Life charts can't cure anxiety, and predicting the market can't foresee the outcome

Source: TechFlow (Shenchao)

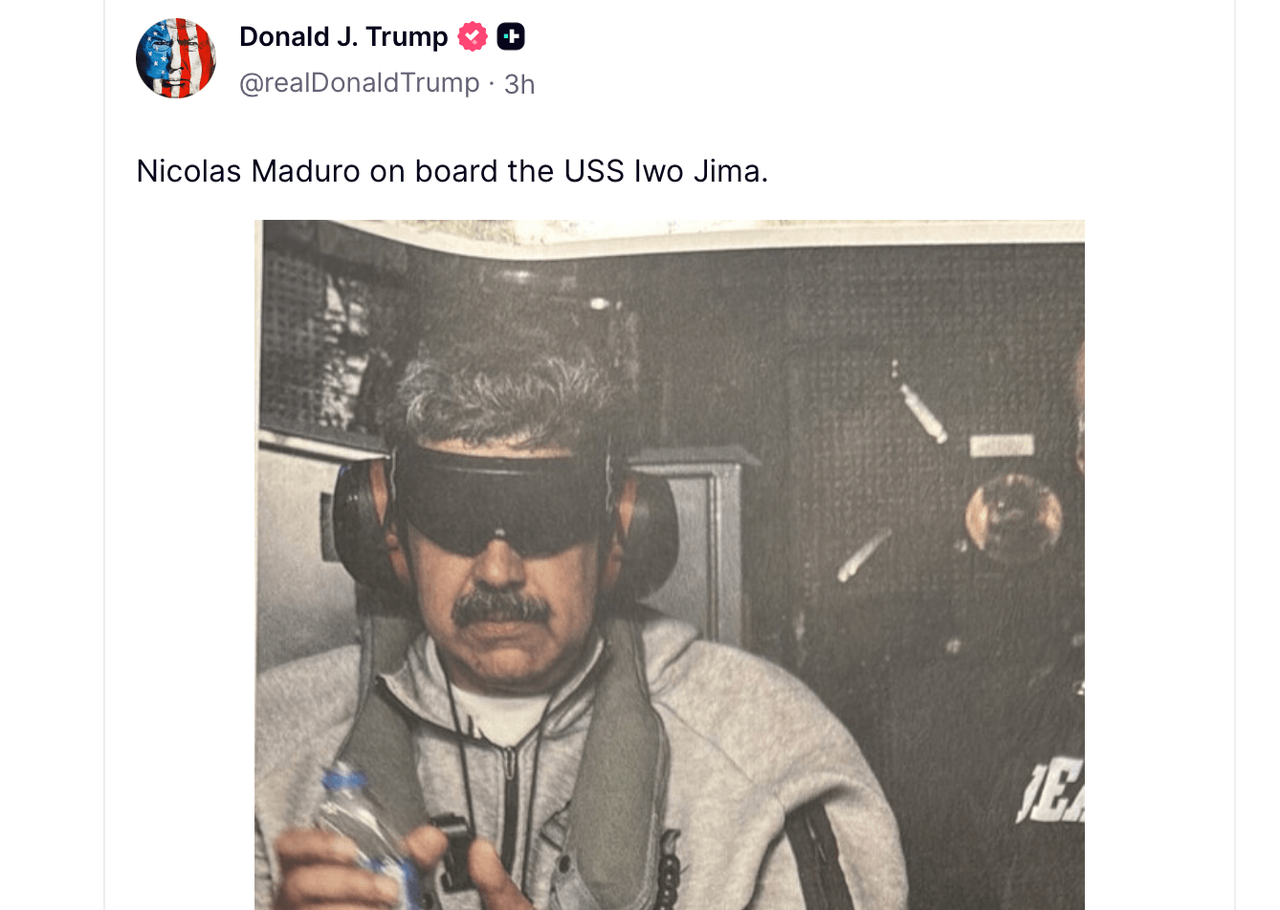

At the beginning of 2026, a sudden geopolitical event shocked the world: On January 3, the United States launched a military operation codenamed "Operation Absolute Resolve," successfully capturing President Nicolás Maduro and his wife Celia Flores, and quickly transporting them to New York to face criminal charges in Manhattan federal court, including drug terrorism conspiracy, cocaine import conspiracy, and weapons charges.

Despite the long-standing standoff between the US and Venezuela, the secrecy and explosiveness of this operation completely defied expectations. Just 24 hours before the raid, everything seemed normal in Caracas, with no public signs of a breakdown in diplomatic efforts. This event quickly made global headlines, not only for its political significance but also because it revealed a stark reality: true historical turning points often occur in the blink of an eye.

Just before the raid, contracts on Polymarket betting on Maduro's potential removal from power were trading at only about 5 to 7 cents, meaning the market generally considered him extremely safe in the short term. No one anticipated his arrest, which brought huge profits to traders who placed bets shortly before the operation was made public.

Despite the unpredictability of life, humanity's desire to predict the future has never been more urgent. At the end of 2025, two tools unexpectedly formed a kind of intertextuality: one is the "life chart," which visualizes the Chinese astrological system, and the other is a prediction market that presents odds on global events.

We attempt to use the former to calculate an individual's fate and the latter to predict the world's destiny. What they both promise is a quantifiable future.

Life charts, through symbolic visualization, provide a sense of certainty; prediction markets, through price signals, offer probabilistic certainty. It seems that by reading these signals early enough, we can prepare in advance, hedge against uncertainty, and seemingly gain a head start. But is this truly the case?

The viral popularity of life charts reflects a psychological need for certainty. Users input their birth information, AI automatically generates a chart, predicts major life cycles, and outputs a candlestick chart; the fluctuations of the graph provide a readable life curve. Under the dual pressures of employment and emotional fluctuations, it acts as a coordinate axis, providing a framework for self-narration and emotional catharsis. This candlestick chart doesn't sell science, but rather meaning and comfort—unquestionable emotional value.

Prediction markets, on the other hand, promise verifiable predictions through financialized language. In 2025, Polymarket and Kalshi dominated the prediction market sector, with sports, political, and economic events becoming predictable and betting targets, and trading volume extending from peak election periods to everyday life. Platforms allowed users to place bets with real money, and prices formed a probabilistic consensus amidst liquidity and divergence.

Amidst the triple anxieties of economic volatility, geopolitical tensions, and AI disruption, young people don't need accurate predictions, but rather the illusion that their destiny is in their hands. These two types of tools offer two heterogeneous forms of "control," seemingly allowing them to hedge against macroeconomic risks and gain an edge in an uncertain world by simulating life and event trajectories in advance.

However, such preparation inevitably has limitations and even carries significant risks. Cultural biases introduced by model training, algorithmic black boxes, and "black swan" events like Maduro's arrest all demonstrate the questionable accuracy of future predictions.

But such preparation inevitably has limitations and carries significant risks. Cultural and algorithmic biases introduced by model training, and the risks of black swan events, all indicate that the true accuracy of future predictions is questionable. The risks of over-focusing on predictions cannot be ignored. While life charts may be presented as entertainment, they can influence crucial individual choices. Cases of market manipulation are frequent, with insider trading and large-scale price manipulation being proven realities.

But this isn't the most dangerous aspect. A deeper crisis lies in the fact that the act of observation itself can interfere with the system, a concept already metaphorically described by Heisenberg's uncertainty principle. The more users blindly trust the probabilities output by tools, the more likely they are to lose their keen intuition for sudden risks. We stare at dashboards for so long that we forget to look up and see where we're going.

Predictive tools can identify trends, but they can never foresee true turning points. They are rearview mirrors, reflecting current anxieties and consensus, but unable to become searchlights illuminating the fog.

Ultimately, uncertainty is the underlying code of the world. After the frequent black swan events of 2025, the best preparation is not staring at candlestick charts or odds on a screen, but acknowledging the limitations of algorithms.

After all, real life often unfolds beyond the candlestick charts. Going with the tide and building individual resilience amidst immense uncertainty may be the only true path we can truly grasp.

You may also like

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

US Senate Agriculture Committee Schedules January 27 for Crypto Market Structure Hearing

Key Takeaways The Senate Agriculture Committee will release its crypto market structure bill on January 21, followed by…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

BitGo’s Revenue Surges with Upcoming IPO as Institutional Interest Grows

Key Takeaways BitGo, a major player in cryptocurrency custody, aims to raise $201 million through a U.S. IPO…

80% of Oil Revenue Settled in Stablecoins: Venezuela’s USDT Dominance

Key Takeaways Venezuela’s economy heavily relies on USDT, with 80% of oil revenue settled using this stablecoin, showcasing…

Key Market Intelligence on January 13th: What You May Have Missed

Key Takeaways The “Clarity Act” draft suggests that users can only earn interest by holding stablecoins, indicating significant…

Life Candlestick Drama Escalates: Fund Established, ‘Cyber Altruism Box’ Feature Launched; Founder Denies Meme Coin Issuance

Key Takeaways The “Life K-Line” phenomenon combines traditional Chinese astrology with modern stock chart analysis, rapidly gaining popularity…

Is the WEEX AI Trading Hackathon Worth Joining? $1.88M Prize Pool and Rules Explained

An AI trading competition with a $1.88M prize pool — explore WEEX AI Trading Hackathon rules, OpenAPI trading, and AI-only participation requirements.

Wintermute's 28-Page Report Unveils the Inner Workings of Off-Chain Liquidity

Key Market Intelligence on January 13th, how much did you miss?

After Stepping Down as Mayor of New York City, He Pivoted to Selling Cryptocurrency

AI Crypto Trading in 2026: How AI Assistants Are Reshaping Trading Platforms and Strategies

Learn how AI assistants support crypto trading decisions, improve risk awareness, and are becoming part of modern trading platforms and exchanges.

A computation bug that allowed Truebit to be hacked for 8535 ETH

Life Candlestick Drama Escalates: Fund Established, 'Cyber Altruism Box' Feature Launched; Founder Denies Meme Coin Issuance

Dubai Bans Privacy Coins and Updates Stablecoin Regulations

Key Takeaways The Dubai Financial Services Authority (DFSA) has completely prohibited privacy tokens within the Dubai International Financial…

Binance Lists United Stables as a New Trading Option

Key Takeaways Binance is adding United Stables (U) to its platform, expanding its offerings in digital currencies. United…

Space Featured in Binance Research Ecosystem Report: Key Signals of the Predictive Market Leverage Layer are Emerging

2026 Top Transaction Themes: Trump's Sore-Loser Attitude, the End of the International Order

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

US Senate Agriculture Committee Schedules January 27 for Crypto Market Structure Hearing

Key Takeaways The Senate Agriculture Committee will release its crypto market structure bill on January 21, followed by…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

BitGo’s Revenue Surges with Upcoming IPO as Institutional Interest Grows

Key Takeaways BitGo, a major player in cryptocurrency custody, aims to raise $201 million through a U.S. IPO…

80% of Oil Revenue Settled in Stablecoins: Venezuela’s USDT Dominance

Key Takeaways Venezuela’s economy heavily relies on USDT, with 80% of oil revenue settled using this stablecoin, showcasing…

Key Market Intelligence on January 13th: What You May Have Missed

Key Takeaways The “Clarity Act” draft suggests that users can only earn interest by holding stablecoins, indicating significant…