WEEX Position Airdrop is Live Now!

For many newcomers to futures (or anyone without a mature trading routine), the real hurdle isn’t “reading the market” — it’s placing that very first order. Traditional “contract trial bonus” campaigns still require users to pick a pair, direction, and leverage themselves, creating both psychological and operational friction.

WEEX’s Position Airdrop is built to solve exactly that: it merges “reward credited” with “live position opened.” As soon as you claim it, you receive a pre-opened contract position. This lowers the learning barrier and lets users focus on what actually matters: managing the position, controlling risk, and planning exits.

This article will quickly walk you through what a Position Airdrop is, its advantages, and how to use it.

What is Position Airdrop ?

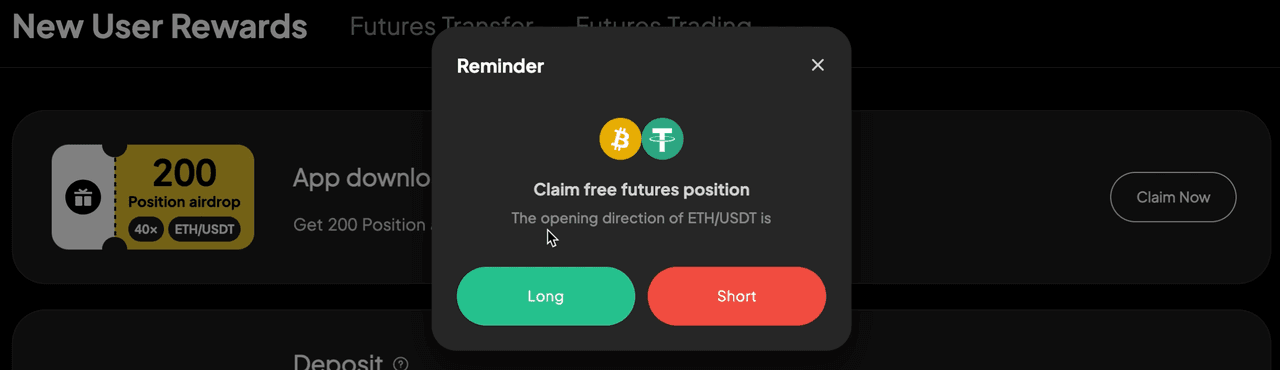

Position Airdrop is like the platform handing you a “ready‑to‑go live futures ticket.” You choose long or short, tap confirm, and a real futures position is instantly opened at market price. In other words: the moment you receive the airdrop, you’re already on the field, experiencing an actual contract trade.

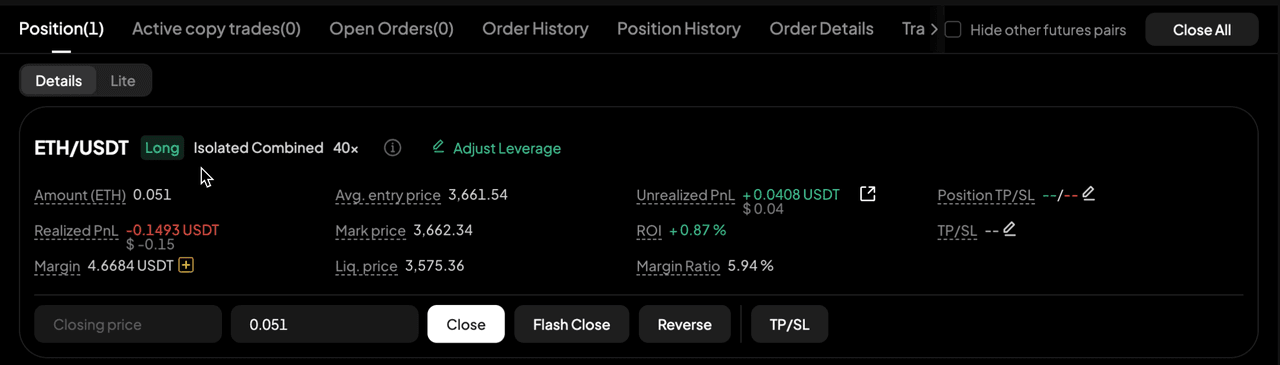

After claiming, you can manage it just like any normal position:

- Set / adjust take-profit and stop-loss

- Close (partial or full)

- Add or remove margin (including adding your own funds)

- After closing, use any remaining trial funds to open new positions (within the validity period)

In one line: Position Airdrop turns “reward credited → user places an order” into “reward credited = position already live,” letting users skip the hesitation phase and practice the core skills immediately.

Difference between a Position Airdrop and a trial futures bonus?

Core difference: Position Airdrop streamlines the very first opening trade, letting users enter the core loop of managing and reviewing positions with minimal psychological burden.

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

Dimension | Position Airdrop | Trial Funds (Futures bonus) |

Distribution method | System automatically places an order to open a position.The user only needs to pick a direction. | Funds are distributed to the user's futures account |

How to Use | No manual setup: once claimed, you go straight to managing the position. | After claiming, the user must still choose pair, direction, leverage, etc., and then open a position. |

Entry threshold | Low, no need to understand leverage or order flow | Relatively high, the user needs to understand the order process and parameter settings |

User Experience | Faster entry into live position management and P&L feedback. | Fully goes through choosing every order parameter. |

Feature Highlights of Position Airdrop

1. Position instantly live upon claim—straight to core actions

Once claimed, the system auto-creates your first real futures position. Pair, leverage, position size, and margin mode are preconfigured; you only choose long or short and can immediately focus on stop placement, risk monitoring, and locking in profits—skipping the typical beginner friction of selecting instruments, leverage, and modes.

2. The remaining trial margin is reusable for iterative practice

Any unconsumed trial funds after closing can be redeployed, letting one allocation power multiple strategy drills: first timely stop-loss discipline, then staged take-profits, then trailing stops and margin adjustments—forming a progressive skill ladder instead of a one‑and‑done burn.

3. Real matching and real fee feedback accelerate leverage intuition

Once the position goes live, users feel real fills, P&L, fees, and funding—seeing how small capital scales into bigger exposure and that gains and risks grow in tandem

User Experience Flow

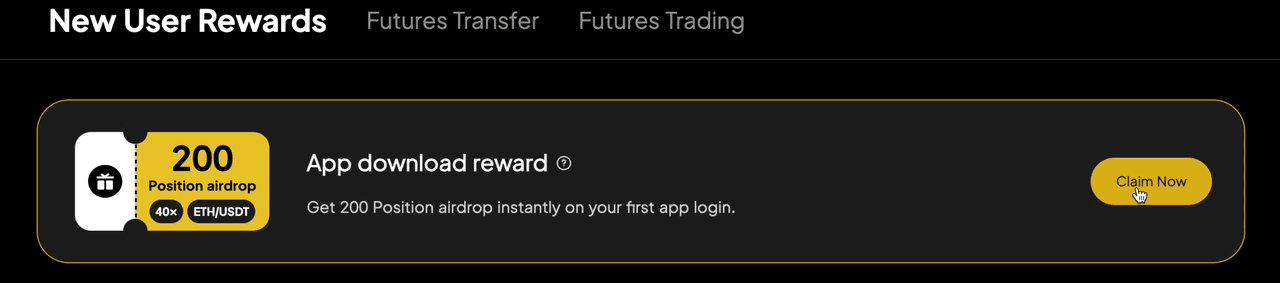

- In any campaign that offers a Position Airdrop , complete the required tasks and then claim the reward directly on the campaign page.

- Tap Claim and a Buy/Sell dialog appears. Simply choose Long or Short—your first position is created instantly.

- Once created at market price, you can manage the position: set or edit take‑profit / stop‑loss, partially or fully close it, and add or remove margin from the Positions (Orders) screen.

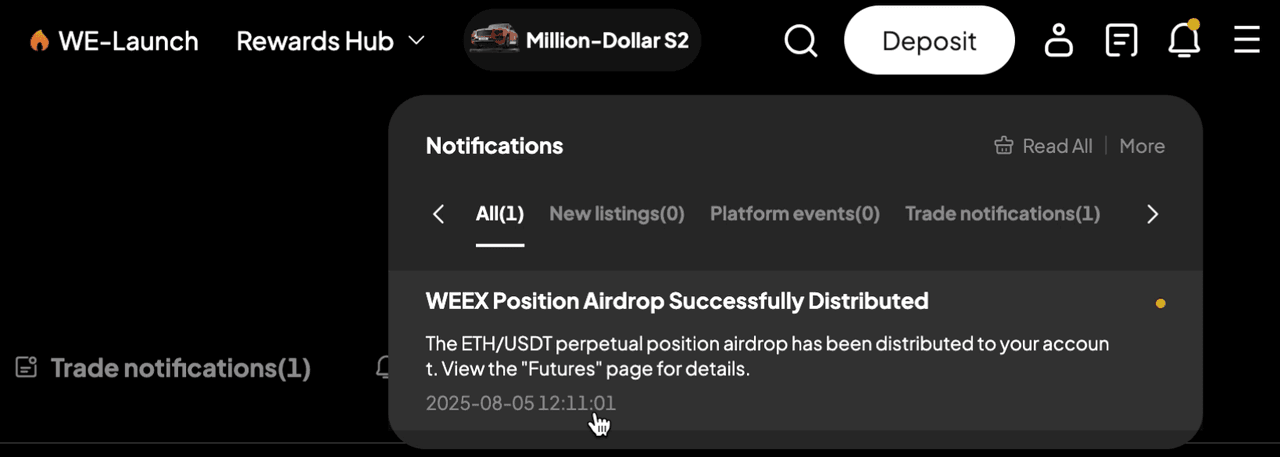

- After a successful claim, an in‑app message confirms the position is live. You can review and manage it from the Futures page.

FAQ

1. Position Airdrop Reclaim Rules

Futures bonus follows the same expiration mechanics as other trial funds

- The unused amount will be reclaimed upon expiration

- Futures bonus will also be reclaimed if the user transfers it out of the futures account

2. What if a user already holds the same position?

The system will add margin to the existing position.

If direction, pair, leverage, and margin mode all match, the system treats this as an add-margin operation and updates average open price and unrealized PnL accordingly.

3. Will the position created by a Position Airdrop be automatically closed if the user doesn’t close it after the 7-day validity period?

No, it will not be automatically closed. Similar to trial funds, the position will remain open even after the bonus expires. Users must manually close the position themselves.

You may also like

Which 4 Chinese Meme Coins Are Tredning in January 2026?

Unlike previous cycles driven by Western internet culture, this surge is deeply rooted in Chinese slang, social satire, and high-context humor. Fueled by the low-fee BNB Chain ecosystem, viral narratives, and rapid speculative capital, several projects saw exponential growth in a remarkably short time.

What defined the top Chinese meme coin trend in January 2026 was not just price action, but the unprecedented speed at which these tokens achieved multi-million dollar market capitalizations without any traditional fundamentals. This article analyzes the four names that dominated the narrative: 我踏马来了, 人生K线 , 币安人生, and 哈基米.

Key TakeawaysThe Chinese meme coin market in January 2026 was dominated by tokens leveraging culturally familiar phrases and high-velocity trading on BNB Chain, rather than utility.Narrative strength and cultural resonance proved more critical for short-term momentum than technological innovation or roadmap promises.While generating exponential returns, these assets exhibited extreme volatility. Success required strict risk management due to their reliance on concentrated liquidity and shifting trader sentiment.Chinese Meme Coin Growth in Early 2026The explosive growth in January followed a distinct, observable pattern:

Narrative-First Adoption: Success was built on pre-existing, viral Chinese internet slang, which created instant community recognition and lowered adoption barriers.BNB Chain Efficiency: The low transaction fees and fast confirmations of BNB Chain made it the preferred launchpad, attracting a dense network of active meme coin traders.Speculative Capital Rotation: After periods of consolidation in major assets, speculative capital aggressively rotated into these high-beta, culturally-themed tokens trending on Chinese crypto social media.Sentiment-Driven Valuation: Prices were almost entirely dictated by social media momentum and chart patterns, with traditional fundamentals like whitepapers or utility playing a negligible role.This environment enabled multiple projects to rocket from obscurity to eight-figure market caps within mere days.

Which Chinese Meme Coins are Trending in January 2026?Amidst numerous launches, four tokens distinguished themselves through market cap growth, trading volume, and viral narrative strength.

我踏马来了我踏马来了 became one of the fastest-rising assets of early 2026, surging into a $30–40 million market cap range with sharp volatility. Its growth was fueled by its aggressive, confident phrase which traders adopted as a hype slogan, combined with high on-chain visibility from large wallet movements that drew further attention.

Read More: What Is 我踏马来了? A New Horse Themed Meme Coin

人生K线Briefly approaching a $40+ million market cap, this 人生K线's power lay in its deeply relatable metaphor for traders, comparing life's ups and downs to a candlestick chart. Its chart-centric community fostered intense engagement through shared analysis and parabolic screenshot culture, creating a self-reinforcing momentum loop.

币安人生 (BIANRENSHENG)Reaching a peak market cap of approximately $150 million, 币安人生 was a dominant force in the sector. It benefited from implicit brand association with the leading exchange, which granted it perceived legitimacy and attracted larger traders viewing it as a more stable meme coin exposure compared to micro-cap alternatives.

Read More: What Is 币安人生 (BIANRENSHENG) and How Does It Work?

哈基米 (HAJIMI)Climbing to a $35–37 million market cap, 哈基米(HAJIMI) stood out due to its high meme adaptability. The playful, phonetically fun name was easily remixed into endless social media content, sustaining community engagement and driving consistent trading volume across multiple platforms.

Read More: What is Hajimi (哈基米)?

ConclusionThe January 2026 surge in Chinese meme coins signifies a maturation of meme-driven markets. These assets have evolved into culturally encoded financial instruments, capable of mobilizing significant liquidity through shared language and collective emotion.

The performance of 我踏马来了, 人生K线 , 币安人生, and 哈基米 cements top Chinese meme coins as a distinct and influential segment within the global crypto ecosystem. For participants, understanding the cultural context is now as essential as technical analysis. However, this exponential growth is a double-edged sword; the same velocity that creates immense opportunity also dictates the speed at which trends can reverse, demanding caution and respect for the market's rhythm.

Still wondering where to buy these trending meme coins? Look no further than WEEX. Register now to start trading instantly. Enjoy 0 trading fees and a smooth, seamless trading experience.

Further ReadingIs Dogecoin(DOGE) a Good Investment in 2026? Everything You Should KnowDogecoin(DOGE) Price Prediction: What's Next for Dogecoin(DOGE)?What Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

WEEX Trade to Earn Phase 2: Trading Discipline and Risk Management in Uncertain Crypto Futures Markets

As 2026 begins, many traders are facing a familiar frustration: the market keeps moving, but clarity doesn’t. Short, volatile swings in Bitcoin and Ethereum put pressure even on experienced traders, often leading to hesitation, overtrading, or reactive decisions that undermine longer-term strategy.

In this environment, the real challenge isn’t just predicting market direction — it’s managing one’s own reactions. Emotional responses can magnify minor price movements, especially in leveraged futures trading. Consistency, however, is often overlooked.

This is where structured reinforcement becomes relevant. Initiatives such as WEEX Trade to Earn emphasize consistent participation, encouraging discipline without influencing individual trading decisions.

From Emotional Reaction to Risk ManagementWhen markets lack clear direction, emotional reactions often step in. Left unchecked, they tend to influence execution rather than strategy, adding unnecessary friction in volatile conditions.

This is where risk management becomes essential — not as theory, but as a practical framework for maintaining consistency in uncertain markets. In crypto, volatility is inevitable, but disciplined risk management helps reduce emotional errors and support more stable execution over time.

Core principles include:

Setting realistic position sizes and stop-loss levelsDiversifying exposure across multiple assetsAvoiding impulsive trades driven by short-term price swingsA structured approach does not eliminate volatility, but it helps traders navigate it with greater discipline and consistency. How does this translate into real trading behavior during volatile moments?

Staying Calm in Volatile Markets: Real ScenariosConsider a day when Bitcoin moves 3% within an hour. Traders reacting emotionally may exit positions too early or enter impulsively. If you’ve ever closed a trade, only to watch price move exactly as planned, this scenario likely feels familiar. Traders who stick to their plan, however, maintain execution discipline and avoid unnecessary losses.

In this context, programs that offer incremental recognition for consistent execution can serve as a subtle psychological buffer. By reinforcing measured decision-making, they support disciplined behavior without interfering with the underlying strategy.

This approach is particularly valuable for moderate leverage users or those exploring algorithmic strategies, where structured reinforcement helps reduce stress and maintain rational execution during short-term swings.

A Subtle Advantage: Trade to Earn Phase 2Structured reinforcement can play a meaningful role in helping traders maintain discipline during volatile periods. By offering small, visible incentives tied to consistent execution, such mechanisms encourage steadier behavior and reduce the tendency to react impulsively to short-term market fluctuations.

One example of this approach is WEEX Trade to Earn Phase 2. The program does not alter trading strategies or risk exposure, but provides tiered recognition in WXT tokens for consistent futures participation — reinforcing disciplined execution without interfering with decision-making.

The value lies not in the reward itself, but in its psychological effect: supporting composure, confidence, and adherence to a well-defined trading plan during periods of market uncertainty.

Key Takeaways for Rational TradingTo navigate early 2026 markets more effectively:

Treat price swings as signals, not threatsAdhere to pre-defined risk limits and execution rulesSupport consistent execution through structured, participation-based mechanismsPrioritize long-term consistency over avoiding every short-term lossThese principles are increasingly reflected in exchange-level mechanisms that emphasize consistency and disciplined participation, rather than short-term risk-taking.

By combining sound strategy with emotional control, traders can navigate volatile conditions with greater clarity, resilience, and execution quality over time.

Conclusion: Consistency Over ReactionIn range-bound markets, consistency depends less on prediction and more on execution quality. Effective risk control and emotional discipline are essential — particularly in leveraged futures trading.

Mechanisms like WEEX Trade to Earn Phase 2 reinforce disciplined participation through structured recognition, supporting composure without altering strategy or increasing risk.

Over time, progress comes not from trading more, but from executing calmly, minimizing emotional errors, and allowing consistency to compound.

About WEEXFounded in 2018, WEEX has grown into one of the world’s most trusted and innovative cryptocurrency exchanges, serving over 6.2 million users across 150+ countries and regions. With more than 2,000 trading pairs and up to 400× leverage, WEEX is known for its deep liquidity, smooth trading experience, and steadfast transparency. The platform’s 1,000 BTC Protection Fund reflects its unwavering commitment to user safety and reliability.

Beyond trading, WEEX continues to lead the frontier of intelligent finance — from launching the AI Trading Hackathon to fostering a global community of traders, builders, and innovators to shape the markets of tomorrow.

Risk & Disclaimer

-Futures trading involves risk. Please manage leverage and position sizes carefully.

-All rewards are subject to the official event rules and will be distributed after the event ends.

-This article is for educational and informational purposes only and does not constitute financial, investment, legal, tax, or other professional advice.

Follow WEEX on social media:X: @WEEX_Official

Instagram: @WEEX Exchange

TikTok: @weex_global

YouTube: @WEEX_Global

Discord: WEEX Community

Telegram: WeexGlobal Group

What is Dogecoin OTC and How to Buy DOGE OTC With VND on WEEX Exchange?

For investors and traders in Vietnam, getting direct access to popular cryptocurrencies like Dogecoin (DOGE) with local currency can be challenging. Dogecoin OTC (Over-the-Counter) trading offers a solution, providing a direct and efficient way to execute significant transactions away from the public market's noise. This guide explains what Dogecoin OTC trading is, why a professional OTC desk is valuable, and gives you a clear, step-by-step walkthrough on how to buy DOGE with Vietnamese Dong (VND) using the streamlined WEEX OTC platform.

What is the Dogecoin OTC Crypto?Dogecoin OTC trading is the direct purchase and sale of DOGE between two parties, negotiated privately rather than through a public exchange's order book. These transactions are facilitated by OTC desks, which act as trusted intermediaries connecting buyers and sellers who wish to trade larger amounts.

This method is particularly suited for a high-profile asset like Dogecoin, which is known for its strong community and occasional sharp price movements. The primary value lies in executing large orders with minimal market impact. Placing a substantial DOGE order on a spot exchange can cause noticeable price slippage due to its volatility. OTC trading eliminates this by providing a fixed, pre-agreed price for the entire transaction. Additionally, it offers greater privacy and flexibility, as terms can be customized to the needs of the parties involved, which is appealing for businesses, influencers, or investors making strategic moves.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized service for executing large, negotiated digital asset trades. It operates parallel to public markets, providing a private venue for deals that are impractical on standard exchanges due to their size or the need for discretion.

Using an OTC desk provides strategic advantages: zero slippage on large orders, enhanced privacy, and flexible settlement options. For assets like Dogecoin, avoiding slippage is key to maintaining cost efficiency. OTC desks bridge traditional finance and crypto by supporting various payment methods, including local currencies like VND. This allows Vietnamese traders to convert funds seamlessly and execute trades without the constraints of exchange trading hours or order book depth.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange provides a dedicated OTC trading solution designed for secure and efficient fiat-to-crypto conversions. The WEEX OTC platform supports a wide range of trading pairs and integrates multiple payment channels, enabling the direct purchase of Dogecoin with Vietnamese Dong. The process is user-friendly, with features like WEEX OTC Quick Buy allowing for fast transactions.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Dogecoin with VND on WEEX OTC Crypto Exchange?Buy Dogecoin OTC with VND on WEEX (Web)Step 1: Select [VND] fiat currency and [DOGE] crypto, then select the payment method.

Step 2: Input the VND payment amount, then click [Buy DOGE] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Dogecoin OTC with VND on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [VND] fiat currency and [DOGE] crypto.

Step 3: Input the VND payment amount, then click [Buy DOGE] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC trading in cryptocurrency?OTC trading is the direct buying and selling of digital assets between two parties, negotiated privately through a broker or desk, rather than on a public exchange's order book.

Who typically uses Dogecoin OTC trading?Dogecoin OTC is used by individuals and entities making large transactions, such as businesses, community leaders, or investors who want to avoid moving the market price, ensure price certainty, or require a more private settlement process.

Is OTC trading safe?OTC trading is safe when conducted through reputable, established platforms like WEEX that provide secure settlement processes and vet their counterparties. The main risk, counterparty default, is mitigated by using trusted services.

Does WEEX support VND payments for OTC trading?Yes, WEEX explicitly supports Vietnamese Dong (VND) for OTC transactions, allowing users to purchase Dogecoin and other cryptocurrencies directly with their local currency.

What are the fees for OTC trading on WEEX?Fees on WEEX vary by trading pair and payment method. The platform automatically suggests the most cost-effective channel. Promotional periods with reduced or zero fees are also common.

Are there legal considerations for OTC trading in Vietnam?The regulatory environment for crypto is evolving. Users should stay informed about local regulations. Trading through internationally compliant platforms like WEEX, which implement security and compliance measures, is advisable.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

Is Dogecoin(DOGE) a Good Investment in 2026? Everything You Should Know

This Dogecoin (DOGE) analysis moves beyond the superficial "meme vs. serious asset" debate to provide a structured, fact-based framework for evaluation. It addresses the most persistent misconceptions by separating protocol mechanics, market dynamics, and social narratives, offering readers a clearer basis for informed decision-making.

Key TakeawaysDogecoin is a meme coin inspired by the Shiba Inu dog meme and launched as a way to satirize the culture around cryptocurrency in the early 2010s;DOGE has experienced several bull runs and crashes over the years, with its price ranging from $0.0000855 to $0.7376;Many experts believe that Dogecoin will continue to grow in value due to its enduring pop culture appeal, a dedicated community, and celebrity word-of-mouth.Meme coins are now an undeniable part of the crypto ecosystem. Dogecoin, launched in 2013 as a humorous critique of the market, remains the most prominent example. Its persistent relevance and dramatic price movements continue to spark the same critical question: is Dogecoin a worthwhile investment today?

On the surface, its appeal is clear: a strong, iconic brand, a dedicated community, and widespread availability on major exchanges make it highly accessible. However, a sound investment decision requires looking beyond popularity. This analysis cuts through the noise to examine the project's fundamentals, its historical patterns of volatility, and the key drivers—from social sentiment to broader market cycles—that will shape its potential in the near and long-term future.

What is Dogecoin?Dogecoin (DOGE) is a decentralized, open-source, peer-to-peer cryptocurrency, often referred to as a "meme coin". It was created in 2013 by Billy Markus and Jackson Palmer, as a fun, lighthearted alternative to Bitcoin, using the image of a Shiba Inu dog from the popular "doge" internet meme. Dogecoin is based on the Litecoin blockchain and utilizes the Scrypt algorithm.

Read More: What Is Dogecoin(DOGE) and How Does It Work?

What's Behind Dogecoin?While originating as a humorous project, Dogecoin is underpinned by a functional and transparent blockchain. Its core protocol, Dogecoin Core, is open-source software with a public development history, active node network, and verifiable on-chain data. Dismissing it as "just a meme" ignores this operational protocol layer, which forms the foundation for its market activity and utility.

Is Elon Musk Controlling Dogecoin?Elon Musk possesses significant narrative influence, capable of driving short-term price volatility through social media. However, this is distinct from protocol control. Changes to Dogecoin's core rules require consensus among developers, node operators, and miners to adopt new client software. This decentralized governance structure means no single individual controls the network's fundamental operations.

Is Dogecoin Secure?Dogecoin's security is often underestimated. By enabling Auxiliary Proof-of-Work (AuxPoW) merged mining with Litecoin, it shares the hashrate and security of a much larger mining network. This pragmatic design choice significantly raises the cost and difficulty of attacking the chain compared to a standalone network of similar market cap, providing robust protection against 51% attacks.

Dogecoin Price HistoryWhile Dogecoin's cultural appeal is well-documented, its investment thesis hinges on a concrete analysis of its market performance over time. Examining its volatile price history reveals distinct cycles that are crucial for understanding its potential future.

A brief chronological overview of its major price movements illustrates this pattern:

2013-2016: Sub-Penny Foundations ($0.0002 to ~$0.0023): Following its launch, DOGE established its baseline value in fractions of a cent. Notably, it briefly achieved higher trading volume than Bitcoin in 2014, though its market capitalization remained a fraction of the leader's, highlighting early speculative interest.2017-2018: First Major Cycle ($0.0002 to $0.017): The 2017 bull run propelled DOGE to a 15x gain, culminating in a peak near $0.017 in early 2018. This was followed by a characteristic ~80% drawdown, establishing the volatile boom-bust pattern that would define its trajectory.2018-2020: Consolidation and Meme Revival ($0.002 to $0.006): Prices stabilized at low levels, with a minor spike in mid-2020 fueled by a viral TikTok campaign. This period underscored the coin's dependence on social momentum rather than organic, utility-driven growth.2021: The Supercycle and Celebrity Catalyst (<$0.01 to $0.74): Driven overwhelmingly by retail frenzy and high-profile endorsements, DOGE experienced a parabolic rise exceeding 800% in a single day at its peak. It briefly reached a market cap over $39 billion before sharply correcting, perfectly mirroring and amplifying the broader market's speculative top.2022-2024: Post-Peak Volatility and Stabilization ($0.06 to ~$0.22): Entering a bear market, DOGE retraced significantly from its all-time high. It has since experienced rallies and corrections tied to broader market sentiment and specific events (e.g., passing of the Shiba Inu mascot), trading within a lower, yet still volatile, range.The key takeaway from this history is not just volatility, but resilience through narrative. Unlike many altcoins that fade after a cycle, Dogecoin has repeatedly reignited. Its price action demonstrates a consistent sensitivity to social sentiment and celebrity influence, making its future value less a function of technological roadmaps and more a gauge of cultural relevance and market-wide risk appetite. This historical pattern suggests that its potential for future growth remains intrinsically linked to its ability to capture the crowd's imagination during the next wave of market optimism.

Is Dogecoin(DOGE) a Good Investment in 2026?Broadly speaking, the cryptocurrency landscape exhibits outsized volatility relative to stocks or bonds. Dogecoin takes this idea to a whole new level, though. Ultimately, the token is a highly speculative investment opportunity in a still-evolving market.

ConclusionDogecoin(DOGE) represents a unique convergence of enduring internet culture and a functioning cryptocurrency. Its long-term trajectory depends not on blanket dismissal or unquestioning belief, but on a clear-eyed analysis that separates its verifiable technological and economic attributes from the noise of social media narratives. A disciplined focus on the protocol's fundamentals, combined with an understanding of its distinct market drivers, provides the most reliable foundation for any engagement with the asset.

Ready to trade Dogecoin(DOGE) and ohther memecoins?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingHow to Trade Dogecoin(DOGE) Futures on WEEX?Dogecoin(DOGE) Price Prediction: What's Next for Dogecoin(DOGE)?What Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Auto Earn vs. Staking: Which is Better for You?

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Read More: What's WEEX Auto Earn and How to Use It?

What is Crypto Staking?Crypto Staking is the process of locking digital assets to support a Proof-of-Stake (PoS) blockchain network. By participating, users help validate transactions and maintain network security while earning rewards—without the energy-intensive mining required in Proof-of-Work systems like Bitcoin.

There are two main roles:

Validators run nodes and verify transactions, often requiring a significant stake (e.g., 32 ETH on Ethereum).Delegators contribute smaller amounts to validators and share in the rewards proportionally.Staking strengthens network security—the more assets are staked, the higher the cost to attack the chain. It offers a sustainable way for holders to grow their crypto while supporting the ecosystem's health and decentralization.

Core Advantages of WEEX Auto EarnFlexibility: Your Funds, Your Control. Unlike platforms like Binance Earn or Coinbase Rewards that often require locking funds for fixed terms, WEEX Auto Earn imposes no lock-up periods. You retain full control—deposit or withdraw anytime without penalties, making it ideal for traders and cautious savers alike.Accessibility: Start Small, Earn Now. While many competitors enforce minimum deposits ranging from $10 to $100 or more, WEEX Auto Earn lets you begin earning with as little as 0.01 USDT. This truly low barrier welcomes beginners and allows seasoned users to test the waters before committing larger sums.Ease of Use: One Click, Instant Activation. Forget complex onboarding steps, multiple confirmations, or navigating nested menus. With WEEX, enabling Auto Earn takes one click in the Assets section—no lengthy enrollment, no confusing settings. Interest starts accruing immediately, with rewards distributed automatically the following day.Auto Earn vs. Staking: Which is Better for You?If you prioritize flexibility, simplicity, and immediate liquidity, WEEX Auto Earn stands out as the more user-friendly and accessible choice—especially if you are new to earning passive income in crypto or prefer to keep your funds readily available.

Unlike traditional staking, which often involves locking assets for fixed periods, navigating validator selection, or meeting minimum deposit thresholds, WEEX Auto Earn allows you to start earning with just 0.01 USDT, withdraw at any time without penalties, and activate the feature instantly with one click. This makes it ideal for traders, cautious savers, or anyone who values control and convenience over potentially higher but less flexible staking returns.

Don't hesitate any longer. Sign up now and experience Auto Earn instantly, exclusively on WEEX.

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: What is the difference between Auto Earn and Staking?A: With Auto Earn, your funds are always available for trading or withdrawal. When using Flexible Staking, there is no bonding or unbonding period. Your funds will be immediately staked and unstaked.

Q2: Should I enable Auto Earn on WEEX?A: By turning on Auto Earn, you can generate earnings with no lock-up periods, and your funds are always accessible. It's the easy way to get more out of your crypto.

Q3: How does Auto Earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Is This AI Token Worth It? Acet (ACT) Price Analysis

Acet (ACT) is a community-driven fan token launched on the Binance Smart Chain, distinguished by its innovative "Zero Initial Supply" mechanism. Unlike conventional token models, ACT tokens are not pre-mined; instead, they are generated exclusively through user participation in liquidity provision. This approach is designed to mitigate issues of token oversupply and promote fair, demand-driven distribution.

Positioned at the intersection of fan engagement and decentralized finance (often referred to as DeFansFi), Acet integrates features such as staking and liquidity incentives to foster community participation. The project also seeks to expand utility beyond the crypto ecosystem by exploring real-world applications and partnerships. It is notably backed by Thai entrepreneur Acme Worawat and supported by the Traderist platform, adding further visibility and credibility to its development roadmap.

What Is ACT Labs Building?ACT is a utility token developed within the ecosystem of ACT Labs, a venture studio focused on creating decentralized, AI-driven infrastructure. Unlike single-application tokens, ACT Labs operates as an incubator and builder, working on multiple products that integrate on-chain execution with autonomous AI agent systems.

The core objective of ACT Labs is to facilitate interactions between AI agents, as well as between humans and AI agents, enabling secure, low-interaction execution of tasks on the blockchain. Examples of its projects include decentralized commerce protocols, autonomous trading frameworks, and AI-verified task coordination systems.

Within this ecosystem, the ACT token functions as a coordination and incentive mechanism across various products, aligning token utility with tangible development progress. This approach differentiates ACT from purely speculative or meme-driven AI tokens and ties its value proposition to real-world utility and ongoing product releases.

ACT Labs emphasizes open collaboration and transparency, maintaining publicly accessible repositories and encouraging external developer contributions. This commitment to building in the open positions the project within the longer-term narrative of decentralized infrastructure, rather than short-lived hype cycles.

Acet (ACT) Price AnalysisACT has recently experienced significant price appreciation, drawing attention to its position within the growing AI and blockchain infrastructure space. Such movements naturally raise questions about whether they are driven by fundamental progress or speculative momentum.

A combination of factors appears to be contributing to the rally:

Increased Trading Activity – Higher transaction volumes and a growing holder base suggest broader market participation rather than isolated speculative trading. Improved liquidity and visibility across social and trading platforms have further amplified price momentum.Rising Interest in AI Crypto Infrastructure – ACT benefits from renewed market focus on tokens associated with autonomous agents, on-chain automation, and decentralized AI execution. Its positioning as a utility-driven infrastructure project resonates with investors looking beyond short-term narratives.Relative Valuation – ACT’s market capitalization remains modest compared to more established infrastructure tokens, which can attract speculative capital while also reflecting its early-stage status. At this phase, price action often reflects expectations around future development milestones rather than current adoption levels.From a neutral standpoint, the rally indicates growing market recognition and engagement. However, sustained value will depend on ACT Labs’ ability to consistently deliver functional products, onboard developers, and deepen token integration across its ecosystem. While price movement signals attention, long-term viability will be determined by execution, not sentiment alone.

ConclusionACT’s recent price movement highlights increasing interest in decentralized AI infrastructure and the tangible development work being conducted by ACT Labs. By anchoring its value to a multi-product venture studio model—rather than a single application—the token is positioned to grow alongside a portfolio of agent-driven systems.

While short-term volatility reflects market sentiment and speculative interest, the long-term trajectory will be shaped by continued delivery, adoption, and real-world usage. For participants interested in the intersection of AI and blockchain, ACT represents a project whose progress can be measured not only by price action but also by development output and ecosystem integration.

Ready to trade Acet (ACT)?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

FAQQ1: What is ACT used for?A: ACT serves as a utility and governance token within the ACT Labs ecosystem, enabling coordination, incentives, and participation across its AI-driven decentralized applications.

Q2: What is ACT Labs?**A: ACT Labs is a venture studio building decentralized infrastructure for AI agents, focusing on autonomous on-chain execution and human-agent interaction.

Q3: Why has ACT’s price increased recently?A: The price rise reflects growing interest in AI-related crypto projects, higher trading activity, and market recognition of ACT Labs' development progress.

Q4: Where can ACT be traded easily?A: Acet (ACT) is available on WEEX, which offers accessible trading with user-friendly interfaces.

WEEX Auto Earn: How to Enable Auto Earn?

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Read More: What's WEEX Auto Earn and How to Use It?

How to Enable Auto Earn on WEEX Exchange?New to WEEX Auto Earn? Follow these simple steps to get started :

Log into WEEX App, go to "Assets" pageTap "Auto Earn" and enable the featureWatch your daily earnings grow automaticallyFor more information, check this video below to learn more:

Note:

New users: Activate within 7 days of verification for bonus APRComplete verification before activation for the best ratesDon't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Top 3 Best Crypto Earning Apps in 2025: Why WEEX Auto Earn Stands Out?

Imagine daily habits—like having coffee, walking, or gaming—now earning you crypto. A growing range of apps turns routines into effortless rewards, making portfolio growth accessible without trading knowledge.

Today, you can earn crypto by learning, staying active, shopping, or even sharing device resources, often starting for free. These approaches lower entry barriers and weave crypto naturally into everyday life.

Leading platforms such as WEEX, Bybit, and KuCoin now integrate staking, learn-and-earn programs, and liquidity incentives. These features let users grow assets through both market activity and structured rewards, creating a more holistic crypto journey. To help you start, here’s a curated list of the best crypto-earning apps for 2025.

WEEX - Best of AllWEEX Auto Earn excels in 2025 with its flexible and transparent approach, allowing users to earn rewards instantly with no lock-up periods or minimum deposits. It calculates interest hourly across Spot, Funding, and Futures accounts, with daily USDT payouts based on your lowest daily balance for predictable returns.

New users benefit from bonus APR by verifying within seven days, while smart features like auto-pausing when balances fall too low enhance user experience. With zero platform fees, WEEX Auto Earn offers a secure and seamless path to passive crypto earnings.

Core Features of WEEX Auto EarnFlexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

BybitWhile widely recognized as a leading crypto trading platform since 2018, Bybit serves a global community of over 50 million users with far more than just advanced trading tools. The exchange offers a diverse suite of earning features designed to help both passive investors and active traders grow their crypto portfolios effectively and conveniently.

Core Features:Bybit Savings: Provides flexible and fixed-term options with competitive, guaranteed APRs for low-risk yield.Crypto Liquidity Mining: Users can supply liquidity to AMM-based pools and earn yields, with optional leverage to increase potential returns.Dual Asset: A short-term trading tool that allows users to choose “Buy Low” or “Sell High” strategies to earn enhanced interest based on market outlook.Wealth Management: Access professionally managed crypto investment funds, allowing hands-off participation in curated trading strategies.Beyond its reputation as a high-performance exchange, Bybit stands out through these integrated earning solutions—making it a comprehensive platform for users seeking growth through savings, staking, liquidity provision, or managed investments.

KuCoinFounded in the Seychelles and operating globally, KuCoin serves over 37 million users across 200+ countries. Beyond its core exchange services, KuCoin offers a wide range of integrated features that enable users to earn, learn, and engage with crypto through accessible, education-driven, and reward-based experiences.

Core Features:

KuCoin Earn: Provides both flexible and fixed-term staking options, recognized by Investopedia and Forbes as a leading staking platform.Learn and Earn: Users earn Token Tickets by completing educational courses and quizzes, which can be redeemed for cryptocurrency.Mystery Box: Offers limited-edition NFT releases through brand collaborations on KuCoin's NFT marketplace.It’s important to note that many of these features require KYC verification, and access may be restricted in certain regions, including the United States and Canada. Users are encouraged to confirm eligibility before participating in any program.

Why WEEX Auto Earn Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature.

What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Grow Your Crypto Daily: Earn Up to 100% APR with WEEX Auto Earn

In the dynamic crypto market, your idle assets can work for you around the clock. WEEX Auto Earn is a flexible savings product designed to let your USDT earn daily compound interest—with no lock-up periods, no minimum deposit, and complete liquidity control.

New User Bonus: High-Yield Welcome OfferAs a new user, you receive a special tiered interest rate to maximize your initial earnings:

Example Earnings (Deposit: 10,000 USDT)

Tiered Rate Structure:

First 100 USDT → 100% APRRemaining 9,900 USDT → 3.5% APR30-Day Earnings Breakdown (Daily Compounding):

High-Yield Portion (100 USDT)Daily rate: 100% ÷ 365 ≈ 0.27397%30-day earnings: 8.55 USDTStandard Portion (9,900 USDT)Daily rate: 3.5% ÷ 365 ≈ 0.009589%30-day earnings: 28.77 USDTTotal 30-Day Earnings for New Users: ≈ 37.32 USDT

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DateToday's EarningsTotal EarningsAccount BalanceDay 11.2451.24510,001.25Day 21.2472.49210,002.49Day 31.2493.74110,003.74Day 41.2514.99210,004.99Day 51.2536.24510,006.25Day 61.2557.510,007.50Day 71.2578.75710,008.76Day 81.25910.01610,010.02Day 91.26111.27710,011.28Day 101.26312.5410,012.54Day 151.27118.8910,018.89Day 201.27925.2810,025.28Day 251.28731.7110,031.71Day 301.29537.3210,037.32Existing User Benefits: Sustained Growth PlanFor our loyal users, WEEX offers a stable enhanced earnings program:

Example Earnings (Deposit: 10,000 USDT)

Tiered Rate Structure:

First 200 USDT → 13% APRRemaining 9,800 USDT → 3.5% APR30-Day Earnings Breakdown (Daily Compounding):

Enhanced Portion (200 USDT)Daily rate: 13% ÷ 365 ≈ 0.03562%30-day earnings: 2.15 USDTStandard Portion (9,800 USDT)Daily rate: 3.5% ÷ 365 ≈ 0.009589%30-day earnings: 28.48 USDTTotal 30-Day Earnings for Existing Users: ≈ 30.63 USDT

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DateToday's EarningsTotal EarningsAccount BalanceDay 11.0211.02110,001.02Day 21.0222.04310,002.04Day 31.0233.06610,003.07Day 41.0244.0910,004.09Day 51.0255.11510,005.12Day 61.0266.14110,006.14Day 71.0277.16810,007.17Day 81.0288.19610,008.20Day 91.0299.22510,009.23Day 101.0310.25510,010.26Day 151.03315.4210,015.42Day 201.03620.610,020.60Day 251.03925.810,025.80Day 301.04230.6310,030.63Core Benefits of WEEX Auto EarnFlexibility & ControlNo lock-up periods: Withdraw or trade anytimeZero management fees: Keep 100% of your earningsLow entry point: Start with as little as 0.01 USDTSmart & EfficientDaily compounding: Automatic reinvestment for exponential growthReal-time calculation: Hourly interest based on eligible balancesTimely payouts: Earnings distributed daily at 12:00 UTCSecure & TransparentMulti-account coverage: Includes spot, funding, and futures balancesFair calculation: Based on daily lowest balance snapshotAuto-management: Pauses and settles when balance drops below 0.01 USDTWEEX Auto Earn Earnings TimelineDay 1 → Activate Auto Earn, start earning immediatelyEvery day → Automatic compounding and reinvestmentDay 30 → New users earn ≈ 37.32 USDTDay 365 → Continuous growth through compoundingTake Action: Put Your USDT to Work TodayWhether you're new to crypto or an experienced trader, WEEX Auto Earn offers the simplest way to grow your idle assets.

Three Simple Steps to Start Earning:

Log into WEEX App, go to "Assets" pageTap "Auto Earn" and enable the featureWatch your daily earnings grow automaticallyFor more information, check this video below to learn more:

Quick Tip:

New users: Activate within 7 days of verification for bonus APRComplete verification before activation for the best ratesDon't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?

A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?

A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?

A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?

A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Grow Your Assets with WEEX Auto Earn! One Click to Gain Profit

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Why Choose WEEX Auto Earn in 2025?WEEX Auto Earn stands out in 2025 with its exceptional flexibility, transparency, and user-friendly design. It offers instant access to funds—no lock-up periods or minimum deposits—while automatically calculating hourly rewards across your Spot, Funding, and Futures accounts. Earnings are paid out daily in USDT based on your lowest daily balance, ensuring fairness and predictability. New users enjoy a bonus APR when verifying within seven days, and the feature includes smart automation like auto-disabling if balances drop too low—all with zero fees, making passive earnings both seamless and secure.

Core Features of WEEX "Auto Earn"Flexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).How to Grow Your Assets with WEEX Auto Earn?Participating in WEEX Auto Earn is simple and fast. Whether you are a beginner or a frequent trader, you can participate and grow your wealth. By following the steps below, you can participate in just a few minutes while making more assets.

Follow the steps to participate now:

Open the APP, go to the Assets page, and click on Auto Earn.Toggle the switch in the middle of the page to enable Auto Earn.Once confirmed, interest will start accruing immediately, and earnings will be distributed to your funds account the next day. Distributed earnings can be viewed in your funds account history.For more information, check this video below to learn more:

WEEX Auto Earn RoadmapWEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Ready to put your idle crypto to work—on your terms? Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interests t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

What is WEEX Auto Earn and Why It Stands Out?

WEEX Auto Earn is a digital asset growth tool launched by Weex, supporting USDT. Users do not need to lock their assets; funds can be deposited or withdrawn flexibly. The system calculates interest daily and automatically distributes earnings, allowing idle funds to continuously generate returns.

WEEX vs Market Products: Why WEEX Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature. In this article, we'll show the core dimensions where WEEX differentiates itself from typical market offerings and directly compares it against major competitors.

Core Advantages of WEEXWEEX's design philosophy prioritizes capital efficiency, ease of use, and clear value for both novice and experienced traders. Check below its key advantages!

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DimensionWEEX AdvantageFor UsersCompared to Typical Market ProductsYieldNew users enjoy 100% APR, existing users up to 13% APRBeginners get amplified returns; loyal users benefit from stable, competitive wealth management.Offers a highly competitive annualized yield, especially for onboarding and rewarding existing customers.Capital FlexibilityNo lock-up, instant accrual, withdraw anytimeMaximizes capital efficiency. Funds remain available for trading or withdrawal without interruption.Most competing platforms require fund transfers to a separate “earn” wallet or enforce lock-up periods.Ease of UseOne-click participation, automatic settlement and payoutOperational barriers are minimized. Users enable the feature once and earnings are handled automatically.Many platforms require manual, repeated subscriptions and redemptions for each earning cycle.Yield TransparencyDaily distribution with a clear interest calculation formulaReturns are credited predictably every day, fostering trust and allowing for easy tracking.Ensures greater transparency compared to opaque or complex yield aggregation methods.Low Entry ThresholdNo mandatory KYC for basic use, extremely low minimum investment (0.01 USDT)Removes access barriers, making sophisticated yield generation accessible to all retail investors.Some products require VIP status, large minimum deposits, or extensive identity verification.What's Special with WEEX Auto Earn?To contextualize WEEX's position, here is a direct comparison of its “Auto Earn” feature against similar flexible savings products from other leading exchanges:

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

ProductWEEX Auto EarnBinance Simple EarnOKX EarningBitget Wealth ManagementProduct TypePassive Income / Auto-CompoundFlexible SavingsSimple EarnFlexible InvestmentAPR / Yield RulesBase Rate: ~3.5%New Users (0-100U): 100% APR

Existing Users (0-200U): 13% APRDaily APR: ~2.21%

Tiered Annualized Yield<1000U: ~10% APR (for 180 days)

>1000U: ~1% APR0-300U: 13% APR

>300U: ~3% APRMinimum Investment0.01 USDT0.1 USDT0.1 USDT0.1 USDTInterest PayoutPaid next day. Automatic after enabling; no separate action needed.Starts accruing next day (T+1) after manual subscription.Starts accruing next day after manual subscription.Hourly accrual, withdraw anytime.Yield SourceOn-chain activitiesLending & DeFi incomeLending & Market MakingNot specifiedAccounts UsedUnified Account: Funding, Contract, & Spot Available BalanceSpot WalletFunding & Spot Trading AccountsFunding & OTC Accounts

Key Takeaways from the Comparison:

Aggressive User Acquisition: WEEX offers the most attractive promotional APRs (100% for new users, 13% for existing) to directly acquire and reward its user base.Unmatched Convenience: The one-click, auto-compounding model with no manual redemption required is a significant usability advantage over competitors who often require recurring manual operations.True Capital Integration: By using a unified account balance for earning, WEEX eliminates the need to manually move funds between “trading” and “savings” wallets, a friction point on other platforms.What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.ConclusionWEEX Auto Earn offers a differentiated approach to crypto yields by prioritizing user convenience and capital efficiency. Its key advantages include seamless integration with trading accounts for automatic earnings on idle balances, highly competitive promotional APRs for new and existing users, and complete liquidity preservation through zero lock-up periods. The platform eliminates traditional friction points through one-click activation and daily automated distribution.

Discover how WEEX transforms passive crypto holdings into productive assets while maintaining full trading flexibility. Experience WEEX Auto Earn to grow your wealth now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Introduction to WEEX Auto Earn and How It WorksDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are the interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interes t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

What Is Quant (QNT)?

Quant represents a pioneering financial technology solution dedicated to bridging conventional financial infrastructure with distributed ledger technologies. The platform's core interoperability solution, Overledger, employs a standardized API architecture to seamlessly integrate diverse blockchain networks, payment platforms, and digital asset ecosystems. This approach empowers financial institutions to facilitate data exchange and cross-system transactions without requiring substantial modifications to their current technological stack.

Developed through collaborations with central banking authorities including the Bank of England and the European Central Bank, Quant's technology has been adopted by international financial institutions to enhance operational efficiency and ensure regulatory compliance in digital finance implementations. Commercial enterprises can leverage Quant's software suite to enable smart payment solutions, tokenized asset exchanges, and cross-chain operational capabilities within their existing applications.

What is Quant Capable for?OverledgerOverledger functions as an API-driven integration layer that enables businesses to connect their established systems with multiple blockchain environments through a unified interface. APIs serve as communication channels between software applications, facilitating seamless data transmission and reception.

By maintaining standardized request and response protocols, Overledger allows development teams to interact with various blockchain networks without requiring deep technical expertise in each specific protocol. The platform additionally enables the creation of multi-chain decentralized applications capable of simultaneous operation across numerous blockchain environments.

Quant FlowQuant Flow operates as an API-centric platform that empowers banking institutions, financial technology companies, and payment processors to integrate programmable digital currency functionality into their current infrastructure. Leveraging Overledger's underlying technology, the platform facilitates the automation of accounting procedures and supports transaction execution triggered by predefined conditions. Quant Flow incorporates regulatory compliance features, fraudulent activity monitoring, and capital control mechanisms to assist organizations in risk mitigation and financial oversight.

QuantNetQuantNet provides a comprehensive solution for financial institutions to transfer tokenized currency and digital assets across disparate networks without depending on isolated ledger systems or manual intervention. Rather than maintaining separate institutional silos, QuantNet delivers a unified gateway connecting both public and private blockchains, payment networks, and digital asset platforms.

The system's native ISO 20022 compatibility ensures adherence to the universal messaging standard prevalent throughout the financial sector. This standardization enables efficient cross-system communication while minimizing the requirement for additional reconciliation tools or intermediary software. QuantNet further automates post-trade settlement processes and coordinates asset transfers across multiple systems.

Quant FusionQuant Fusion establishes a connectivity framework that interfaces public blockchain networks with permissioned institutional systems. This enables organizations to transfer data and assets across different platforms without utilizing conventional bridging solutions or token wrapping mechanisms. The Fusion architecture comprises two primary components: the Multi-Ledger Rollup (MLR) and the Network of Networks infrastructure.

Quant's MLR technology processes and settles transactions across multiple blockchain networks simultaneously, distinguishing it from traditional rollup solutions limited to single-chain operations. The Network of Networks functionality allows participants to integrate their proprietary nodes or blockchain instances into an interconnected ecosystem.

The Fusion rollup maintains adaptability to support various blockchain types, including public networks, corporate systems, and regulated environments requiring controlled interoperability. To preserve privacy, Quant Fusion does not provide conventional public blockchain exploration tools. Instead, users access activity-specific information including balance details, transaction records, and smart contract data through dedicated API endpoints and user interfaces.

PayScriptQuant PayScript operates as a financial programming instrument that enables banking institutions and corporations to define monetary movement and behavior parameters. The platform supports both traditional banking accounts and stablecoin implementations, facilitating automated payment processing, optimized workflow management, and enhanced administration of complex financial transactions. By utilizing PayScript's rules configuration engine, organizations can establish precise instructions for capital flows without requiring advanced programming expertise.

How Does Quant Work?Central Bank Digital Currencies: Governmental entities can develop and implement CBDC frameworks using Quant's interoperability solutions that connect payment systems, private ledgers, and regulated networks.

Corporate Supply Chains: Business enterprises can optimize settlement processes, monitor asset movement, and automate regulatory compliance by integrating supply-chain management platforms with blockchain networks through Quant's API infrastructure.

Cross-Network Operations: Organizations can execute transactions and deploy smart contracts across multiple public and private blockchain environments using Quant Fusion's multi-ledger ecosystem.

Programmable Payment Solutions: Financial institutions can automate payroll distribution, tax processing, treasury management, and event-driven transactions through Quant Flow's payment orchestration tools.

Tokenized Settlement Systems: Banking organizations and financial platforms can facilitate real-time settlement of tokenized deposits, investment funds, and digital assets via QuantNet's unified regulatory-compliant infrastructure.

What is Quant (QNT)?QNT serves as the native digital asset within the Quant ecosystem, fulfilling multiple functional roles:

Transaction Fees: QNT functions as the primary currency for Multi-Ledger Rollup transaction costs, operating as the rollup's native settlement token when deposited.

Cross-Chain Transfers: QNT enables the deposit and withdrawal processes for ERC-20 tokens within the Multi-Ledger Rollup environment, supporting cross-chain asset mobility.

Network Participation: QNT can be staked by node operators performing sequencer or validator functions. Participants receive QNT rewards for contributing to network operations and security maintenance.

ConclusionQuant is architected to assist financial institutions in transitioning toward interconnected, programmable digital infrastructure. Its interoperability layer enables cross-ledger communication, while complementary products including Quant Flow, QuantNet, Quant Fusion, and PayScript facilitate tokenized settlement and cross-network execution. Collectively, these solutions aim to streamline financial organizations' adoption of blockchain technology while supporting compliant digital currency implementation.

Further ReadingWhat Is Edel (EDEL)?

What Is Decred (DCR)?

What Is Momentum (MMT)?

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Cardano (ADA) Price Prediction: It's the Right Time to Buy Cardano (ADA)?

Cardano (ADA) has reclaimed market attention, though not through the sustained bullish performance many early investors had anticipated. While the token opened 2025 with notable strength—achieving year-to-date gains exceeding 60%—this upward momentum has significantly moderated. Currently trading near $0.47, ADA has retreated approximately 45% from its mid-year peak, reflecting the broader cryptocurrency market's struggle with macroeconomic pressures, profit realization activities, and ongoing regulatory ambiguity.

Nevertheless, Cardano continues to demonstrate underlying vitality. Below the surface price action, retail accumulation patterns have intensified, capital inflows show gradual improvement, and the network maintains steady progress through technical enhancements and ecosystem development. Counterbalancing these positive indicators, substantial holder distributions and deteriorating market sentiment present a more cautious narrative. With conflicting signals emerging across different market dimensions, investors face a recurring question: does current price levels represent an accumulation opportunity or warrant defensive positioning?

Cross-Currents Impacting ADA's TrajectoryUnderstanding ADA's price movement requires examination of broader financial market conditions. Recent months have witnessed deteriorating risk appetite across global financial markets, with simultaneous corrections affecting equity indices, cryptocurrency assets, and high-growth technology sectors. This risk-off transition stems from mounting investor concerns regarding persistent inflation metrics, evolving central bank policies, and escalating geopolitical tensions. Bitcoin's inability to maintain levels above $95,000 has particularly impacted altcoin markets, with ADA following the prevailing trend as liquidity conditions tighten and uncertainty prevails.

The macroeconomic outlook isn't uniformly pessimistic, however. Analytical consensus suggests the U.S. Federal Reserve may initiate interest rate reductions during late 2025, potentially lowering the federal funds rate toward 2.75%. Such monetary policy normalization could establish more favorable conditions for risk-sensitive assets, including cryptocurrencies. Concurrently, resolution of U.S. budgetary impasses and emerging narratives around quantitative easing resumption could stimulate institutional interest and retail participation in ADA, contingent upon restored market confidence.

Regulatory developments represent another significant macroeconomic factor gradually taking shape. The European Union's MiCA framework continues implementation across member states, while U.S. legislative proposals have suggested commodity classification for ADA rather than security designation. Such regulatory clarity could eventually facilitate traditional capital access, though these developments currently represent long-term supportive factors rather than immediate catalysts.

Technical Perspective: Consolidation or Impending Breakdown?Cardano's price structure has entered a tightening consolidation phase following its mid-year advance, with current trading concentrated around $0.47. This positioning places ADA more than 45% below its 2025 peak of $0.85, confined within a progressively narrowing trading range. Many technical analysts interpret this pattern as characteristic compression dynamics—extended low volatility periods typically preceding significant directional movements, though the ultimate direction remains uncertain.

The $0.45 support level has demonstrated resilience thus far, though its defense has been tenuous. A decisive breach below this threshold could initiate tests of deeper support zones between $0.40 and $0.33. Conversely, reclaiming the $0.60 resistance level would likely shift short-term momentum toward bullish scenarios. Present conditions reflect cautious trader positioning, with declining volume metrics and limited conviction evident across both bullish and bearish factions.