Metcalfe's Law "Bankruptcy": Why Has Cryptocurrency Been Overvalued?

Original Article Title: Crypto Is Priced for Network Effects It Doesn't Have

Original Article Author: Santiago Roel Santos, Founder of Inversion

Original Article Translation: AididiaoJP, Foresight News

The Dilemma of Cryptocurrency Network Effects

My previous view on "cryptocurrency trading prices far exceeding its fundamentals" has sparked discussions. The strongest opposition is not about usage or fees but stems from ideological differences:

· "Cryptocurrency is not a business"

· "Blockchain follows Metcalfe's Law"

· "The core value lies in network effects"

As a witness to the rise of Facebook, Twitter, and Instagram, I am well aware that early internet products also faced valuation challenges. However, a pattern gradually emerged: as more users joined the social circle, the product's value experienced exponential growth. User retention strengthened, engagement deepened, and the flywheel effect became clearly visible in the experience.

This is the true manifestation of network effects.

If one advocates for "evaluating the value of cryptocurrency from a network rather than a corporate perspective," then let us delve deeper.

Upon closer examination, a glaring issue emerges: Metcalfe's Law not only fails to support the current valuation but also exposes its vulnerability.

The Misunderstood "Network Effect"

In the cryptocurrency field, the so-called "network effect" is mostly a negative effect:

· User growth leads to degraded experience

· Soaring transaction fees

· Worsening network congestion

A deeper issue lies in:

· Open-source nature causing developer attrition

· Liquidity being profit-driven

· User Cross-Chain Migration with Incentive

· Institution Platform Switch Based on Short-Term Gain

A successful network has never operated this way; the experience did not degrade when Facebook added tens of millions of users.

But the New Blockchain Has Solved the Throughput Issue

This has indeed alleviated congestion but hasn’t addressed the fundamental issue of network effects. Increasing throughput merely eliminates friction and does not create compounded value.

The fundamental contradiction still exists:

· Liquidity may drain

· Developers may migrate

· Users may depart

· Code can fork

· Weak value-capture ability

Scaling improves availability, not inevitability.

The Truth Revealed by Fees

If an L1 blockchain truly has network effects, it should capture most of the value as iOS, Android, Facebook, or Visa do. The reality is:

· L1 holds 90% of the total market value

· Fee share plummeted from 60% to 12%

· DeFi contributes 73% of fees

· But accounts for less than 10% of the valuation

The market still prices based on the "Fat Protocol Theory," but the data points to the opposite conclusion: L1 is overvalued, applications are undervalued, and the ultimate value will aggregate towards the user layer.

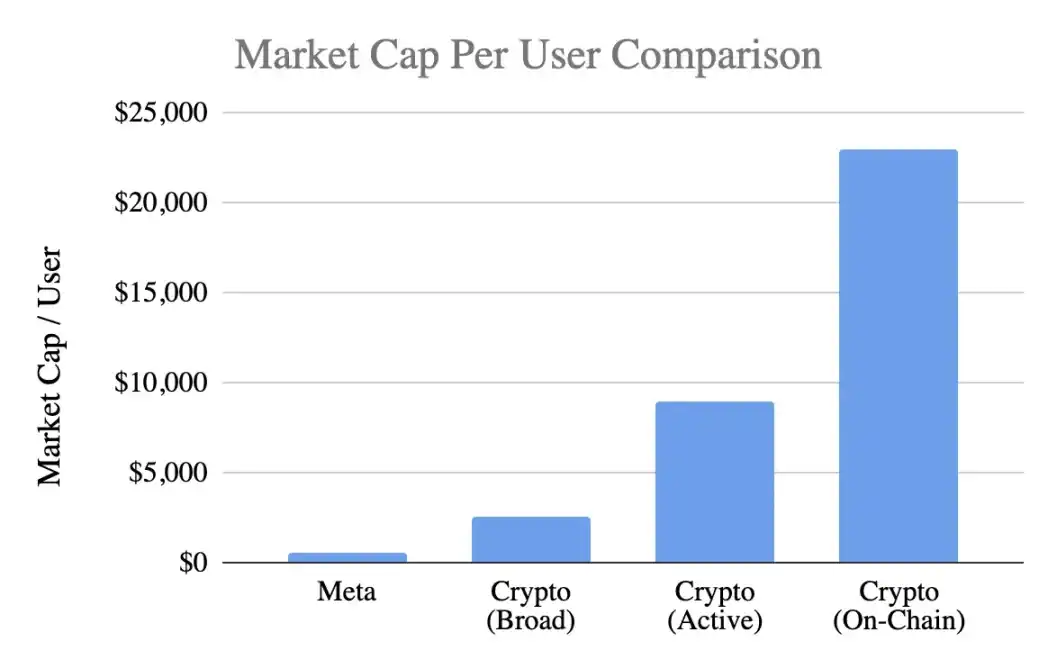

User Valuation Comparison

Using a common metric, the per-user market value:

Meta (Facebook)

· 3.1 billion monthly active users

· $1.5 trillion market cap

· Per-user value $400-500

Cryptocurrency (Excluding Bitcoin)

· $1 Trillion Market Cap

· 400 Million General Users → $2,500 per Person

· 100 Million Active Users → $9,000 per Person

· 40 Million On-chain Users → $23,000 per Person

Valuation Levels Reached:

· Optimistic Premium of 5x

· Conservative Premium of 20x

· On-chain Activity-based Premium of 50x

Meanwhile, Meta is considered the most efficient monetization engine in consumer technology.

Analysis of Development Stage

The argument of "Facebook was also like this in its early days" is worth debating. While Facebook also lacked revenue in its early days, its product had already built:

· Daily Usage Habits

· Social Connections

· Identity Verification

· Community Membership

· Value Growth from User Expansion

In contrast, the core product of cryptocurrency remains speculative, leading to:

· Rapid User Adoption

· Faster Churn

· Lack of Stickiness

· Lack of Habit Formation

· No Improvement with Scale

Unless cryptocurrency becomes "Invisible Infrastructure," a bottom-layer service imperceptible to users, network effects are challenging to self-reinforce.

This is not a maturity issue but a product essence issue.

Metcalf Law Misuse

The law's description of value≈n² is indeed appealing, but its assumptions are biased:

· Deep interaction between users (actually rare)

· Network stickiness (actually lacking)

· Value concentration (actually dispersed)

· Existence of conversion costs (actually very low)

· Building defensive moats through scale (not yet evident)

Most cryptocurrencies do not meet these prerequisites.

Insights on Key Variable k Value

In the V=k·n² model, the k value represents:

· Monetization efficiency

· Level of trust

· Depth of engagement

· Retention capability

· Conversion costs

· Ecosystem maturity

The k value for Facebook and Tencent ranges from 10⁻⁹ to 10⁻⁷, being minute due to the massive network scale.

Estimated k values for cryptocurrencies (based on a $1 trillion market cap):

· 400 million users → k≈10⁻⁶

· 100 million users → k≈10⁻⁵

· 40 million users → k≈10⁻⁴

This implies that the market assumes each crypto user's value far exceeds that of a Facebook user, despite their disadvantages in retention rate, monetization ability, and stickiness. This is not early optimism but rather overdrawn future prospects.

Current State of Real Network Effects

Cryptocurrencies actually possess:

Bilateral network effects (users ↔ developers ↔ liquidity)

Platform effects (standards, tools, composability)

These effects indeed exist but are fragile: easily forked, slow to scale, far from reaching the n² flywheel effect of Facebook, WeChat, or Visa.

Rational Perspective on Future Outlook

The vision of the “Internet being built on a cryptographic network” is indeed appealing, but it needs to be clarified:

1. This future may be realized but has not yet arrived,

2. The existing economic models have not reflected it.

The current value distribution presents:

· Cost flowing to the application layer rather than L1

· Users controlled by exchanges and wallets

· MEV capturing surplus value

· Forks weakening barriers to entry

· L1 struggling to solidify created value

Value capture is undergoing a transition from the base layer→application layer→user aggregation layer, which is favorable to users but should not warrant a premature premium.

Characteristics of a Mature Network Effect

A healthy network should exhibit:

· Stable liquidity

· Developer ecosystem concentration

· Increased base layer fee capture

· Continued retention of institutional users

· Retention rate growth across cycles

· Composability to fend off forks

Currently, Ethereum is showing initial signs, Solana is gaining momentum, with most public chains still far apart.

Conclusion: Valuation Judgment Based on Network Effect Logic

If crypto users:

· Have lower stickiness

· Monetization is more difficult

· Have higher churn rates

Then their unit value should be lower than Facebook users, not 5-50 times higher. The current valuation has overestimated the nascent network effects, and market pricing seems to imply a strong effect already exists, when in fact, it is not the case, at least not yet.

You may also like

If I Were the Founder of Kaito, How Would InfoFi 2.0 Survive?

Key Takeaways InfoFi’s collapse highlighted the dangers of relying heavily on centralized platforms. The InfoFi project faces five…

Understanding Twitter’s Open-Source Recommendation Algorithm

Key Takeaways The recommendation algorithm on Twitter, now named Platform X, is a three-step process: Candidate Generation, Rating…

2026 Airdrop Interoperability Guide: Navigating 182 Projects Across Eight Key Tracks

Discover comprehensive interaction strategies for 182 projects across eight tracks to capitalize on 2026 airdrop opportunities. Understand the…

ARK Founder “Wood Sister” 2026 Forecast: Gold Hits a Peak, Dollar Recovers, Bitcoin Sets Its Path

Key Takeaways Cathie Wood anticipates a “golden age” for the US stock market influenced by deregulation, tax cuts,…

Scaramucci Criticizes Stablecoin Yield Ban’s Impact on U.S. Dollar

Key Takeaways The CLARITY Act’s prohibition on stablecoin yields potentially weakens the U.S. dollar’s competitiveness against the digital…

CLARITY Act Stalls: Why Has the Interest-Bearing Stablecoin Become a Bank’s “Thorn in the Side”?

Key Takeaways The debate surrounding the CLARITY Act is primarily focused on interest-bearing stablecoins and their implications for…

Why Digital Asset Treasuries That Only Hodl May Fall Short

Key Takeaways Digital Asset Treasuries (DATs) that solely focus on holding crypto assets such as Bitcoin face significant…

These Vibe Coding Crypto Games Are So Immersive

Key Takeaways Vibe coding in the crypto world provides immersive gaming experiences with instant dopamine feedback. Popular games…

NYSE Introduces Blockchain-Based Platform for Tokenized Stocks and ETFs

Key Takeaways The New York Stock Exchange is spearheading the development of a blockchain trading platform aimed at…

The CLARITY Act Stalling is a Boon for the Crypto Industry

Key Takeaways The delay in passing the CLARITY Act is seen as beneficial for the crypto market. Coinbase’s…

Paradex Rollback Roasted, HIP-3 Competition Heats Up, What’s New in the Mainstream Ecosystem?

Key Takeaways The NYSE’s move towards an on-chain securities trading platform signals a transformative intersection of blockchain and…

Key Market Insights for January 20th: What You Need to Know

Key Takeaways The newly open-sourced X Algorithm from Musk promises ongoing improvements, enhancing efficiency and functionality. ‘Distinguished Wall…

Wintermute: The Four-Year Cycle is Dead, Crypto Breakthrough 2026, Where to Next?

Key Takeaways The traditional four-year crypto cycle, once deemed a fundamental market principle, is becoming obsolete as market…

Crypto Mortgages in the US: Navigating Valuation Challenges and Regulatory Uncertainties

Key Takeaways The Federal Housing Finance Agency (FHFA) mandates Fannie Mae and Freddie Mac to consider cryptocurrencies in…

Why Can Coinbase Halt a CLARITY Act Vote with Just One Sentence?

Key Takeaways Coinbase CEO Brian Armstrong’s opposition to the Clarity Act halted a critical Senate vote, showcasing the…

South Korea considers changing the one-bank rule for crypto exchanges: An In-depth Review

Key Takeaways: South Korea is examining the current “one exchange–one bank” model amidst concerns of market concentration, potentially…

Error Occurred Due to Excessive API Requests

Key Takeaways: – Excessive API requests can result in blocked access, highlighting the importance of managing request rates…

Satoshi-era Wallet Moves $85M in Bitcoin After 13 Years

Key Takeaways A dormant Bitcoin wallet from the Satoshi era has transferred 909.38 BTC, valued at around $84.6…

If I Were the Founder of Kaito, How Would InfoFi 2.0 Survive?

Key Takeaways InfoFi’s collapse highlighted the dangers of relying heavily on centralized platforms. The InfoFi project faces five…

Understanding Twitter’s Open-Source Recommendation Algorithm

Key Takeaways The recommendation algorithm on Twitter, now named Platform X, is a three-step process: Candidate Generation, Rating…

2026 Airdrop Interoperability Guide: Navigating 182 Projects Across Eight Key Tracks

Discover comprehensive interaction strategies for 182 projects across eight tracks to capitalize on 2026 airdrop opportunities. Understand the…

ARK Founder “Wood Sister” 2026 Forecast: Gold Hits a Peak, Dollar Recovers, Bitcoin Sets Its Path

Key Takeaways Cathie Wood anticipates a “golden age” for the US stock market influenced by deregulation, tax cuts,…

Scaramucci Criticizes Stablecoin Yield Ban’s Impact on U.S. Dollar

Key Takeaways The CLARITY Act’s prohibition on stablecoin yields potentially weakens the U.S. dollar’s competitiveness against the digital…

CLARITY Act Stalls: Why Has the Interest-Bearing Stablecoin Become a Bank’s “Thorn in the Side”?

Key Takeaways The debate surrounding the CLARITY Act is primarily focused on interest-bearing stablecoins and their implications for…