Bitcoin Miner Survival Threshold: Plummeting Transaction Fees and Soaring Costs, What Lies Ahead?

Original Article Title: "Bitcoin Miners' Survival Line: Plunging Transaction Fees and Soaring Costs, What Lies Ahead?"

Original Article Author: Alvis, Mars Finance

Bitcoin is now at a real risk of being "done for" without a new ecological hotspot. Miners' survival pressure has reached its limit, with transaction fees plummeting and costs skyrocketing, causing many small miners to consider shutting down. Once miners start to exit, hash rates decrease, block generation slows down, and the network's security is threatened. Moreover, in a situation of price instability, without new ecological developments to drive demand growth, Bitcoin will fall into a downward spiral.

Income Squeeze: Miners' Profits Face Multiple Pressures

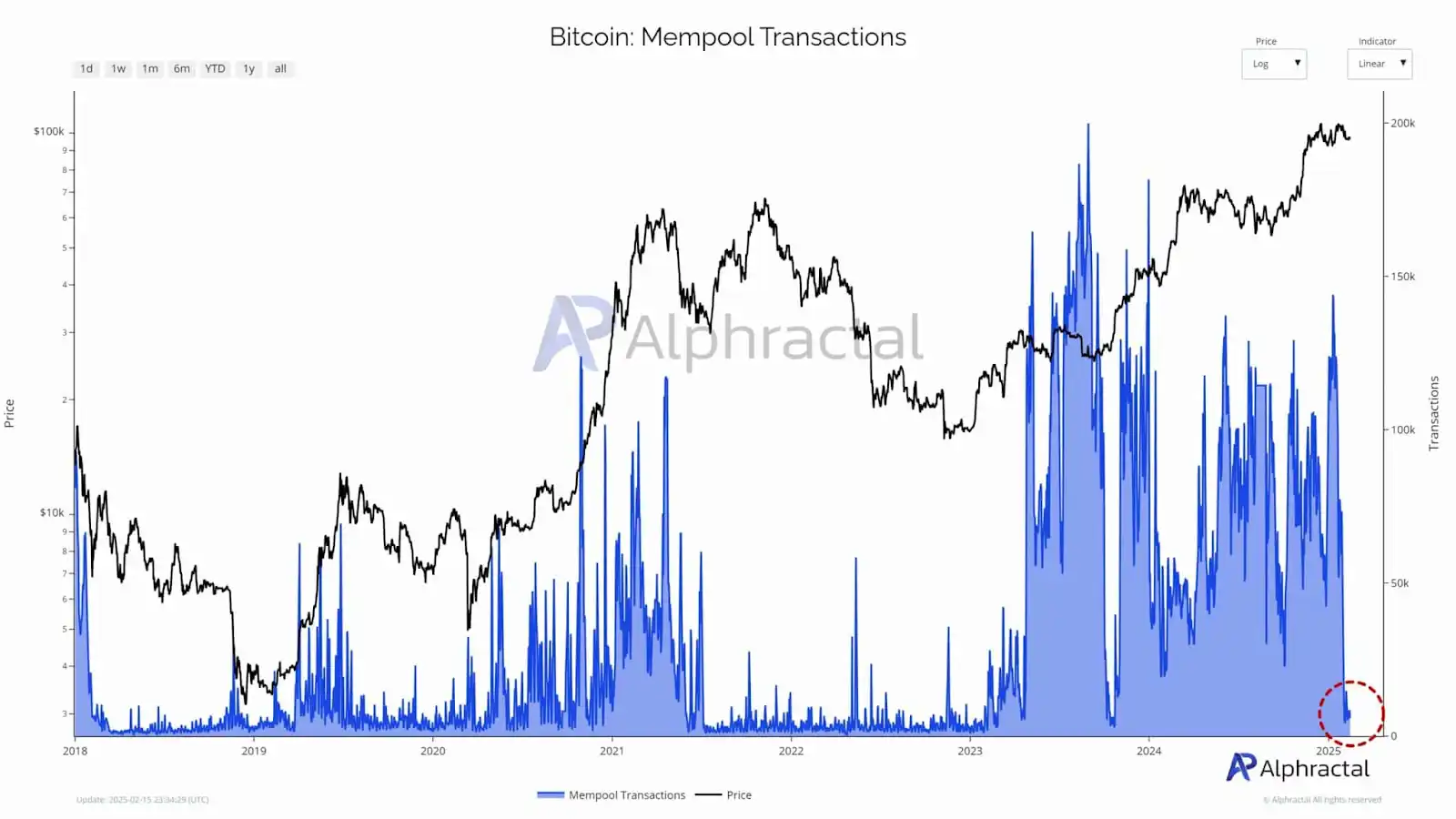

The profitability of Bitcoin mining has significantly deteriorated, with several key indicators showing a weakening profit potential. Firstly, the unconfirmed transactions in the Bitcoin memory pool have dropped to a multi-year low, indicating reduced network demand, directly impacting miners' transaction fee income. Historically, a decrease in transaction activity has often led to a bear market, which, although not necessarily implying a price drop, may suggest structural changes in the network.

Furthermore, the gradual decline of SegWit transaction types has reduced network efficiency, further increasing block space requirements, squeezing miners' income potential. Despite the rise in Bitcoin prices, the downward trend in revenue highlights the impact of rising network difficulty and intensified competition.

Industry Consolidation Accelerates: Small Miners Face Exit Risk

A key miner indicator, revenue/hash rate, is at a historical low, with diminishing returns indicating that rising network difficulty and intensified competition are eroding profitability.

With the block reward halving, particularly small miners are facing survival pressure. Decreased profitability and reduced transaction fee income put small enterprises at risk of exiting the market, accelerating industry consolidation. In the future, only well-capitalized, technologically advanced large miners will be able to maintain competitiveness, leading to increased market concentration.

Network Difficulty Increases: Rising Costs Force Miners to Seek Survival Strategies

Bitcoin network difficulty has hit a new high, putting miners under greater cost pressure. With rising energy and hardware costs, especially for small miners with outdated equipment, survival pressure intensifies. Some miners are turning to low-cost, sustainable energy sources, such as hydroelectric or geothermal power, while some mining companies are seeking breakthroughs through diversified income sources or mergers and acquisitions.

This trend may accelerate the centralization of the industry, where the most well-capitalized and efficient miners will take the lead, impacting Bitcoin's decentralized nature. In the future, changes in miners' geographic distribution and mining security practices may raise concerns about network security.

Market Rebalancing: Increased Industry Threshold

As operating costs continue to rise, inefficient miners will be eliminated, leading to a natural industry "rebalancing." This change may further promote industry centralization, where only large-scale miners can survive in fierce competition, solidifying Bitcoin mining as a high-threshold industry.

However, market centralization also raises questions about Bitcoin's decentralized ethos. The reduction of dominant miners could concentrate network security in the hands of a few miners, potentially affecting the network's long-term stability and resistance to censorship.

Impact on Bitcoin

In the short term, Bitcoin miners face dual pressure from declining transaction fees and rising costs, which may cause small miners to exit the market, leading to a decrease in network hashrate and tightening Bitcoin supply. The compression of miner revenue may affect market confidence in Bitcoin, causing short-term price volatility and possibly threatening the network's decentralization, introducing security risks.

In the long run, with technological innovation and optimized energy costs, miners may regain some profitability, lower operating costs, helping alleviate profit pressures and stabilize the market. While there may be short-term downward price risks, with sustained demand growth and tightened supply, Bitcoin prices may trend upward in the long term, especially as market demand for Bitcoin steadily increases.

Bitcoin currently urgently needs a new ecosystem, clearly more than just speculative trading of "buying the dip." It needs more use cases, smart contracts, decentralized applications, and even a brand-new financial system to support it.

If Bitcoin lacks a strong enough ecosystem, once miners cannot maintain profitability, the entire network's operation will become challenging, and market trust in Bitcoin will be shaken. Miner exodus could be a "crisis" in Bitcoin's future outlook, while ecosystem development flourishing is the key to Bitcoin's survival.

Disclaimer: This article does not constitute investment advice. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances and comply with relevant laws and regulations in their country or region.

You may also like

X Pulls the Plug — the Era of “Talking Your Way to Traffic” Comes to an End.

Other people’s traffic will always belong to them—not to you.

First Zero, First Revival: A Real Story from the WEEX Global AI Trading Hackathon Preliminary Round

WEEX Labs, the innovation arm of the global crypto exchange WEEX, launched the preliminary round of its flagship AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by world-class sponsors including AWS, the prize pool has reached $1.88 million, with a Bentley Bentayga S awaiting the champion in Dubai. Already, 788 elite teams worldwide are battling for a spot in the finals. This is more than a hackathon — it is a real-market stress test for AI trading. Registration remains open until January 18. If you want your AI to face real volatility, this is your moment.

AI Wars: WEEX Alpha Awakens – Insights, Top Strategies, and Real-Market Execution Takeaways

WEEX Labs has officially launched the preliminary round of its global AI trading hackathon, AI Wars: WEEX Alpha Awakens, bringing together hundreds of elite teams to compete in real-market conditions. With a record-breaking $1.88 million prize pool and backing from top-tier sponsors like AWS, the event has quickly become a global proving ground for AI-powered trading strategies. As competition intensifies and standout teams emerge on the leaderboard, the hackathon not only showcases cutting-edge AI execution and risk management, but also offers valuable insights and inspiration for traders looking to build or refine their own AI-driven systems.

WEEX P2P now supports Polish zloty (PLN)—new users and merchant rewards

To make crypto deposits easier, WEEX has officially launched its P2P trading platform and continues to expand fiat support. We're excited to announce that the Polish Zloty (PLN) is now available on WEEX P2P!

Layoffs of 30%, But Spending $250 Million to Buy a Company - What Is Polygon Thinking?

Sentient Reveals Tokenomics, How Will the Market Price It?

AI in the Crypto Market: How Artificial Intelligence is Changing Trading Strategies

This article explores how AI contributes to these movements and share practical strategies to help you navigate an AI-powered crypto market.

Yen Weakness Nears Inflation Red Line: Bank of Japan May Be Forced to Hike Early

Cross-chain Collaboration: Tom Lee Invests $200 Million, Joins Forces with Global Top Streamer Mr. Beast

Interactive Brokers Integrates USDC, US Bank Questions Stablecoin, What's the Overseas Buzz?

Trump Waves Hand, Stirs Venezuela's Game Hurricane

The Genius Stopping Law: Why Did Coinbase Backpedal at the Eleventh Hour?

Fact Check: How Much Money Did the University of Chicago Lose in its Crypto Investment?

Rumor has it that Coinbase is set to acquire Farcaster, still an Acquihire.

VanEck Q1 Market Outlook: Long-Term Bullish on Cryptocurrency, Strong Gold Demand

In the span of a week, what does Twitter's continuous updating on the Coin Circle Plate reform and Musk's intentions mean?

By seizing the first five seconds of Gold Dog, "Dry Sitting P Junior" earns $430,000 in 30 days.

DAU of 8? The Data Truth in the Solana vs. Starknet Public Opinion Battle

X Pulls the Plug — the Era of “Talking Your Way to Traffic” Comes to an End.

Other people’s traffic will always belong to them—not to you.

First Zero, First Revival: A Real Story from the WEEX Global AI Trading Hackathon Preliminary Round

WEEX Labs, the innovation arm of the global crypto exchange WEEX, launched the preliminary round of its flagship AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by world-class sponsors including AWS, the prize pool has reached $1.88 million, with a Bentley Bentayga S awaiting the champion in Dubai. Already, 788 elite teams worldwide are battling for a spot in the finals. This is more than a hackathon — it is a real-market stress test for AI trading. Registration remains open until January 18. If you want your AI to face real volatility, this is your moment.

AI Wars: WEEX Alpha Awakens – Insights, Top Strategies, and Real-Market Execution Takeaways

WEEX Labs has officially launched the preliminary round of its global AI trading hackathon, AI Wars: WEEX Alpha Awakens, bringing together hundreds of elite teams to compete in real-market conditions. With a record-breaking $1.88 million prize pool and backing from top-tier sponsors like AWS, the event has quickly become a global proving ground for AI-powered trading strategies. As competition intensifies and standout teams emerge on the leaderboard, the hackathon not only showcases cutting-edge AI execution and risk management, but also offers valuable insights and inspiration for traders looking to build or refine their own AI-driven systems.

WEEX P2P now supports Polish zloty (PLN)—new users and merchant rewards

To make crypto deposits easier, WEEX has officially launched its P2P trading platform and continues to expand fiat support. We're excited to announce that the Polish Zloty (PLN) is now available on WEEX P2P!