Stable is having its TGE tonight, will the market still buy into the stablecoin public blockchain narrative?

Original Article Title: "Stable Tonight TGE, Does the Stablecoin Public Chain Narrative Market Still Buy It?"

Original Article Author: 1912212.eth, Foresight News

At 21:00 on December 8th Beijing time, the Stable mainnet will be officially launched. Stable, as a Layer 1 blockchain supported by Bitfinex and Tether, focuses on stablecoin infrastructure. Its core design aims to use USDT as the native gas fee to achieve sub-second settlement and gas-free peer-to-peer transfers. As of the time of writing, exchanges including Bitget, Backpack, and Bybit have announced the listing of STABLE spot trading. In addition, Binance, Coinbase, and Korean exchanges have not yet announced the listing of STABLE spot trading.

Total Supply of 1 Trillion, Tokens Not Used as Gas Fees

Prior to the mainnet launch, the project team has released the whitepaper and tokenomics details. The native token of the project, STABLE, has a total supply of 1 trillion tokens, with the total amount fixed. Stable network transfers, payments, and transactions are settled in USDT, and STABLE is not used as a gas fee but is used for coordinating incentive mechanisms between developers and ecosystem participants. The STABLE token distribution is as follows: Genesis Distribution accounts for 10% of the total supply, supporting initial liquidity, community activation, ecosystem activities, and strategic distribution work; the Genesis Distribution portion will be fully unlocked at the launch of the mainnet.

40% of the total supply is allocated to the ecosystem and community, distributed to developer grants, liquidity programs, partnerships, community initiatives, and ecosystem development; 25% is allocated to the team, including the founding team, engineers, researchers, and contributors; and 25% is allocated to investors and advisors, supporting strategic investors and advisors for network development, infrastructure construction, and promotion.

Both the team and investor shares have a one-year cliff period, with zero unlock in the first 12 months, followed by linear release. The ecosystem and community fund share unlocks 8% at launch, with the remaining portion gradually released through linear vesting to incentivize developers, partners, and user growth.

Stable adopts the StableBFT consensus protocol and utilizes a DPoS (Delegated Proof of Stake) model. This design maintains the economic security properties required for a global payment network while supporting high-throughput settlement. Staking the STABLE token is the mechanism for validators and delegators to participate in consensus and earn rewards. The STABLE token's main roles are governance and staking: holders can stake their tokens to become validators, participate in network security maintenance, and influence protocol upgrades through DAO voting, such as adjusting fee rates or introducing support for new stablecoins.

In addition, STABLE can be used for ecosystem incentives, such as liquidity mining or cross-chain bridging rewards. The project team claims that this separation design can attract institutional funds because USDT's stability is much higher than that of volatile governance tokens.

Pre-Deposit Controversy: Insider Trading, KYC Bottleneck

Similar to Plasma, Stable also opened deposits twice before the mainnet launch. The first-phase pre-deposit started at the end of October with a cap of $825 million but was filled within minutes after the announcement. The community questioned some players' insider trading. The top-ranked wallet deposited hundreds of millions of USDT 23 minutes before open deposits.

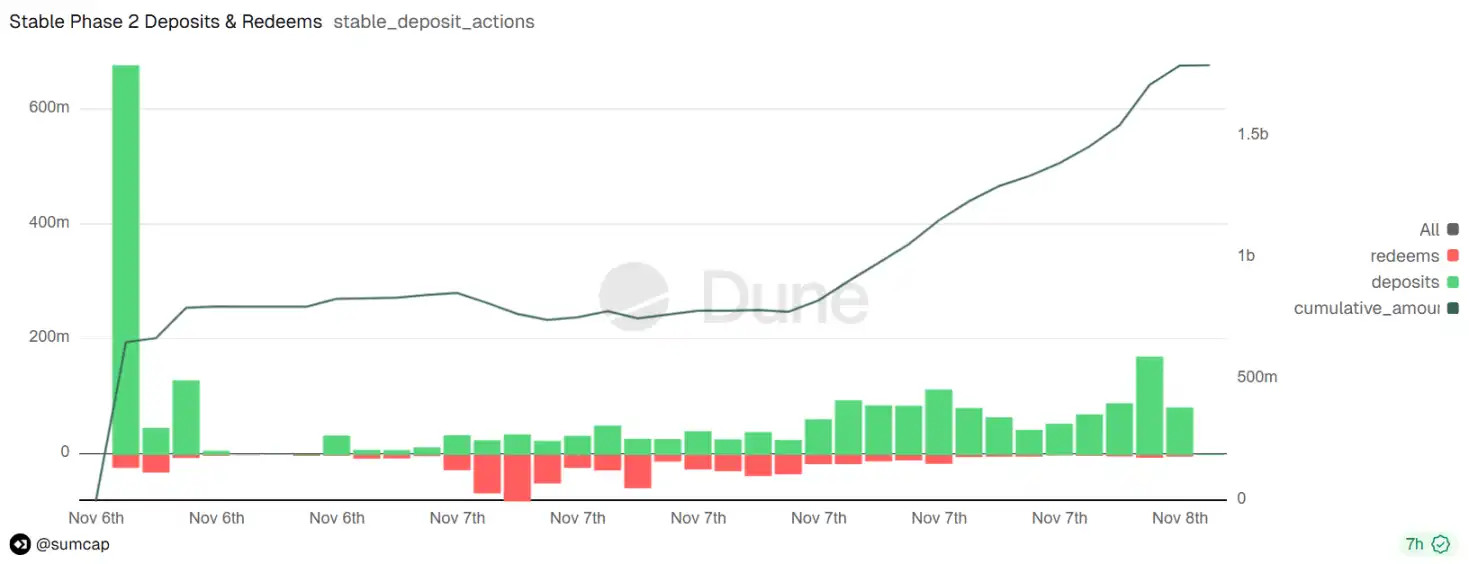

The project team did not directly respond and opened the second phase of pre-deposit activities on November 6 with a cap of $500 million.

However, Stable underestimated the market's enthusiasm for deposits. At the moment the second phase opened, a massive influx of traffic caused the website to slow down and bottleneck. As a result, after updating the rules, Stable allowed users to deposit through the Hourglass frontend or directly on-chain; the deposit feature reopened for 24 hours, with each wallet able to deposit up to $1 million, with the minimum deposit amount remaining at $1,000.

Ultimately, the total deposits in the second phase were approximately $1.8 billion, with around 26,000 participating wallets.

The audit time varied from a few days to a week, with some community users complaining about system bottlenecks or repeated requests for additional documentation.

$20 Billion FDV Probability Over 85%

At the end of July this year, Stable announced the completion of a $28 million seed round of financing, led by Bitfinex and Hack VC, bringing its market valuation to around $3 billion.

By comparison, Plasma's market value is now $3.3 billion, with an FDV of $16.75 billion.

Some optimistic observers believe that the stablecoin narrative, Bitfinex's endorsement, and Plasma's rise and fall may indicate that there will still be some heat and upward price momentum in the near future. However, pessimistic voices are stronger: Gas fees not payable with STABLE, limited utility, especially as the market has entered a bear market cycle where liquidity has become tight, its price may drop rapidly.

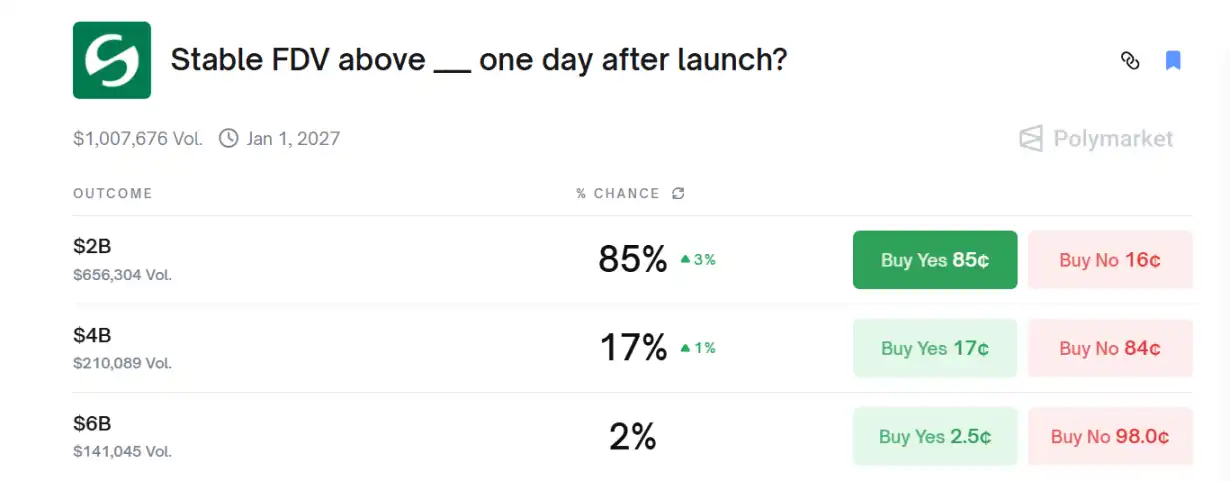

Currently, Polymarket data shows that the probability of FDV exceeding $20 billion after its listing day is 85%. Based on a conservative $20 billion calculation, the STABLE price would correspond to $0.02.

In terms of perpetual contract market, according to Bitget data, the STABLE/USDT is currently priced at $0.032, with its estimated FDV expected to rise to around $3 billion.

The first phase of Stable's pre-deposit reached $825 million, with the actual contribution of the second phase exceeding $1.1 billion, but after proportional distribution, the actual amount entered the pool was $500 million. The total pre-deposit scale is $1.325 billion. The tokenomics disclosed an initial allocation of 10% (used for pre-deposit activity incentives, exchange platform activities, initial on-chain liquidity, etc.). Assuming Stable eventually airdrops a share of 3% to 7% to pre-deposits, calculated based on the pre-market price of $0.032, the corresponding return is approximately 7% to 16.9%. This means that for every $10,000 deposit, the corresponding earnings are $700 to $1,690.

You may also like

Alibaba Backed Latin America Stablecoin Company, Why VelaFi?

a16z Secures $15 Billion: Redefining Venture Capital Through Visionary Storytelling

Key Takeaways a16z Raises Capital: The firm has raised an astronomical $15 billion, marking a significant point in…

Solana and Twitter Collaborate to Enable Cryptocurrency Trading on X

Key Takeaways: Solana and Twitter have integrated to introduce Smart Cashtags, allowing direct cryptocurrency trading on X, marking…

After Stepping Down as Mayor of New York City, He Pivoted to Selling Cryptocurrency

Solana teams up with Twitter, now you can trade on Twitter

Space Featured in Binance Research Ecosystem Report: Key Signals of the Predictive Market Leverage Layer are Emerging

a16z Raises $15 Billion in New Fund: Long Criticized, Why Has It Become the "Best Storytelling" Venture Capitalist?

Coinbase May Withdraw Support for CLARITY Act Amid Stablecoin Rewards Ban Debate

Key Takeaways Potential Withdrawal: Coinbase is considering withdrawing support for the CLARITY Act if it restricts stablecoin rewards.…

Coinbase Warns of Withdrawal Over Senate Crypto Bill: Report

Key Takeaways Coinbase is considering retracting its support for a significant crypto legislation pending in the U.S. Senate…

Trump Gets Serious: Powell Faces Criminal Investigation, Rate Battle Intensifies

Twitter Hashtag Price Check, Will Trading Go Further?

Base contributes 70% of revenue but pays only 2.5% in rent; Superchain may be entering its "forking" countdown

$250 Billion, 6723 Rounds of Funding: Where Did Crypto VCs Invest in 2025?

Ranger Fund Takes a New Approach to Public Offering: Can a Grassroots Team Earn Market Trust?

Visa Crypto Lead: Eight Key Evolutions of Crypto and AI by 2026

Former Brazil Central Bank Official Introduces Real-Pegged Stablecoin Offering Yield Sharing

Key Takeaways BRD, a newly unveiled stablecoin by Tony Volpon, a former director of the Central Bank of…

After Lighter, the next batch of Perp DEXs Worth Keeping an Eye On

Doubling in a single day won't make up for a 98% crash - Did Parcl's 'Polymarket Story' Hold Up?

Alibaba Backed Latin America Stablecoin Company, Why VelaFi?

a16z Secures $15 Billion: Redefining Venture Capital Through Visionary Storytelling

Key Takeaways a16z Raises Capital: The firm has raised an astronomical $15 billion, marking a significant point in…

Solana and Twitter Collaborate to Enable Cryptocurrency Trading on X

Key Takeaways: Solana and Twitter have integrated to introduce Smart Cashtags, allowing direct cryptocurrency trading on X, marking…