Tariff Clouds Part, Is the Bull Market's Bugle Call Sounding Again?

Original Article Title: "Tariff Cloud Temporarily Lifted, Is the Bull Market Coming Back?"

Original Article Author: Azuma, Odaily Planet Daily

With new progress in the tariff negotiations between China and the United States, the crypto market sentiment is quickly heating up.

From last night to this morning, the market once again saw a significant surge. According to the OKX market data on Odaily, as of 9:30 AM, BTC broke through 115,000 USDT, reaching a high of 115,590 USDT, with a 24-hour gain of 3.02%; ETH approached 4,200 USDT, reaching a high of 4,194.84 USDT, with a 24-hour gain of 5.88%; SOL reclaimed the $200 mark, reaching a high of 205.09 USDT, with a 24-hour gain of 5.58%.

In addition to BTC, ETH, and SOL, the altcoin market finally saw a decent recovery, with some tokens showing impressive gains. For example, the consistently strong ZEC reached 368 USDT at one point, with a 24-hour gain of 30.03%; benefiting from the resurgence of AI concept popularity, VIRTUAL reached 1.5761 USDT at one point, with a 24-hour gain of 22.25%; popular protocols like PUMP, PENDLE, ENA also performed well, with 24-hour gains of 17.64%, 10.06%, 9.22%, respectively...

Driven by the overall market uptrend, the cryptocurrency's total market capitalization has rapidly rebounded. According to CoinGecko data, the current total market cap has returned to $3.984 trillion, with a 24-hour growth of 3.5%, just one step away from re-entering the $4 trillion mark. The cryptocurrency user's panic sentiment has also significantly eased, with today's Fear & Greed Index reaching 51, shifting from "Fear" to "Neutral."

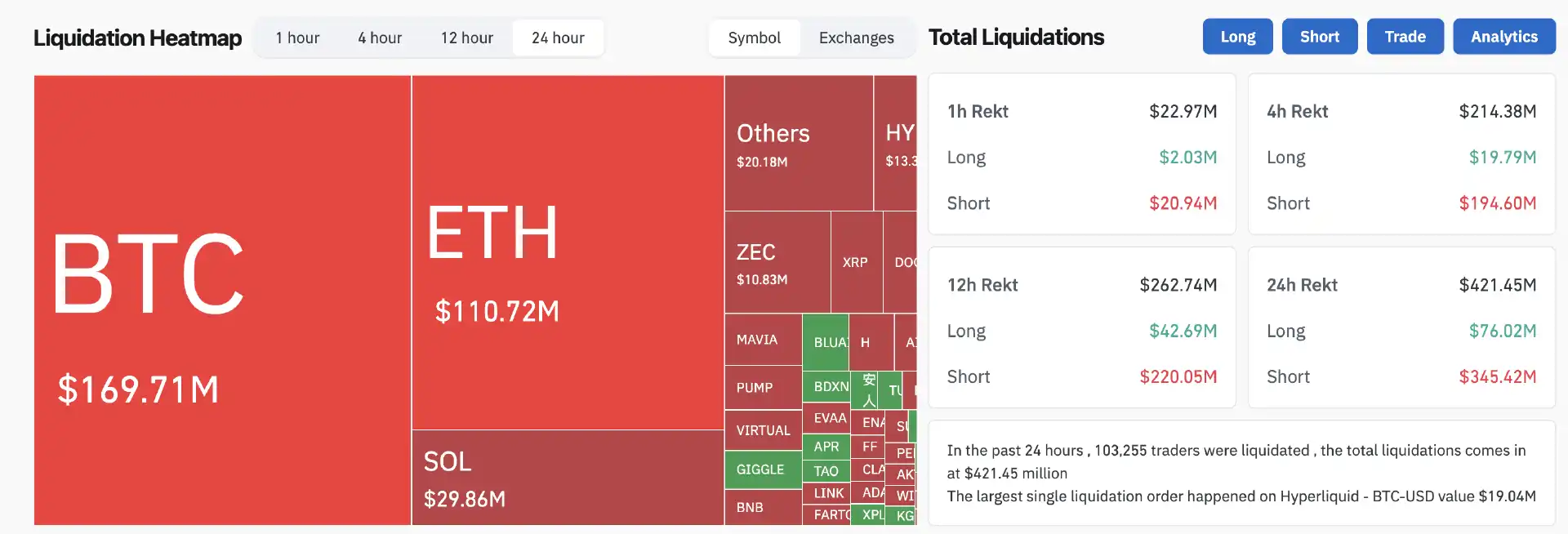

Regarding derivative trading, Coinglass data shows that over the past 24 hours, the entire network has liquidated $421 million, with the vast majority being short liquidations totaling $345 million. By asset, BTC had $169.7 million in liquidations, and ETH had $110.7 million.

Tariff Cloud Temporarily Lifted

From a news perspective, the most direct reason for the rapid market recovery is undoubtedly the new progress in the tariff negotiations between China and the United States.

From October 25th to 26th, Chinese Vice Premier and lead negotiator of the China-US economic and trade talks, He Lifeng, met with the US lead negotiators, US Treasury Secretary Yellen and Trade Representative Tai, in Kuala Lumpur for the China-US economic and trade negotiations.

Chinese Vice Minister of Commerce and Deputy China International Trade Representative Li Chenggang told reporters from domestic and foreign media after the talks that the two sides have reached a preliminary consensus on properly addressing several key economic and trade issues of mutual concern and will next go through their respective domestic approval procedures.

US Treasury Secretary Yellen also stated in an interview with US media after the conclusion of the talks that after the two-day meeting in Kuala Lumpur, the two sides reached a "very substantive framework agreement," laying the groundwork for a meeting between the leaders of the two countries. The US side has "ceased consideration" of imposing 100% tariffs on China. US Trade Representative Tai also stated at a press conference that the China-US trade negotiations have been fruitful, covering various topics, and the two sides are discussing the final details of a trade agreement proposal, which is almost ready for review by the leaders of the two countries.

Since earlier this month when Trump suddenly raised the issue of tariffs again, a shadow has been hanging over the cryptocurrency market and even the global financial markets. On October 11th, the market experienced a historic crash. As tensions gradually eased, the market naturally began to warm up. It seems to be Trump's classic "lift high, put down lightly" strategy, but fortunes have already undergone a major shift during these ups and downs.

Focus of the Week: Interest Rate Decision

The focus of the market this week is undoubtedly the Federal Reserve interest rate decision early Thursday morning—2:00 AM Beijing time on October 30th (Thursday), the Federal Reserve's FOMC will announce the interest rate decision and economic projections summary; then at 2:30 AM, Fed Chair Powell will hold a monetary policy press conference.

Last Friday, the US Bureau of Labor Statistics released September's overall and core inflation indicators, both of which were below expectations, paving the way for further Fed rate cuts. The US's non-seasonally adjusted CPI for September recorded an annual rate of 3%, a slight increase from the previous month's 2.9%, hitting a new high since January 2025 but slightly below the market's general expectation of 3.1%; the seasonally adjusted CPI for September recorded a 0.3% monthly rate, lower than the market's expectation and the previous value of 0.4%. The US's non-seasonally adjusted core CPI for September recorded an annual rate of 3%, lower than the market's expectation and the previous value of 3.1%; the seasonally adjusted core CPI for September recorded a 0.2% monthly rate, also lower than the market's expectation and the previous value of 0.3%.

After the CPI data was released, traders increased their bets on the Fed cutting interest rates twice more this year. CME's "Fed Watch" data shows that the probability of a 25 basis point rate cut by the Fed in October is currently at 97.3%, with only a 2.7% probability of keeping rates unchanged; the probability of a total 50 basis point rate cut by the Fed by December is at 95.5%.

Insider Whales' Move: Continued Bullish Outlook

Setting aside all traditional influencing factors with uncertainty, abstracting the market trend into a minimalist question, the most influential individual recently is undoubtedly the whale with a 100% win rate since the 10/11 plunge.

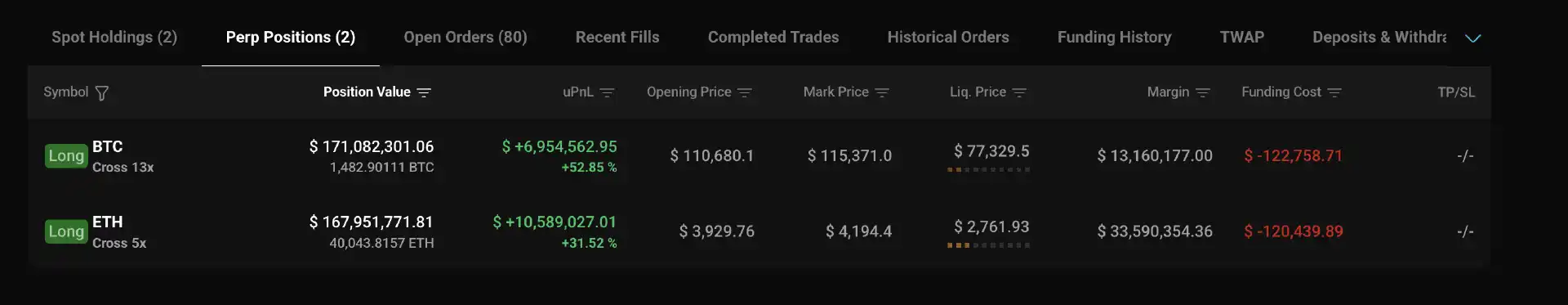

HyperBot data shows that the "10/11 100% Win Rate Whale" currently holds 13x BTC longs and 5x ETH longs with an unrealized gain of around $17.54 million. Moreover, they have not taken profits yet and even added 1,868 ETH longs three hours ago. Currently, the whale's total position is worth approximately $339 million, with BTC longs valued at around $171 million at an entry price of $110,680 and ETH longs valued at around $168 million at an entry price of $3,929.

Evidently, the whale is still bullish. Whether based on insider information or technical analysis, closely following the whale's short-term moves might be the optimal response to the current market trend.

You may also like

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

US Senate Agriculture Committee Schedules January 27 for Crypto Market Structure Hearing

Key Takeaways The Senate Agriculture Committee will release its crypto market structure bill on January 21, followed by…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

BitGo’s Revenue Surges with Upcoming IPO as Institutional Interest Grows

Key Takeaways BitGo, a major player in cryptocurrency custody, aims to raise $201 million through a U.S. IPO…

80% of Oil Revenue Settled in Stablecoins: Venezuela’s USDT Dominance

Key Takeaways Venezuela’s economy heavily relies on USDT, with 80% of oil revenue settled using this stablecoin, showcasing…

Story is Trading 33.03% Above Our Price Prediction for Jan 17, 2026

Key Takeaways Current Market Positioning: Story is trading at $2.58, significantly above the predicted price of $1.94 for…

Sky Price Prediction – SKY Price Estimated to Decline to $ 0.042476 By Jan 17, 2026

Key Takeaways Short-term Decline Expected: The price of SKY is currently predicted to decrease by 23.14% within the…

Mantle Price Forecast – MNT Value Predicted to Decline to $0.732292 by January 17, 2026

Key Takeaways Mantle’s current trading price is $0.952625. The coin is anticipated to decrease by 23.31% to $0.732292…

Is the WEEX AI Trading Hackathon Worth Joining? $1.88M Prize Pool and Rules Explained

An AI trading competition with a $1.88M prize pool — explore WEEX AI Trading Hackathon rules, OpenAPI trading, and AI-only participation requirements.

Wintermute's 28-Page Report Unveils the Inner Workings of Off-Chain Liquidity

After Stepping Down as Mayor of New York City, He Pivoted to Selling Cryptocurrency

AI Crypto Trading in 2026: How AI Assistants Are Reshaping Trading Platforms and Strategies

Learn how AI assistants support crypto trading decisions, improve risk awareness, and are becoming part of modern trading platforms and exchanges.

Life Candlestick Drama Escalates: Fund Established, 'Cyber Altruism Box' Feature Launched; Founder Denies Meme Coin Issuance

Dubai Bans Privacy Coins and Updates Stablecoin Regulations

Key Takeaways The Dubai Financial Services Authority (DFSA) has completely prohibited privacy tokens within the Dubai International Financial…

Binance Lists United Stables as a New Trading Option

Key Takeaways Binance is adding United Stables (U) to its platform, expanding its offerings in digital currencies. United…

Crypto Market Recovery Signals: Bitcoin’s Downside Risks Diminish

Key Takeaways Matrixport’s analysis indicates a positive shift in crypto market sentiment, suggesting a recovery phase. The “Greed…

2026 Top Transaction Themes: Trump's Sore-Loser Attitude, the End of the International Order

Most US debanking cases stem from government pressure, says report

Key Takeaways A report from the Cato Institute indicates that most debanking incidents in the US originate from…

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

US Senate Agriculture Committee Schedules January 27 for Crypto Market Structure Hearing

Key Takeaways The Senate Agriculture Committee will release its crypto market structure bill on January 21, followed by…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

BitGo’s Revenue Surges with Upcoming IPO as Institutional Interest Grows

Key Takeaways BitGo, a major player in cryptocurrency custody, aims to raise $201 million through a U.S. IPO…

80% of Oil Revenue Settled in Stablecoins: Venezuela’s USDT Dominance

Key Takeaways Venezuela’s economy heavily relies on USDT, with 80% of oil revenue settled using this stablecoin, showcasing…

Story is Trading 33.03% Above Our Price Prediction for Jan 17, 2026

Key Takeaways Current Market Positioning: Story is trading at $2.58, significantly above the predicted price of $1.94 for…