DOGE tokens between two parties, outside of public exchange order books. These transactions are facilitated by specialized brokers or OTC desks, which connect buyers and sellers for direct negotiation and settlement.

The primary benefit of OTC trading for Dogecoin is executing substantial orders without causing market slippage. On a public exchange, a large DOGE buy or sell order can move the price adversely before the trade completes. OTC trading solves this by allowing parties to agree on a fixed price in advance. This guarantees price certainty, minimizes market impact, and offers greater privacy, making it ideal for influencers, community funds, or any trader moving a significant volume of DOGE tokens.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange is a specialized platform, often called an OTC desk, that arranges private cryptocurrency transactions. It operates differently from standard spot markets by providing clients with a firm, fixed quote for their trade. This price is locked in and does not fluctuate during the settlement process, unlike prices on a public order book.

This model delivers three key advantages for traders. First, it serves as an ultra-efficient fiat gateway, enabling rapid conversion of traditional bank funds into crypto to capitalize on timely market movements. Second, it ensures zero price "/wiki/article/slippage-243">slippage; the final execution price is exactly the quoted price, protecting the value of large orders. Third, top-tier OTC platforms support multi-currency infrastructure, seamlessly connecting local banking systems like Pakistan's to global digital asset liquidity for smooth cross-border capital flow.

What is WEEX OTC Crypto Trading Exchange?WEEX is a global cryptocurrency exchange that features a dedicated and secure OTC trading desk. The WEEX OTC platform is designed to provide a streamlined, confidential service for converting fiat currency into Dogecoin and other major cryptocurrencies.

A core feature designed for user convenience is the WEEX OTC Quick Buy service, which simplifies the purchase process into just a few clicks. The platform supports instant transactions, allowing users to buy crypto anytime and from anywhere. It achieves reliable execution by aggregating deep liquidity pools and integrating a wide array of mainstream global and local payment methods, creating a dependable bridge between traditional finance and the dynamic crypto market.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Dogecoin with INR on WEEX OTC Crypto Exchange?Buy Dogecoin OTC with PKR on WEEX (Web)Step 1: Select [PKR] fiat currency and [DOGE] crypto, then select the payment method.

Step 2: Input the PKR payment amount, then click [Buy DOGE] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Dogecoin OTC with PKR on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [PKR] fiat currency and [DOGE] crypto.

Step 3: Input the PKR payment amount, then click [Buy DOGE] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC Bitcoin trading?OTC Bitcoin trading is the process of buying or selling BTC directly between two parties through a private broker or desk, rather than on a public exchange. It is used for large transactions to ensure a fixed price, avoid moving the market, and maintain a higher level of privacy for the participants involved.

How to buy BTC on OTC?To buy BTC OTC, you typically engage with a reputable OTC desk via an exchange platform. You specify the amount of Bitcoin you want, receive a firm price quote, and upon agreement, the desk matches you with a seller and facilitates the secure, off-exchange settlement of the trade.

What is the OTC trading platform?An OTC trading platform is a specialized service offered by financial institutions or crypto exchanges that facilitates large, private trades directly between buyers and sellers. It provides a venue for obtaining fixed price quotes, negotiating terms, and ensuring secure settlement outside of public order books.

Is Bitcoin traded in OTC?Yes, Bitcoin is extensively traded in OTC markets. A significant volume of large-scale BTC transactions, especially by institutional investors, miners, and high-net-worth individuals, are conducted through OTC desks to avoid market impact and ensure price stability for bulk orders.

Does WEEX charge fees for OTC trading?WEEX applies variable fees based on the specific trading pair and the payment method selected by the user. The platform's system is designed to automatically suggest the most cost-effective payment channel available. During special promotional campaigns, OTC trading can often be conducted with zero fees (no fees).

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Bitcoin OTC Crypto Trading and How to Trade BTC OTC with JPY on WEEX Exchange?

Bitcoin remains the most influential cryptocurrency, widely used as a store of value and a global settlement asset. As BTC trading volumes grow, many investors seek more stable and private ways to buy or sell Bitcoin using fiat currencies like JPY. Bitcoin OTC crypto trading provides a solution designed for price certainty and discretion. This article explains what Bitcoin OTC crypto trading is, how crypto OTC trading exchanges work, why WEEX Exchange is suitable for BTC OTC trading, and how to trade BTC with JPY step by step on WEEX.

What is the Bitcoin OTC Crypto?Bitcoin OTC crypto refers to over-the-counter trading of Bitcoin, where BTC is traded directly between parties outside public exchange order books. Crypto OTC trading is typically facilitated by brokers, OTC desks, or trusted platforms instead of open market matching.

As explained in educational resources such as MoonPay’s guide on what is crypto OTC trading, this model allows buyers and sellers to negotiate prices in advance. This reduces the risk of slippage and avoids sharp price movements caused by large orders on centralized exchanges. For Bitcoin, which often attracts institutional and high-net-worth traders, OTC trading provides a controlled environment with predictable execution and enhanced privacy.

What is Crypto OTC Trading Exchange?A crypto OTC trading exchange is designed to execute trades privately at fixed prices. In traditional spot markets, large orders can move prices and result in unfavorable average execution. An OTC crypto exchange eliminates this issue by offering confirmed quotes before settlement.

Crypto OTC trading exchanges also serve as efficient fiat gateways. They allow users to move capital quickly between bank accounts and the blockchain ecosystem. With multi-currency support, OTC desks connect local banking systems with global crypto liquidity. For BTC traders, this means faster execution, stable pricing, and reduced exposure to market volatility during large or strategic trades.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange has launched its OTC Quick Buy service to simplify fiat-to-crypto trading for global users. The WEEX OTC platform supports more than 200 trading pairs and multiple mainstream payment methods, making Bitcoin OTC trading accessible at any time.

Through the WEEX OTC Quick Buy feature, users can complete BTC OTC trades in just three steps, from selecting fiat and crypto to payment and settlement. The platform is designed to balance security, speed, and ease of use. For users looking to trade Bitcoin OTC with JPY, WEEX provides a streamlined and reliable crypto OTC trading platform.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Bitcoin with JPY on WEEX OTC Crypto Exchange?Trading Bitcoin OTC with JPY on WEEX is designed to be simple and fast, whether on web or mobile.

Buy Bitcoin OTC with JPY on WEEX (Web)Step 1: Select [JPY] fiat currency and [BTC] crypto, then select the payment method.

Step 2: Input the JPY payment amount, then click [Buy BTC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Bitcoin OTC with JPY on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [JPY] fiat currency and [BTC] crypto.

Step 3: Input the JPY payment amount, then click [Buy BTC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Bitcoin OTC Crypto TradingHow does buying BTC OTC crypto work?BTC OTC trading works by agreeing on a fixed quote before execution. This process reduces slippage and helps maintain price stability for larger trades.

What is an OTC crypto exchange?An OTC crypto exchange facilitates direct trades between counterparties outside public markets. It focuses on privacy, stable pricing, and efficient settlement.

Is OTC crypto trading legal?OTC crypto trading is legal in most regions when conducted in compliance with local regulations. Reputable platforms follow AML standards and risk controls.

Does WEEX Exchange charge fees for OTC trading?WEEX Exchange charges fees based on trading pairs and payment methods. During certain promotional periods, BTC OTC trading may be offered with zero fees.

Is KYC required for Bitcoin OTC trading on WEEX?For non-CNY fiat deposits, WEEX does not require KYC verification. This allows global users to access Bitcoin OTC trading with fewer onboarding steps.

By combining Bitcoin OTC crypto trading with a streamlined fiat gateway, WEEX Exchange offers an efficient way to trade BTC with JPY while maintaining price certainty, speed, and operational simplicity.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Ethereum OTC Crypto Trading and How to Trade ETH OTC with JPY on WEEX Exchange?

Ethereum is the backbone of smart contracts, DeFi, and NFTs, making ETH one of the most actively traded digital assets in the world. As trading volumes grow, many investors look for more stable and private ways to buy or sell ETH using fiat currencies like JPY. Ethereum OTC crypto trading offers exactly that. This article explains what Ethereum OTC crypto trading is, how a crypto OTC trading exchange works, why WEEX Exchange is a suitable choice, and how to trade ETH with JPY step by step on WEEX using both web and app.

What is the Ethereum OTC Crypto?Ethereum OTC crypto refers to over-the-counter trading of ETH, where Ethereum is traded directly between counterparties outside public exchange order books. Crypto OTC trading involves private transactions facilitated by OTC desks, brokers, or trusted platforms rather than open market matching.

According to educational resources such as MoonPay’s explanation of what is crypto OTC trading, this model allows buyers and sellers to agree on prices in advance. This helps reduce price slippage and avoids sudden volatility caused by large orders on centralized exchanges. For Ethereum, which often sees high-volume trades due to DeFi and institutional demand, OTC trading provides a controlled environment with predictable execution and greater privacy.

What is Crypto OTC Trading Exchange?A crypto OTC trading exchange is designed to execute large or strategic trades at fixed prices without exposing them to public markets. In standard spot trading, large orders can move prices and lead to unfavorable execution. An OTC crypto exchange removes this risk by offering confirmed quotes before settlement.

Crypto OTC trading exchanges also act as efficient fiat gateways. They allow users to convert fiat currencies into crypto, or vice versa, quickly and securely. With support for multiple local currencies, OTC desks bridge traditional banking systems and the Web3 ecosystem. For ETH traders, this means stable pricing, faster execution, and easier access to global liquidity without relying on volatile order books.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange has officially launched its OTC Quick Buy service to make fiat deposits and crypto purchases more convenient. The WEEX OTC platform supports over 200 trading pairs and integrates multiple mainstream payment methods, enabling users to buy cryptocurrencies anytime.

Through the WEEX OTC Quick Buy feature, users can complete an ETH OTC trade in just three steps, from selecting fiat and crypto to payment and settlement. The platform is designed for simplicity, security, and speed, making it suitable for both beginners and experienced traders. For those looking to trade Ethereum OTC with JPY, WEEX offers a streamlined and accessible crypto OTC trading platform.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Ethereum with JPY on WEEX OTC Crypto Exchange?Trading Ethereum OTC with JPY on WEEX is designed to be simple and fast across both web and mobile platforms.

Buy Ethereum OTC with JPY on WEEX (Web)Step 1: Select [JPY] fiat currency and [ETH] crypto, then select the payment method.

Step 2: Input the JPY payment amount, then click [Buy ETH] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Ethereum OTC with JPY on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [JPY] fiat currency and [ETH] crypto.

Step 3: Input the JPY payment amount, then click [Buy ETH] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Ethereum OTC Crypto TradingHow does buying ETH OTC crypto work?ETH OTC trading works through fixed-price quotes agreed upon before execution. This approach minimizes slippage and ensures predictable pricing for larger or strategic trades.

What is an OTC crypto exchange?An OTC crypto exchange facilitates direct trades between buyers and sellers outside public order books. It focuses on privacy, price stability, and efficient settlement.

Is OTC crypto trading legal?OTC crypto trading is legal in most regions when conducted in compliance with local regulations. Reputable platforms follow AML and risk control standards to ensure secure operations.

Does WEEX Exchange charge fees for OTC trading?WEEX Exchange applies fees based on the trading pair and payment method. During promotional events, OTC trading may be offered with zero fees.

Is KYC required for Ethereum OTC trading on WEEX?For non-CNY fiat deposits, WEEX does not require KYC verification. This allows global users to access ETH OTC trading with fewer onboarding steps.

By combining Ethereum OTC crypto trading with a streamlined fiat gateway, WEEX Exchange offers a practical and efficient way to trade ETH with JPY while maintaining price certainty, speed, and ease of use.

Follow WEEX on social media: