Is USD0 the next UST? Will USUAL holders need to panic?

2024 was a big year for stablecoin projects, with an increasing number of innovative new stablecoin projects emerging in the market. Just in the second half of last year, at least 23 stablecoin projects received funding ranging from 2 million to 45 million. Apart from Ethena, which surpassed DAI in market share with its USDe, Usual became another eye-catching stablecoin project. Not only did it have the endorsement of French Member of Parliament Pierre Person's government background, but Usual also launched on Binance at the end of 2024, showcasing its performance in the market.

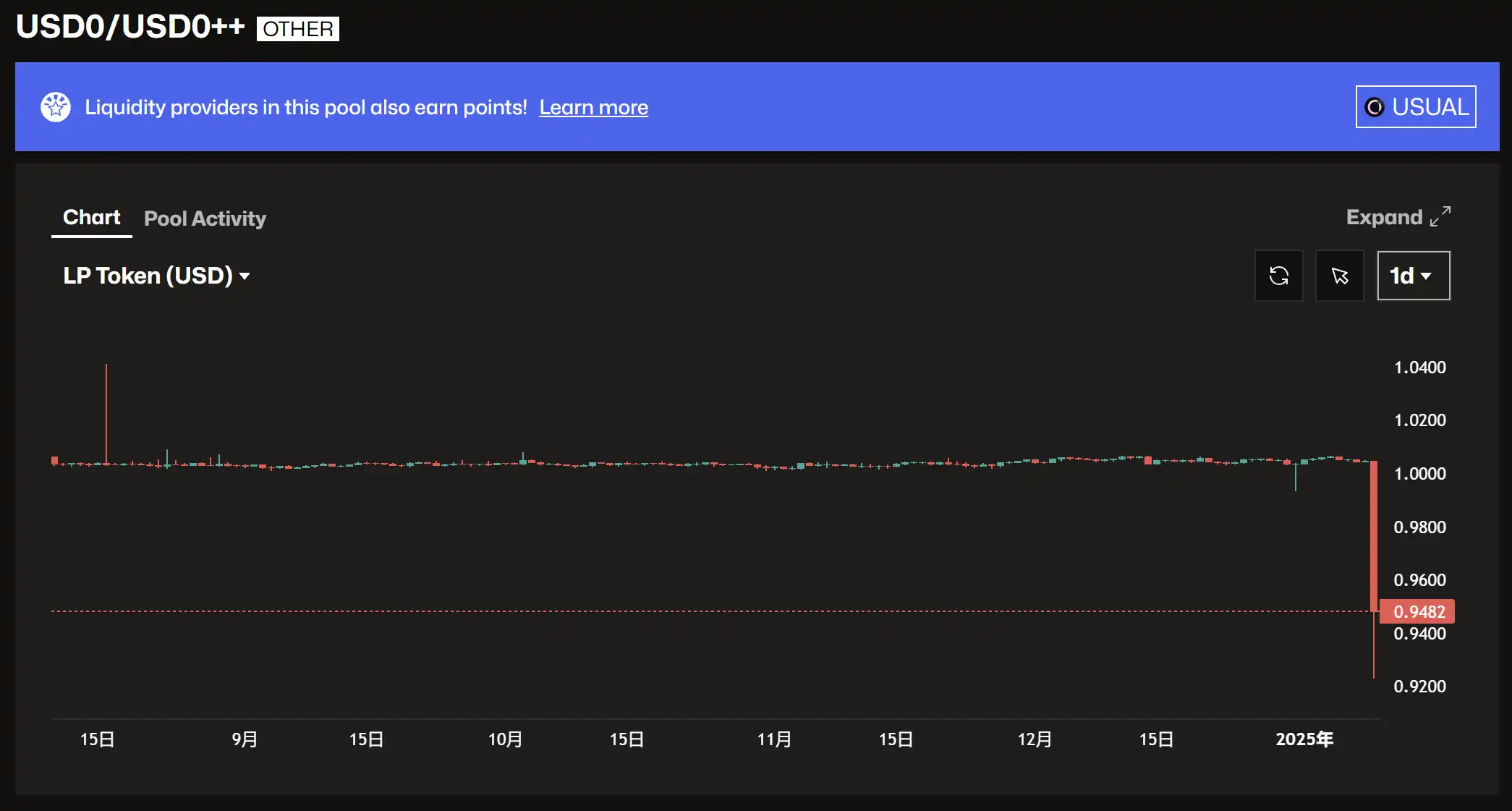

However, Usual, once a market darling, saw its token Usual plummet by over 30% in a week, and this morning its USD0++ token instantly dropped to around $0.946, where a USD0++ token can only be redeemed for approximately $0.94. Currently, in the Curve USD0/USD0++ pool, USD0++ accounts for a skewed 90.75%.

USD0++ Price Drop, Image Source: Curve

What exactly happened to Usual, and why did USD0++ suddenly experience a flash crash?

A Panic-Inducing Run on the Bank Triggered by a Single Announcement

The unpegging of USD0++ can be traced back to an announcement made by Usual's official team on the morning of January 10. In the announcement, the Usual team changed the redemption terms of USD0++, transitioning from the original 1:1 redemption to a brand-new dual-exit strategy. One of the ways is a conditional exit, where users can still exit USD0++ at a 1:1 ratio but will need to burn a portion of the yield upon exit. The other way is an unconditional exit, but unlike the previous deterministic 1:1, the official team set a minimum exit ratio of 0.87:1, gradually re-anchoring to $1 over time.

Usual Announcement on Two Exit Strategies, Image Source: Usual Website

Usual's announcement quickly spread within the usual community. Thus, under the fermentation of the new USD0++ redemption rules, panic gradually spread from large whale holders to retail investors. In this game of "running for your life," those who run first always suffer less loss than those who are slower. After today's announcement, under the fleeing of large holders and the spread of panic, retail investors also began to sell off. The outflow of USD0 not only accelerated but also "broke through" in the Curve USD0/USD0++ pool. As a large amount of USD0++ was redeemed, the USD0 ratio plummeted to an astonishing 8.18%.

Image Source: Curve

Let's rewind the timeline back to when USUAL was listed on Binance. Initially, the Usual team set up a redemption mechanism last year that allowed for a 1:1 redemption. Unlike Ethena, which leans more towards a B2B positioning, Usual's product leaned more towards a C2C approach, attracting many whales. In this scenario where Usual's official 1:1 redemption acted as a safety net, many whales not only took large positions but also continuously increased their leverage and capital efficiency through strategies like yield farming. This approach, essentially providing risk-free returns to all users, was viable as long as Usual's team didn't change the rules of the game. This meant that whales could gain USUAL rewards without incurring additional opportunity costs.

Simultaneously, the price of USUAL surged, leading to a skyrocketing APY, attracting more users to stake their assets. This positive feedback loop, underpinned by Usual's tight control of the token and the impressive paper APY, attracted more TVL, further driving up the price. Usual's strategy of controlling the token and using high paper APY to attract TVL almost seemed like an overt plan. Small retail holders could also follow the whales' lead under Usual's "follow the leader" model. Therefore, Usual's positive feedback loop quickly started spinning.

Usual's sky-high APY, Image Source: Usual Website

However, the key aspect of this mechanism lies in the exit strategy. For long-term holders, USUAL's issuance is tied to the overall protocol's income, where higher TVL translates to lower USUAL issuance, creating a deflationary mechanism. By reducing the token's supply on the supply side, Usual artificially introduced a level of scarcity. The team also didn't overlook the design of the USUAL mechanism; holders staking the USUAL token would receive USUALx, with these holders receiving 10% of the daily newly minted USUAL, incentivizing early adopters. Additionally, in the event of an early redemption at USD0++, 33% of the burned USUAL will be allocated to USUALx holders, creating an additional income source. Now, for short-term holders, the decision lies between selling off USUAL and running for the hills or continuing to hold USUAL and stake for more rewards. The dilemma is whether to choose "take the small benefits" or "cut and run." In a scenario where the coin price keeps rising, opting for an exit strategy will only yield the immediate USUAL returns, whereas standing the test of time will provide "staking rewards + USUAL token price appreciation + additional rewards." Usual's equilibrium is constantly being tugged in the economic game between short-term and long-term holders.

However, all gifts in fate already come with a price tag. The Usual team had hinted at the early imposition of an exit fee of USD0++, and almost all Usual participants tacitly understood the game, all vying to be the last one standing before the collapse of the tower.

Why the "Mysterious" 0.87?

So why did the team choose to set the proportion of unconditional exits to 0.87 in today's announcement? How did the team come up with this precise figure of 0.87?

Profit Burning Theory

The 0.87:1 ratio set in the announcement prompted a delicate balance of interests among whales. With the previous 1:1 redemption strategy no longer in effect, losing official protection, whales now face the challenge of finding a general among the "shorts." If the team were to opt for a conditional redemption, investors would need to return a portion of their future profits to the project team, but the details of this profit clawback have not been disclosed by the team. Conversely, if they choose to accept unconditional redemption, the worst-case scenario would only secure 0.87, leaving the remaining 0.13 as the core of the game. When one of the two exit methods offers higher returns, funds will naturally vote for the most profitable exit method. However, a well-designed mechanism should allow users the flexibility to choose between the two options rather than a one-sided decision. Therefore, the existence of the 0.13 gap is likely the portion the team has yet to disclose as requiring profit burning, forcing users to make a decision between the two methods. From the user's perspective, if the subsequent payout of 0.13 for a downside cost is anticipated, it may be more prudent to sell at the current anchor price (currently holding at around 0.94). USD0++ will also shed its previous packaging and return to its bond's economic essence. The 0.13 is the discounted portion, while 0.87 reflects its intrinsic value.

Liquidation Floor Theory

Since Usual previously offered users a 1:1 peg to USD0++, allowing many whales to safely leverage their positions to nearly risk-free returns through protocols like Morpho and further increase leverage to enhance capital efficiency. Typically, users engaging in this leverage cycle would collateralize their USD0++, borrow a certain amount of USDC, exchange this USDC back into USD0++, and then start a new cycle. These users enthusiastic about leveraged loans provided Usual with a substantial TVL, soaring higher with one foot on the floor, but behind the perpetual motion machine of TVL lies a liquidation line.

In the Morpho protocol, the USD0 liquidation line is determined by the loan-to-value ratio (LLTV). LLTV is a fixed ratio, and when a user's loan-to-value ratio (LTV) exceeds LLTV, their position is at risk of liquidation. Currently, Morpho's liquidation line stands at 86%, just a step away from the team's 0.87 safety net in unconditional exits.

The settlement line for USD0++ in Morpho is 86%, Image Source: Morpho

The official announcement of 0.87 in Usual is precisely above Morpho's 0.86 settlement line. It can be said that the official setting of 0.87 is the final barrier set by the official to prevent systemic liquidation risks. Although the setting of 0.87 provides a final bottoming out, it maintains the dignity of a project for users.

However, this is also the reason why many whales are waiting on the sidelines. There is a space of 13 points in between for free fluctuation, and more people will interpret it as long as there is no final chain liquidation, the project will eventually be left to "free fall."

What are the short-term and long-term impacts after the anchor breaks?

So how will USD0++ end after breaking the anchor? The panic sentiment about USD0++ in the market has not ended yet. The vast majority of people are holding a risk-management attitude, staying put, and maintaining a wait-and-see approach. The market's consensus on the reasonable value of USD0++ stabilizes around 0.94, based on the situation after the temporary announcement. The official announcement regarding the "unconditional exit" in the exit mechanism, including how much burning and specific profit deductions will occur, has not been disclosed in detail yet and is expected to be further detailed next week. To be extreme, if next week the official does not follow the market's predicted 13-point space and instead burns 0.5% of USUAL, then USD0++ will quickly re-anchor at the 0.995 level. The re-anchoring of USD0++ will depend on the burning details announced by the Usual official next week.

Regardless of how the final mechanism details are decided, it will benefit the holders of the UsualX and USUAL tokens. The Usual official's design of a new exit method reduces the earnings of USD0++, leading to a decrease in the TVL of USUAL/USD0++ and a consequent rise in the price of the USUAL token. After the burning starts, USUAL will be consumed, further capturing token value, and the price will become more resilient as a result. From the design of Usual's mechanism, it can also be seen that in the design of the protocol flywheel, USUAL is a crucial part of the flywheel's rotation. Since its peak at 1.6, USUAL has fallen by about 58%, and another takeoff of USUAL is needed to turn the flywheel again.

USUAL Token Price Surges Over 58%, Image Source: TradingView

Amusingly, while a large number of arbitrageurs contributed a significant amount of TVL to Usual through Morpho's circular lending, the official announcement of the 0.87 floor seems more like a warning to those leveraged at the 0.86 liquidation line.

Usual has now removed the previous "privilege" of a 1:1 rigid redemption, correcting the previously "should-not-have-existed" mechanism. As for the USD0++ anchoring situation, the entire market is also awaiting Usual's official announcement next week, at which time Blockbeats will continue to follow up.

You may also like

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Never Underestimate the Significance of the US Stablecoin 'Infrastructure Bill'

If the US stablecoin bill, the "GENIUS Act," passes smoothly this time, its significance will be tremendous. I even think it's significant enough to enter the top five in Crypto history.

Although abbreviated as the GENIUS Act, which translates directly to the Genius Act, it is actually the Guiding and Establishing National Innovation for U.S. Stablecoins, which translates to "Guiding and Establishing National Innovation for US Dollar Stablecoins."

The proposal is lengthy, with several key points summarized for everyone:

· Mandatory 1:1 Full Asset Backing: Assets include cash, demand deposits, and short-term US Treasuries. At the same time, misappropriation and rehypothecation are strictly prohibited.

· High-Frequency Disclosure: Reserve reports must be published at least monthly, introducing external audits.

· Licensing Requirement: Once the circulating market cap of the issuer's stablecoin exceeds $100 billion, it must transition into the federal regulatory system within a specified timeframe, adopting banking-grade regulation.

· Introduction of Custody: The custodian of the stablecoin and its reserve assets must be a regulated qualified financial institution.

· Clear Definition as a Payment Medium: The bill explicitly defines stablecoin as a new type of payment medium, primarily regulated by the banking regulatory system, rather than restricted by the securities or commodities regulatory system.

· Embracing Existing Stablecoins: A maximum 18-month grace period after the bill's enactment, aimed at encouraging existing stablecoin issuers (such as USDT, USDC, etc.) to promptly obtain licenses or become compliant.

After finishing the main content, let's talk about the significance of this matter with an excited heart.

Over the years, when others asked, "After working in the Crypto industry for 16 years, what application have you created?"

In the future, you can confidently tell others—Stablecoins.

Some people have held opposing views. In the past, people's impression of stablecoins was that they were an opaque black box. Every few months, there would be FUD — whether Tether's assets were frozen or Circle had a significant black hole deficit.

In fact, if you think about it, Tether easily rakes in billions of dollars a year just from the interest on those underlying government bonds. Circle, slightly less, also made a $1.7 billion profit last year.

They basically made money while standing there. From a motivational standpoint, they have no malicious intentions. In fact, they are the most eager for compliance.

Now, this opaque black box will become a transparent white box.

In the past, the only complaint was that Tether's funds might have been frozen by the United States. Now, they will be directly placed into U.S. compliant custodial institutions, with high-frequency disclosures, so you can rest assured.

【No need to worry about a rug pull】 is such a huge advantage—I think especially all Crypto people understand this.

Stablecoins were once almost on the verge of being overtaken by CBDCs. In any country, if a central bank digital currency really exists, it is highly likely not built on a blockchain, at most it is built on some internal central bank consortium chain, which to be honest, is meaningless.

When CBDCs were at their peak, that was the most dangerous time for stablecoins.

If CBDCs had become a reality back then, stablecoins today would have been relentlessly suppressed into a dark corner, and blockchain would only be able to play a minimal role.

The remaining half-dead stablecoins would even have to learn the standards of central bank digital currencies, completely relinquishing their standard-setting power.

And now, stablecoins have won (or are about to).

Instead, everyone should learn the 【Blockchain + Token】 standard.

Nowadays, many blockchains actually have no meaningful applications on top, only stablecoin transfers. For example, with Aptos, the only scenario I use Aptos for is transfers between Binance and OKX.

And now, stablecoins will be legislated, what does that mean?

That's right, blockchain will become the only standard.

In the future, every stablecoin user will be the first to learn how to use a wallet.

As an aside, I actually think Ethereum's concerted push for EIP-7702 is quite forward-thinking. While other chains are all about memes, thank you Ethereum for sticking to account abstraction.

EIP-7702 is about Account Abstraction, which can support, for example:

· Social Account Registration Wallet

· Paying GAS with Native Coin

· And more

This paves the way for future new users to heavily use stablecoins, solving the last-mile problem.

Furthermore, once stablecoins receive legislative support, deposits and withdrawals will become even easier.

Let's imagine a scenario: previously, hindered by the gray nature of stablecoins, but after the bill passes, many traditional brokerages can support stablecoins themselves. The money from a US stock investor can be converted into stablecoins in minutes and instantly deposited into Coinbase. Believe it or not.

Let's imagine another scenario: if the brilliant bill smoothly passes through the House of Representatives, next, you will see:

Due to the extremely lucrative nature of this trading, existing stablecoin leaders and newly entering traditional giants will crazily start promoting their stablecoin products.

And an outsider, due to these promotions, will start using stablecoins. And then one day, after finding out that the wallet account has been created, will explore Bitcoin inside. Is mining Bitcoin difficult?

Stablecoins are a huge Trojan horse. The moment you start using stablecoins, you unwittingly step half a foot into the Crypto world.

As a large reservoir for digesting US debt, although stablecoins cannot directly absorb debt, they at least provide ammunition for the US debt secondary market. These functions are quite important, and slowly, stablecoins are becoming a part of the US debt market's body. Therefore, once the US legislation is passed and experiences the benefits, there is no turning back.

And, we are also confident that stablecoins are indeed one of the great innovations in our industry. People who have used stablecoins will find it hard to return to the traditional cash-banking system.

Once the bill is passed, users can't go back. In the future, concerns are about to be resolved, standards will be mastered, and the era of large deposits seems to be on the horizon.

Original Article Link

After CEX and Wallet, OKX enters the payment game

Why Are Crypto Projects Rushing to Issue Credit Cards? A Battle Between Web3 and the Real World

Launch on Binance Alpha, how much is your HAEDAL airdrop worth?

Taking Stock of the Top 10 Emerging Launchpad Platforms: Who Will Succeed in Disrupting Pump.fun?

Parse Haedal Protocol: Sui Liquidity Staking Gem Project, TVL Ratio Exceeds Sum of Competitors

Stablecoin Showdown: Six Rising Stars Enter the Fray, Will the Market Structure Shift?

Deep Dive into Dubai's Crypto Dream: Illusion, Capital, and Decentralized Empire

HTX Research Latest Research Report丨Sonic: A Case Study of the New DeFi Paradigm

While the industry was still embroiled in the Layer 2 scaling debate, Sonic offered a new answer through a "foundational revolution." Recently, HTX Research released its latest research report "Sonic: A Blueprint for the DeFi New Paradigm," detailing the new public chain Sonic. While fully compatible with the EVM, Sonic has achieved a throughput of over 2000 TPS, 0.7-second transaction finality, and a transaction cost of 0.0001 USD, outperforming mainstream Layer 1 solutions and even surpassing most Layer 2 solutions. The performance-boosting Sonic is reshaping public chain infrastructure, officially ushering in the "sub-second era" of public chains.

As a high-performance public chain based on a Directed Acyclic Graph (aDAG), Fantom Opera initially stood out for its high throughput and fast confirmation capabilities. However, as the on-chain ecosystem expanded, the limitations of its traditional EVM architecture became increasingly apparent: state storage expansion, slow node synchronization, and constrained execution efficiency. To address this, Fantom introduced the new upgrade solution Sonic, aimed at achieving performance leaps through fundamental reconstruction without relying on sharding or Layer 2.

Led by the restructured Sonic Labs, Sonic's core development team brought together top industry talents, including CEO Michael Kong, CTO Andre Cronje (founder of Yearn Finance), and Chief Research Officer Bernhard Scholz. Over a period of two and a half years, the team comprehensively optimized from the virtual machine, storage engine to the consensus mechanism, ultimately creating the standalone new chain Sonic. While being EVM-compatible, Sonic has achieved over 2000 TPS, 0.7-second finality, $0.0001 transaction cost, a 90% improvement in storage efficiency, and reduced node synchronization time from weeks to within two days.

· SonicVM: The new virtual machine dynamically compiles EVM bytecode, caches high-frequency operations (such as SHA3 hashing), and pre-analyzes jump instructions, improving execution efficiency several times over to support high-throughput demands.

· SonicDB: Using a layered storage design, it separates real-time state (LiveDB) from historical data (ArchiveDB), compressing storage space by 90%, reducing node maintenance thresholds, and enhancing decentralization.

· Sonic Gateway: A Layer 2-like cross-chain bridge to Ethereum, balancing security and efficiency through a batch processing mechanism, supporting bi-directional asset migration, and seamless integration with the Ethereum ecosystem.

Sonic introduces its native token S, exchanged 1:1 with the old token FTM, undertaking functions such as gas payment and governance staking. Its innovative mechanisms include:

· Gas Fee Monetization (FeeM): Developers can receive up to 90% of transaction fee sharing, incentivizing ecosystem app innovation; non-FeeM apps have 50% of fees burned to deter inflation.

· Point Airdrop System: Users earn points (Passive/Activity Points and Gems) through holding tokens, participating in DeFi, or ecosystem interactions, redeemable for a total of 200 million S tokens, creating a "usage is mining" positive feedback loop.

During the market downturn in 2025, Sonic's on-chain TVL grew over 500% against the trend, with stablecoin volume surpassing $260 million, driven by high-leverage yield strategies:

· Silo v2 Recurring Borrowing: Pledge S tokens to borrow stablecoins, leverage up to 20x, capturing multiple points and spread yields.

· Euler+Rings Combination: Deposit USDC to mint overcollateralized stablecoin scUSD, leverage up to 10x, while receiving Sonic points and protocol airdrops.

· Shadow DEX Liquidity Mining: Provide liquidity for mainstream trading pairs, earning up to 169% APY and receiving a share of trading fees.

The ecosystem's future plans involve introducing Real World Asset (RWA) yields and off-chain payment scenarios, expanding through compliant asset backing and consumer app integration, establishing a sustainable stablecoin utility loop.

Sonic's core DEX, FlyingTulip, designed by Andre Cronje, integrates trading, lending, and leverage functions, with key technological breakthroughs including:

· Adaptive AMM Curve: Combining Curve V2's liquidity aggregation advantage, introducing external oracle monitoring of volatility, dynamically adjusting the curve shape—close to a constant-product curve during low volatility (low slippage), and approaching a constant-product curve during high volatility (preventing liquidity depletion), reducing impermanent loss by 42%, and improving capital efficiency by 85%.

· Dynamic LTV Lending Model: Drawing inspiration from Curve's LLAMA liquidation mechanism but dynamically adjusting the loan-to-value (LTV) ratio based on market volatility. For example, the ETH collateral loan-to-value ratio can plummet from 80% during calm periods to 50% during volatile periods, reducing systemic risk.

With its triple advantage of "high performance + nested yield + low threshold," Sonic is expected to exceed $2 billion in TVL within 12 months, and its token S may impact billions of dollars in market capitalization. Its model has established a new paradigm for the industry: replacing liquidity speculation with on-chain efficiency and real returns, potentially triggering a fundamental shift in the logic of public chain competition.

Potential risks are concentrated at the technical level, including the Adaptive AMM relying on an external oracle, which could result in liquidity pool anomalies if the price feed is attacked. High-leverage strategies face liquidation risks during extreme market conditions and require hedging tools (such as perpetual contract shorts) to manage volatility.

From a macro perspective, Sonic is poised to be the dark horse in the 2025 DeFi revival wave, with the success of its stablecoin ecosystem creating broad upside potential for the ecosystem token S and overall network value. Sonic's rise validates a key proposition: even in a bear market, through mechanism innovation and performance breakthroughs, DeFi can still build a "yield fortress" to attract rational capital for long-term retention. Its nested yield model, developer incentive system, and efficient infrastructure provide the industry with a reusable template. If successfully integrated with RWAs and payment scenarios, Sonic may become a bridge connecting on-chain yield with real economic demand, propelling DeFi into a new stage of mass adoption.

To read the full report, please visit: https://square.htx.com/wp-content/uploads/2025/04/HTX-Research-Latest-Report.pdf

HTX Research is the dedicated research arm of HTX Group, responsible for in-depth analysis of a wide range of areas including cryptocurrency, blockchain technology, and emerging market trends. HTX Research produces comprehensive reports, offers professional evaluations, and is committed to providing data-driven insights and strategic foresight. It plays a key role in shaping industry perspectives and supporting informed decision-making in the digital asset space. With rigorous research methods and cutting-edge data analysis, HTX Research always remains at the forefront of innovation, driving industry thought leadership and facilitating a deep understanding of the evolving market dynamics.

From Cantor to Securitize, Crypto Industry Buys Up Washington

WLFI Holdings Token Analysis: Did the Trump Family's Crypto Investment Pay Off?

This Week in Review | Trump to Host Dinner for TRUMP Holders; Musk and US Treasury Secretary Engage in Heated Argument at the White House

Key Market Information Discrepancy on April 27th - A Must-Read! | Alpha Morning Report

Cryptocurrency Market Sentiment Warms Up, MCP Emerges as New AI Frontier

Dialogue Backpack CEO: Everything is a Meme, Bitcoin is always the ultimate value

Three-Day 54% Surge: Where Does SUI's Growth Momentum Come From?

RWA Track Deep Dive Playbook: 10 RWA Projects to Watch in 2025

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Never Underestimate the Significance of the US Stablecoin 'Infrastructure Bill'

If the US stablecoin bill, the "GENIUS Act," passes smoothly this time, its significance will be tremendous. I even think it's significant enough to enter the top five in Crypto history.

Although abbreviated as the GENIUS Act, which translates directly to the Genius Act, it is actually the Guiding and Establishing National Innovation for U.S. Stablecoins, which translates to "Guiding and Establishing National Innovation for US Dollar Stablecoins."

The proposal is lengthy, with several key points summarized for everyone:

· Mandatory 1:1 Full Asset Backing: Assets include cash, demand deposits, and short-term US Treasuries. At the same time, misappropriation and rehypothecation are strictly prohibited.

· High-Frequency Disclosure: Reserve reports must be published at least monthly, introducing external audits.

· Licensing Requirement: Once the circulating market cap of the issuer's stablecoin exceeds $100 billion, it must transition into the federal regulatory system within a specified timeframe, adopting banking-grade regulation.

· Introduction of Custody: The custodian of the stablecoin and its reserve assets must be a regulated qualified financial institution.

· Clear Definition as a Payment Medium: The bill explicitly defines stablecoin as a new type of payment medium, primarily regulated by the banking regulatory system, rather than restricted by the securities or commodities regulatory system.

· Embracing Existing Stablecoins: A maximum 18-month grace period after the bill's enactment, aimed at encouraging existing stablecoin issuers (such as USDT, USDC, etc.) to promptly obtain licenses or become compliant.

After finishing the main content, let's talk about the significance of this matter with an excited heart.

Over the years, when others asked, "After working in the Crypto industry for 16 years, what application have you created?"

In the future, you can confidently tell others—Stablecoins.

Some people have held opposing views. In the past, people's impression of stablecoins was that they were an opaque black box. Every few months, there would be FUD — whether Tether's assets were frozen or Circle had a significant black hole deficit.

In fact, if you think about it, Tether easily rakes in billions of dollars a year just from the interest on those underlying government bonds. Circle, slightly less, also made a $1.7 billion profit last year.

They basically made money while standing there. From a motivational standpoint, they have no malicious intentions. In fact, they are the most eager for compliance.

Now, this opaque black box will become a transparent white box.

In the past, the only complaint was that Tether's funds might have been frozen by the United States. Now, they will be directly placed into U.S. compliant custodial institutions, with high-frequency disclosures, so you can rest assured.

【No need to worry about a rug pull】 is such a huge advantage—I think especially all Crypto people understand this.

Stablecoins were once almost on the verge of being overtaken by CBDCs. In any country, if a central bank digital currency really exists, it is highly likely not built on a blockchain, at most it is built on some internal central bank consortium chain, which to be honest, is meaningless.

When CBDCs were at their peak, that was the most dangerous time for stablecoins.

If CBDCs had become a reality back then, stablecoins today would have been relentlessly suppressed into a dark corner, and blockchain would only be able to play a minimal role.

The remaining half-dead stablecoins would even have to learn the standards of central bank digital currencies, completely relinquishing their standard-setting power.

And now, stablecoins have won (or are about to).

Instead, everyone should learn the 【Blockchain + Token】 standard.

Nowadays, many blockchains actually have no meaningful applications on top, only stablecoin transfers. For example, with Aptos, the only scenario I use Aptos for is transfers between Binance and OKX.

And now, stablecoins will be legislated, what does that mean?

That's right, blockchain will become the only standard.

In the future, every stablecoin user will be the first to learn how to use a wallet.

As an aside, I actually think Ethereum's concerted push for EIP-7702 is quite forward-thinking. While other chains are all about memes, thank you Ethereum for sticking to account abstraction.

EIP-7702 is about Account Abstraction, which can support, for example:

· Social Account Registration Wallet

· Paying GAS with Native Coin

· And more

This paves the way for future new users to heavily use stablecoins, solving the last-mile problem.

Furthermore, once stablecoins receive legislative support, deposits and withdrawals will become even easier.

Let's imagine a scenario: previously, hindered by the gray nature of stablecoins, but after the bill passes, many traditional brokerages can support stablecoins themselves. The money from a US stock investor can be converted into stablecoins in minutes and instantly deposited into Coinbase. Believe it or not.

Let's imagine another scenario: if the brilliant bill smoothly passes through the House of Representatives, next, you will see:

Due to the extremely lucrative nature of this trading, existing stablecoin leaders and newly entering traditional giants will crazily start promoting their stablecoin products.

And an outsider, due to these promotions, will start using stablecoins. And then one day, after finding out that the wallet account has been created, will explore Bitcoin inside. Is mining Bitcoin difficult?

Stablecoins are a huge Trojan horse. The moment you start using stablecoins, you unwittingly step half a foot into the Crypto world.

As a large reservoir for digesting US debt, although stablecoins cannot directly absorb debt, they at least provide ammunition for the US debt secondary market. These functions are quite important, and slowly, stablecoins are becoming a part of the US debt market's body. Therefore, once the US legislation is passed and experiences the benefits, there is no turning back.

And, we are also confident that stablecoins are indeed one of the great innovations in our industry. People who have used stablecoins will find it hard to return to the traditional cash-banking system.

Once the bill is passed, users can't go back. In the future, concerns are about to be resolved, standards will be mastered, and the era of large deposits seems to be on the horizon.

Original Article Link